#bitcoin

#bitcoin

[ follow ]

#market-volatility #kidnapping #corporate-treasury #liquidations #ransom-demand #ethereum #price-decline

fromFortune

1 week agoWhen Bitcoin prices turned against Michael Saylor, he quietly pivoted to risky financial gambit at Strategy | Fortune

Few business topics are garnering more coverage than Michael Saylor's unconventional strategy at Strategy, the software purveyor turned Bitcoin treasury outfit he still controls as top shareholder and Executive Chairman (the firm was formerly known as MicroStrategy). But one big shift has gone almost entirely unnoticed. As Bitcoin prices plunged, Saylor has attempted to remediate the situation by unleashing a torrent of new shares, the size of which has never before witnessed by a big market cap U.S. company. This immense dilution is keeping his Bitcoin stash growing as a point of pride-but dragging shareholders into dangerous territory.

Cryptocurrency

from24/7 Wall St.

1 week agoMSTR Has Lost 62% in a Year and Bitcoin Is Still Below Its Buy Price

The company's Q4 2025 earnings, filed on February 5, 2026, showed a $12.44 billion net loss, driven by a $17.44 billion unrealized loss on digital assets. Shockingly, Strategy holds 713,502 bitcoins valued at $59.75 billion against a cost basis of $54.26 billion, leaving the company essentially underwater on its massive bet.

Business

fromBitcoin Magazine

1 week agoLedn Sells $188M Bitcoin-Backed Bonds In Unprecedented Deal

Crypto lender Ledn Inc. has sold $188 million in securitized bonds backed by Bitcoin-linked loans, marking a first-of-its-kind deal in the asset-backed debt market. The transaction includes two bond tranches, according to Bloomberg, one of which received an investment-grade rating and priced at a spread of 335 basis points over the benchmark rate, according to people familiar with the matter. Jefferies Financial Group Inc. served as the sole structuring agent and bookrunner.

Cryptocurrency

fromBitcoin Magazine

1 week agoBitcoin Bears Dominate: Failure To Break $71,800 Keeps Downside Risk Alive

The past week's price action has been rather lackluster for Bitcoin. After seeing a big bounce from $60,000, the price failed to get above short-term resistance at $71,800 last week. Instead, the price tested the short-term support at $65,650 before bouncing back up to close the week out at $68,811. While the weekly chart is showing some buying strength below $66,000, the lack of follow-through for buyers on the bounces so far is a sign of weakness.

Cryptocurrency

fromLondon Business News | Londonlovesbusiness.com

1 week agoGeopolitics keep crypto liquidity at bay - London Business News | Londonlovesbusiness.com

Bitcoin has failed to break out above the $70,000 threshold despite multiple attempts since last week, remaining pinned near its lowest levels of 2024. A convergence of risk factors, ranging from AI-related anxieties to a persistent higher-for-longer interest rate environment and the specter of conflict in the Middle East, is preventing liquidity from returning to the crypto market through its usual channels.

Business

fromBitcoin Magazine

1 week agoBitcoin Price Reclaims $70,000 After Deep February Slide

The latest upside followed January's Consumer Price Index report, which showed inflation rising 2.4% year-over-year, slightly under the 2.5% forecast. The softer print strengthened expectations that the Federal Reserve could begin cutting rates sooner than previously anticipated, a shift that typically benefits higher-beta assets like cryptocurrencies. Prediction markets reflected the change in sentiment. Traders on Kalshi increased the implied odds of an April rate cut to 23%, while Polymarket pricing also moved higher over the week.

Business

fromBitcoin Magazine

2 weeks agoDanske Bank Embraces Bitcoin After Years Of Resistance

Denmark-based Danske Bank will now allow customers to invest in cryptocurrency-linked products tied to Bitcoin, marking a shift for Denmark's largest lender after years of resistance to the asset class. The bank said customers using Danske eBanking and Danske Mobile Banking can now gain exposure through exchange traded products, or ETPs, that track the performance of Bitcoin or Ethereum. The offering includes three products at launch, with two linked to Bitcoin and one linked to Ethereum.

