#financial-literacy

#financial-literacy

[ follow ]

#personal-finance #parenting #investing #retirement-planning #debt-management #trump-accounts #entrepreneurship

fromAol

2 weeks ago61% of young adults turn to social media for investing advice. Why tips from 'finfluencers' should be part of the process, but not your whole strategy

Recently released data from the FINRA Investor Education Foundation (1) shows that about 25% of U.S. adults surveyed say they use recommendations from social media influencers when making investment decisions. Among people aged 35 and younger, the share jumps to 61%. Even more concerning: 57% of people with less than two years of investing experience reported relying on social media for financial guidance.

US news

fromwww.housingwire.com

1 month agoA turning point for the mortgage industry: Inside the industry effort to build trust with the next generation

Five years later, that decline has reached a clear low point. Only 20 percent of Millennials and Gen Z say they trust mortgage professionals to help them make informed decisions. The knowledge gap remains significant, but in an age when information is everywhere, knowledge is no longer the only barrier. The deeper challenge is a lack of trust, and trust cannot be automated or outsourced. It has to be built in community.

Real estate

from24/7 Wall St.

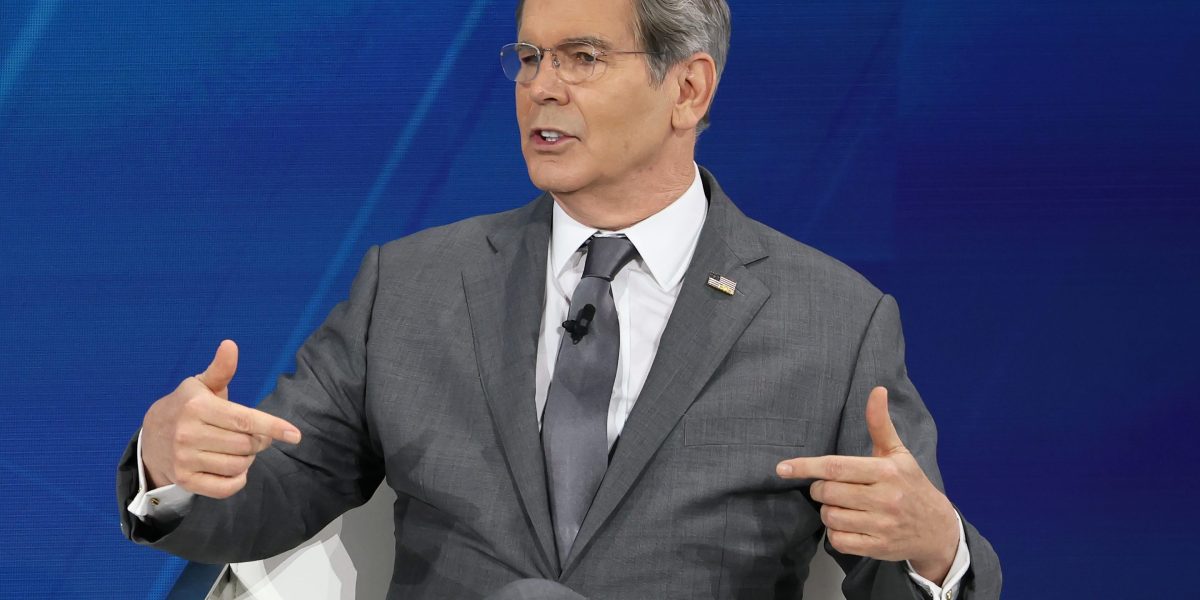

2 months agoMark Cuban Hates Trump but Loves Kid Savings Accounts -- Will He Shock Everyone?

Billionaire Mark Cuban has long championed the idea that kids should start saving early to secure their futures. Drawing from his own childhood in Pittsburgh, where he sold garbage bags door-to-door to fund small dreams like new basketball shoes, Cuban stresses hands-on financial lessons. In interviews, he advises parents to open savings accounts for children and encourage them to build that first pot of money.

