Retirement

from24/7 Wall St.

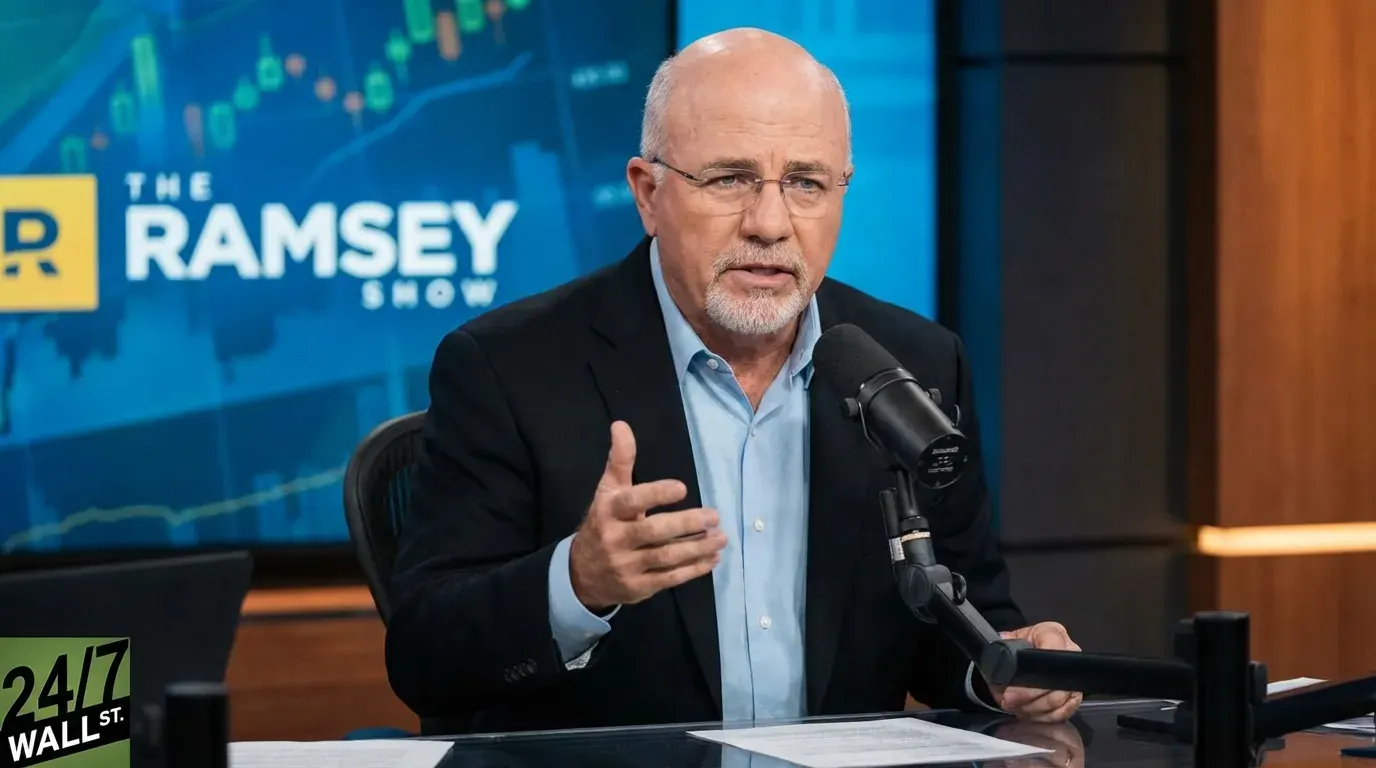

2 hours agoClaim Social Security at 62? Dave Ramsey's Advice Looks Riskier as Benefit Cuts Loom

Dave Ramsey recommends claiming Social Security at 62 to maximize lifetime payouts and investment opportunities, but this strategy becomes riskier given Social Security's uncertain financial future.

:max_bytes(150000):strip_icc()/TAL-lead-image-pasadena-LIVECA0126-224f95a5af494f2380a58226605d8699.jpg)