Cryptocurrency

Cryptocurrency

fromLondon Business News | Londonlovesbusiness.com

2 weeks agoBitcoin stalls below $70,000 as sentiment remains subdued - London Business News | Londonlovesbusiness.com

Bitcoin consolidates below $70,000 as markets await US nonfarm payrolls that could shift Federal Reserve expectations and broader asset sentiment.

fromBitcoin Magazine

2 weeks agoU.S. Treasury: U.S. Needs To Pass Clarity Act To Clear Path For Bitcoin And Crypto Markets

Bessent told host Maria Bartiromo that the recent volatility and developments in crypto markets really show the need for legal certainty. "What we're seeing in the crypto market over the past few months means more than ever that the U.S. needs market structure, we need clarity, and we need to get this across the line this spring," he said. Bessent acknowledged resistance from some quarters but said he remains optimistic that Congress can bring the bill back for a markup session.

US politics

Miscellaneous

fromLondon Business News | Londonlovesbusiness.com

2 weeks agoBP's profit falls, Bitcoin's descent and AI winners and losers - London Business News | Londonlovesbusiness.com

Markets weaken as geopolitical easing and lower oil pressures weigh on miners and energy giants, while Bitcoin falls below $70,000 and BP shares slide.

fromFuturism

2 weeks agoBitcoin Finally Finds Practical Use: Kidnapping Senior Citizens for Ransom

Perhaps it's the future of digital commerce? As it turns out, none of those really stuck, as extreme price swings and fees make the crypto a bad fit for most practical commercial purposes. The horrifying abduction of Nancy Guthrie, however, highlights perhaps the one persistent utility Bitcoin has been able to maintain: its place as the de facto global currency of crime.

Cryptocurrency

fromwww.theguardian.com

2 weeks agoFiles cast light on Jeffrey Epstein's ties to cryptocurrency

Documents published last week by the US Department of Justice reveal Epstein bankrolled the principal home and funding source for bitcoin, the world's largest cryptocurrency, during its nascent stages; he also invested $3m in Coinbase in 2014, the largest cryptocurrency exchange in the US, and cut a check that same year to Blockstream, a prominent bitcoin-focused technology firm. Both crypto startups accepted Epstein's investments in 2014 six years after his 2008 conviction in Florida for soliciting prostitution from a minor.

US news

fromFortune

3 weeks agoDow soars by 1,200 points to top 50,000 for the first time as chips and airlines lead ferocious stock market rebound | Fortune

The U.S. stock market roared back on Friday, as technology stocks recovered much of their losses from earlier in the week and bitcoin halted its plunge, at least for now. The S&P 500 rallied 2% for its best day since May. The Dow Jones Industrial Average soared 1,206 points, or 2.5%, and topped the 50,000 level for the first time, while the Nasdaq composite leaped 2.2%.

Business

fromBitcoin Magazine

3 weeks agoStrategy ($MSTR) Soars 25% As Bitcoin Bounces Off Lows

Shares of Strategy ($MSTR) surged sharply Friday, lifting more than 25% at times, trading near $133, after a brutal prior session left the bitcoin‑linked stock deeply oversold. The jump comes as markets stabilized and bitcoin rebounded from multi‑week lows to around $71,000, injecting newfound demand into equities tied to digital assets. Friday's rally reversed a dramatic sell‑off on Thursday, during which MSTR shares plunged to multi‑year lows on earnings losses and renewed pressure in crypto markets.