US politics

Fundraising

fromFortune

2 months agoMichael Dell, who's donating $6.25B to 'Trump Accounts' for kids, says a childhood savings account changed his life | Fortune

Michael Dell will donate $6.25 billion to fund $250 Invest America accounts for 25 million children to encourage early saving, investing, and financial literacy.

Artificial intelligence

fromComputerWeekly.com

3 months agoTechnology innovation drives accountancy job changes | Computer Weekly

Professional accounting services improve SME cash flow, financial reporting, and financial literacy while AI integration is reshaping and automating traditional accounting roles.

Marketing

fromBusiness Insider

3 months agoPayPal's chief corporate affairs officer on how Venmo is helping college athletes get paid, and the rise of agentic commerce

Venmo processes payments to college athletes under new NCAA rules while PayPal expands campus services, financial education, and explores AI-driven agentic commerce.

Healthcare

fromFortune

3 months agoRGA CEO Tony Cheng: Americans are living longer-adding risk for insurers-but the real danger is people outliving their savings | Fortune

Rising life expectancy increases risk of outliving savings and requires financial literacy and structural changes to close the longevity insurance gap.

Brooklyn

fromNew York Post

3 months agoExclusive | Meet Linus, the adorable vending machine king of Brooklyn building a boffo secret brand - at just 8 years old

An 8-year-old named Linus sells homemade New York–themed buttons from a gumball vending machine, earning quarters while learning creative entrepreneurship.

Relationships

fromBusiness Insider

4 months agoWhen my 20-year marriage ended, I had no job and knew little about money. Now, I'm confident in my financial future and career.

A divorce forced a woman to urgently learn and organize her own finances, locate accounts, set budgets, reenter the workforce, and plan for retirement.

Fashion & style

fromwww.amny.com

5 months agoComplex takes over Soho for their Brands to Watch' event for New York Fashion Week | amNewYork

Financial literacy, affordable style, and investment-focused entrepreneurship were showcased through celebrity insights, a Chime partnership, and fashion collaborations at Complex's Brands to Watch NYFW event.

fromSlate Magazine

5 months agoMy Wife and I Agreed to Parent Our Own Kids. But She's Setting Hers Up for Disaster.

My parents were never upfront with me about financial matters and basically left me flat footed when it came to learning to be an adult. I never wanted that for my son and have been frank about covering the costs of college and his car when he graduates. He has been working since he was 14 and saving half his paycheck. He also is taking dual credit and AP classes. He will essentially start college off as a junior if he plays his cards right.

Higher education

Education

fromwww.cbc.ca

5 months agoOntario's Grade 10 financial literacy test could discourage teens' interest in personal finances: experts | CBC News

Ontario's financial literacy graduation requirement, including a mandatory 70% test in Grade 10 math, may discourage students and overlook low-income experiences.

Social justice

fromBuzzFeed

5 months agoAdults Are Getting Real About How Their Parents' Finances Are Shaping Their Future

Intergenerational financial outcomes vary widely: some older generations secretly accumulated wealth, others face sudden poverty, and many younger adults outearn and struggle relative to parents.

fromThe Oaklandside

5 months agoTalk to your kids about money

It's never too early to start having a conversation with your kids - whether they're in elementary school, high school or college - about smart ways to navigate finances. Starting the conversation earlier will help create healthy money habits as they grow, ultimately benefiting their financial future. To help you get started, here are tips that make it easier for kids of all ages to learn how to save, budget and begin managing their finances more independently:

East Bay (California)

New York City

fromwww.theguardian.com

6 months agoEverybody's starved of affection': Past Lives director Celine Song on the brutal dating scene and her realistic new romcom

Celine Song critiques financial literacy and perceptions of wealth, emphasizing that billionaires should not be portrayed as likable characters in narratives.

