#budgeting

#budgeting

[ follow ]

fromTravel + Leisure

3 weeks ago15 Best Ski Resorts in the U.S., According to Lifelong Skiers

Both avid and casual skiers know that winter requires preparation. If you want to ski as many days as possible, you must have a game plan. After all, skiing is an expensive sport, so budget is typically one of the top considerations. But before you book flights, hotels, and lift tickets, or decide if you want to invest in an Epic Pass or Ikon Pass, you'll need to identify which ski resorts you want to explore over the course of a few months.

Skiing

fromInc

4 weeks agoHow Much Influencer Marketing Really Costs in 2026-and Why $50,000 Is the Magic Number

That $50,000 goes toward turning a brand's "educated guess" into "metrics they're confident about," Titus says. Here's how that test and learn process typically works on Faved: A beauty brand, for example, will typically spend their first $15,000 to $20,000 on 10 differently priced collaborations with beauty or lifestyle influencers whose audiences fit their ideal customer profile. During this step, he adds, the brand's only goal is to figure out which influencer's content drove the most sales at the lowest cost.

Marketing

fromApartment Therapy

1 month ago5 Expensive Mistakes Interior Designers Won't Make Again

They may seem like they have magical powers to some, but interior designers are not born ready to create beautiful interiors at the drop of a hat - they're human, just like any other professional. And many learn the best lessons about chic style and great function the hard way. A costly mistake is a design pro's worst nightmare (especially for a budget!), but it's a gem for everyone else in that it's an opportunity to prevent it from happening again.

Renovation

fromIrish Independent

1 month ago'You need to get to the point where you absolutely hate your debt': Eoin McGee on how to defeat debt in 2026

Get rid of your ability to borrow - whether that's credit cards, if it's an overdraft you need to treat it like a loan. If you owe €500 in an overdraft, you need to say, 'Right, for the next 10 months, I'm going to put €50 a month off that and I'm going to create a new zero'. For a lot of people, an overdraft is an interesting one because they go to minus 500, they get paid, they get through the month, they go back to minus 500. That's your zero.

Business

Digital life

fromeLearning Industry

2 months agoHow eLearning Improves Personal Finance And Responsible Spending

eLearning delivers accessible, interactive personal finance education that builds budgeting, saving, debt management, and investing skills, improving financial decisions and long-term stability.

Food & drink

fromBusiness Insider

2 months agoI've been in over 125 weddings. Here are 5 things guests actually care about - and 5 that are a waste of money.

Guests prioritize cocktails, comfort and a catered meal over lavish decor and personalized favors; allocate budget to food and beverages instead of intricate florals.

from24/7 Wall St.

2 months agoThis Is How Many Americans Have Socked Away At Least $500K for Their Retirement Years

According to the Employee Benefit Research Institute , more than 50% of Americans have less than $10,000 saved for retirement. This is a big concern, especially considering how shocking it is that a much smaller number have more than $500,000 tucked away for retirement. When you look at the data breakdown provided by the research, there is no question that it will shock people of all income and savings levels.

US news

from24/7 Wall St.

