fromFortune

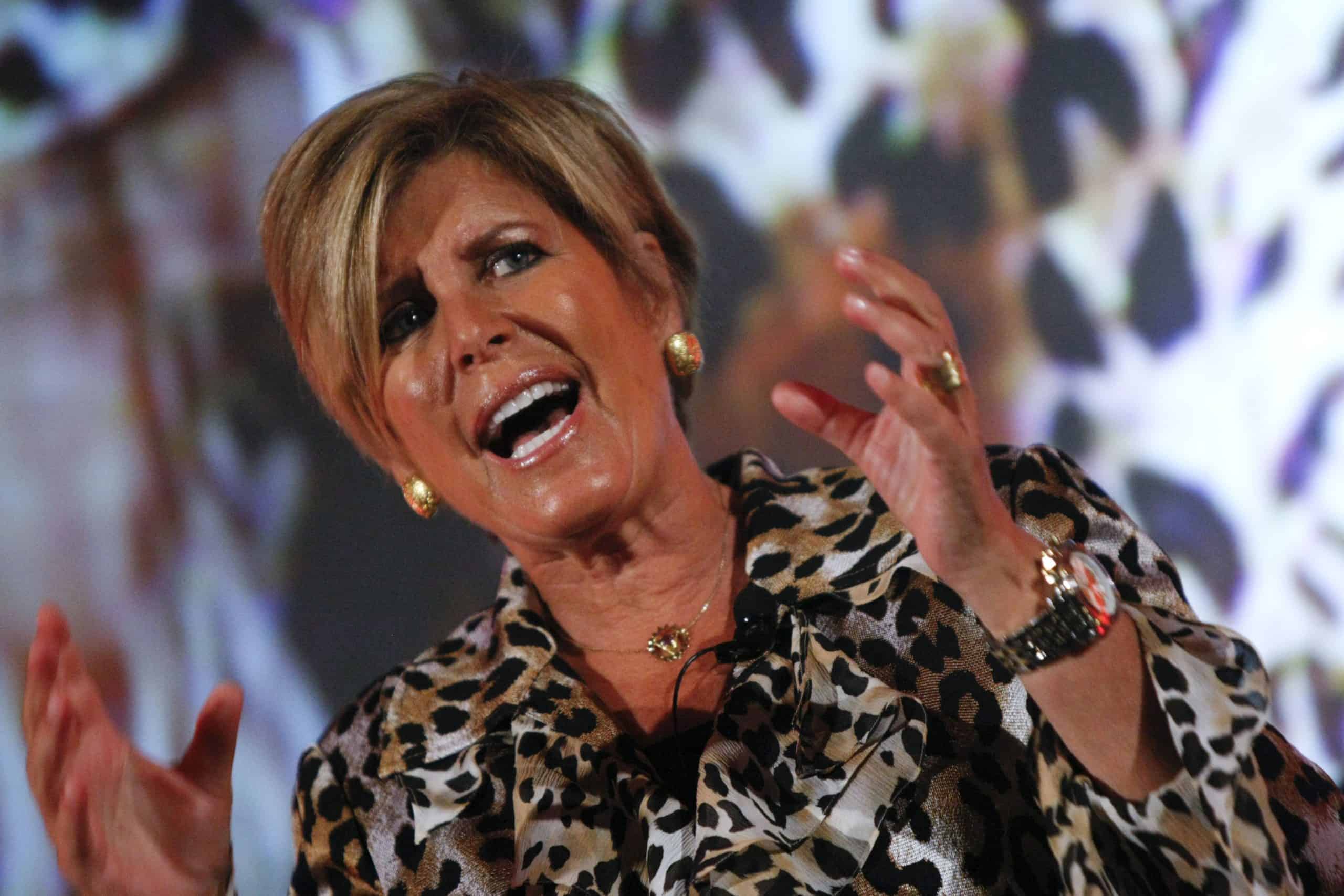

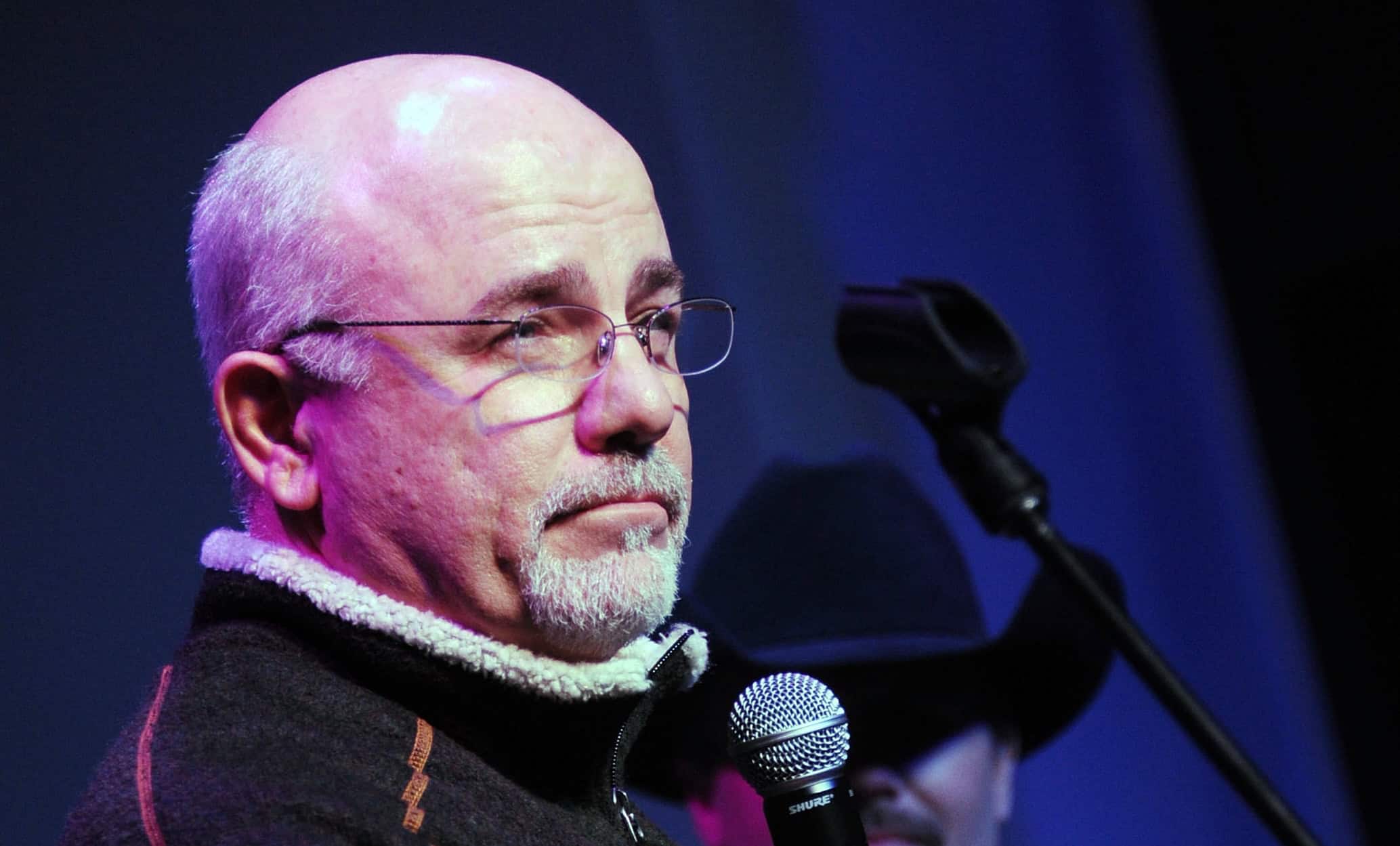

23 hours agoDave Ramsey slams Trump Accounts, the new investment accounts for babies-he's advising parents to take the $1,000 and put their own money elsewhere | Fortune

While $1,000 offers a nice head start for children, Trump Accounts lack flexibility, restrict access, and limit your investment options. The account is unusable until kids are at least 18 years old, and when they do come of age, they'll still have to pay taxes on any investment growth. It's also restrictive around what they can use the money for, and limits investment choices due to the government's control.

Miscellaneous