fromwww.amny.com

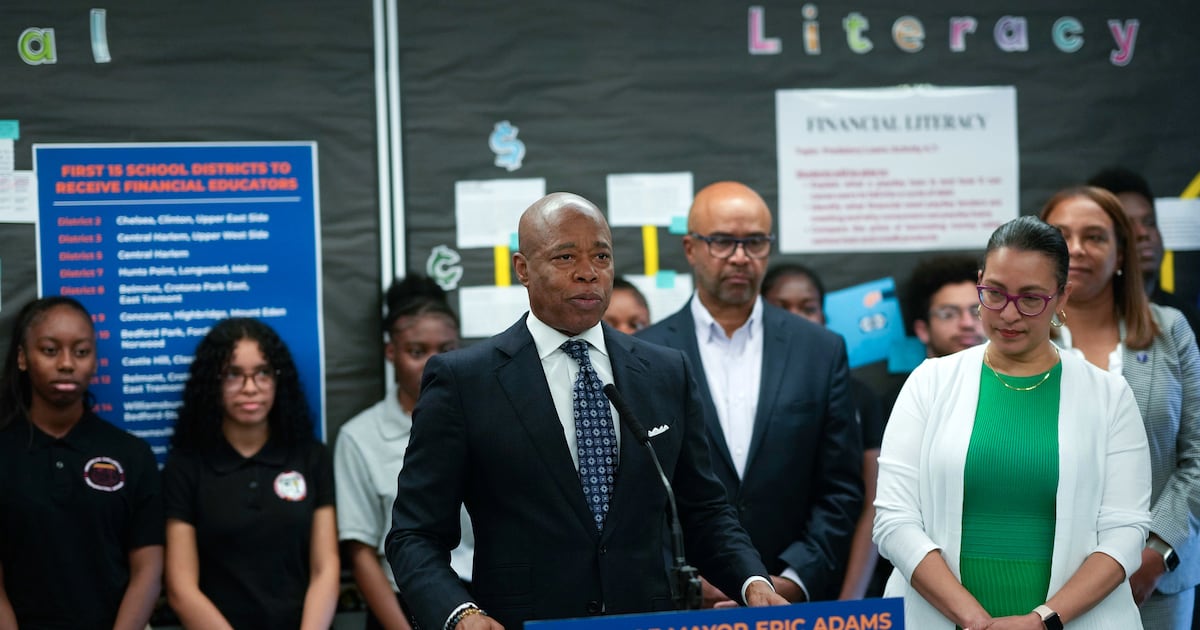

8 months agoNYC public schools to get new financial literacy education | amNewYork

Mayor Adams emphasized that current school curricula inadequately prepare students for real-world financial responsibilities, leaving them unable to manage essential financial tasks like taxes.

NYC parents

from24/7 Wall St.

8 months agoDiscovering My Dad's Credit Line - Was He Helping Me or Hurting My Credit Score?

On the surface, it looks good. The credit line only had one missing payment over 14 years. If that missed payment was several years ago, then it won't have an impact on the original poster's credit score.

Parenting

fromLondon Business News | Londonlovesbusiness.com

8 months agoAviva study reveals critical knowledge gap about UK pensions - London Business News | Londonlovesbusiness.com

"The survey of over 2000 UK adults highlights a significant misalignment between perceived knowledge and actual understanding of pension schemes, especially among younger adults."

Retirement

fromLondon Business News | Londonlovesbusiness.com

8 months agoWhat are the most common mistakes new traders make? - London Business News | Londonlovesbusiness.com

New traders often skip essential preparation and risk control, leading to mistakes that can quickly deplete their trading accounts.

Startup companies

Startup companies

fromFast Company

8 months agoA third of Gen Z feels 'pressure' to become social media creators-and most say their schools encourage it

Many recent high school graduates feel unprepared for life skills needed in today's economy.

A large percentage of grads wish they had learned about financial literacy during high school.

fromEntrepreneur

8 months agoOnly 48% of Founders Feel Confident About Their Taxes - Here's How to Join Them | Entrepreneur

Nearly three out of four founders admit they go into every filing season with gnawing doubt about whether they paid the right amount, overpaid or overlooked a key incentive.

Startup companies

[ Load more ]