Business

fromwww.bbc.com

3 weeks agoBitcoin falls to lowest level since Trump took office

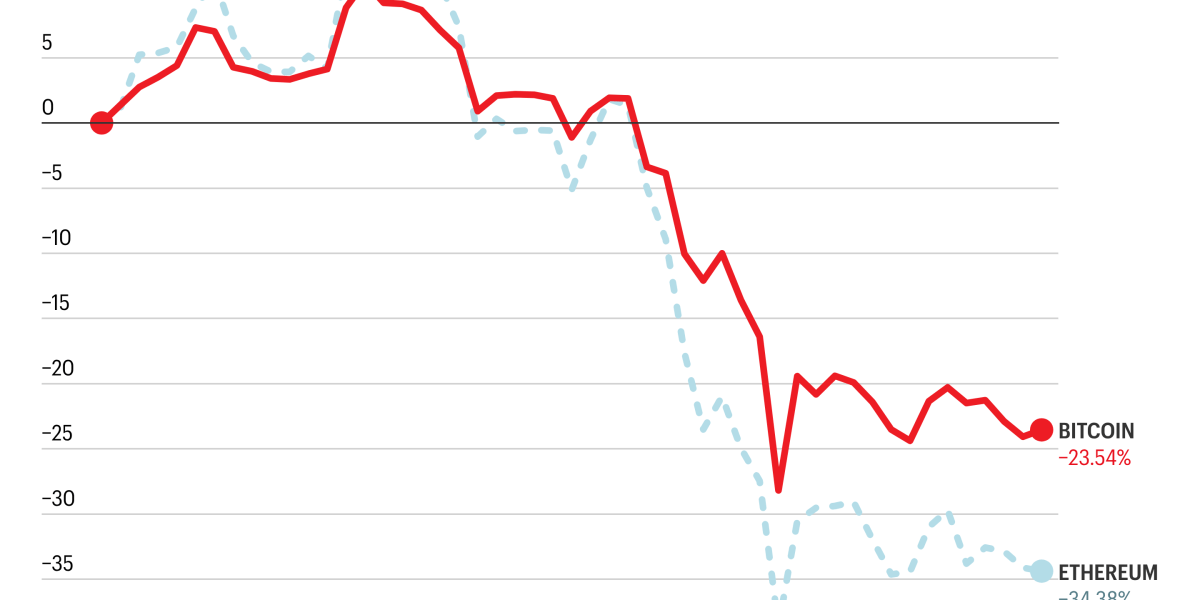

The price of Bitcoin has fallen to its lowest level in 15 months despite US president Donald Trump's personal and public support of cryptocurrency. A single Bitcoin is now worth $66,000 (48,700), its lowest level since October of 2024, with the price down 24% since the start of this year. The drop followed months of surging Bitcoin prices, which saw the cryptocurrency hit an all-time high of $122,200 in October.

US politics

Business

fromBitcoin Magazine

3 weeks agoHow A B2B Payments Giant Is Sneaking Bitcoin Onto Corporate Balance Sheets Without Anyone Noticing

Paystand uses Bitcoin as a settlement layer to provide fast, auditable corporate payments, handling receivables, payables, payroll and cross-border transfers for large businesses.

Cryptocurrency

fromFortune

3 weeks agoCrypto market in free fall as Bitcoin plunges below $70,000 while shares in Coinbase and Circle tumble | Fortune

Bitcoin plunged below $68,000, a 46% drop from its $126,000 peak, dragging major crypto firms' stocks down amid macroeconomic and political uncertainty.

fromBitcoin Magazine

3 weeks agoBitcoin Falls Over $59,000 In Largest Drawdown Ever

Bitcoin's price crashed sharply on Thursday, sliding through critical support and dipping near $66,000 in volatile trading - marking what appears to be the largest absolute dollar drawdown on record for the world's largest cryptocurrency. The latest plunge comes during a broader global risk-off sell-off, with equities, commodities and digital assets all under pressure. Major U.S. and Asian stock indices weakened on economic growth concerns

World news

from24/7 Wall St.

3 weeks ago3 Crypto ETFs to Buy Now

Cryptocurrencies have become a valuable asset, with Bitcoin ( CRYPTO: BTC) almost doubling over the past five years. The famed digital asset is in the middle of a sharp correction, which presents a buy-the-dip opportunity for assets with exposure to the crypto industry. Luckily, you don't have to guess which crypto stock will be the next winner. Crypto ETFs give investors broad exposure to the opportunity and have diversified portfolios.

Business

fromBitcoin Magazine

3 weeks agoVirginia Lawmakers Advance Bill For A State Bitcoin Fund

Senate Bill 557, patroned by Senator Reeves, would establish the Commonwealth Strategic Cryptocurrency Reserve Fund, a special nonreverting fund housed in the state treasury and administered by the Virginia State Treasurer. The measure advanced this week after passing the Senate General Laws and Technology Committee in a 13-2 vote. Under the legislation, Virginia would be authorized to invest state-held funds directly into bitcoin or other qualifying cryptocurrencies, creating what supporters describe as a strategic reserve designed to modernize treasury management.

US politics

[ Load more ]