Retirement

from24/7 Wall St.

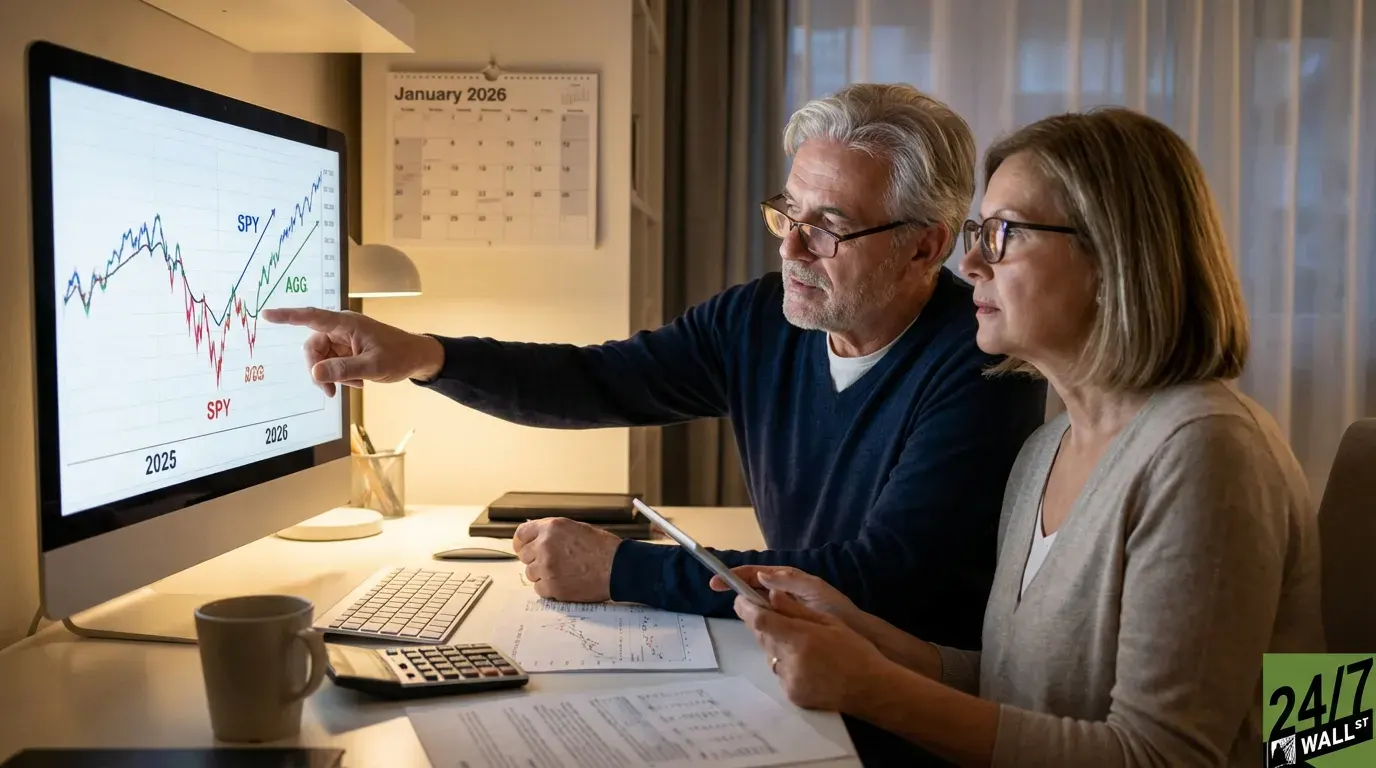

21 hours ago20 Years to Retirement? These 3 ETFs Could Make You Rich

ETFs offer low-cost portfolio diversification with minimal research requirements, and specific funds like Invesco QQQ Trust provide access to top-performing companies with strong historical returns.

:max_bytes(150000):strip_icc()/TAL-lead-image-pasadena-LIVECA0126-224f95a5af494f2380a58226605d8699.jpg)