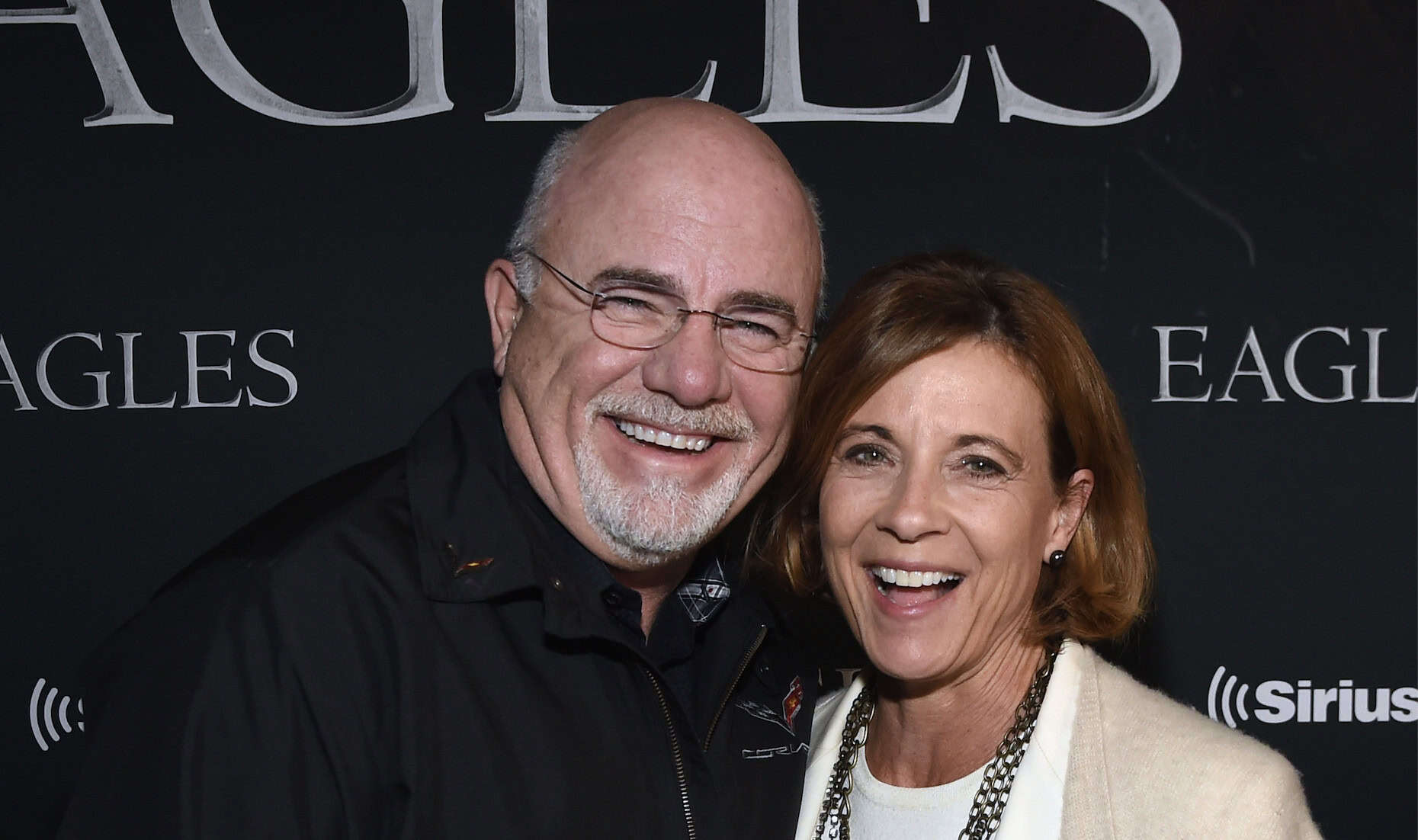

2 months agoDave Ramsey Tells Struggling 27-Year-Old Guardian to Cover the 'Four Walls' Before Attacking $35,000 Debt

On a December 4 episode of The Dave Ramsey Show, a caller named Michael, 27, sought help after falling behind on nearly all his bills. Raising his 17-year-old brother for four years while working as a door-to-door roofing salesman, he'd accumulated $35,000 in debt from a car lease, credit cards, and charge-offs. His commission-based income ranged from $3,000 to $3,500 monthly during the slow season, barely covering his $850 rent and other expenses.

Business

from24/7 Wall St.

2 months ago5 Surprising Things You Didn't Know Your Financial Advisor Could Do

There are certain aspects of life it pays to hire a professional for. You could try to tackle a plumbing issue on your own, for example, like a busted faucet or leaky pipe. But if you're not sure what you're doing, there's a pretty big risk in going it alone. You could cause your house to flood or make the situation worse. So it pays to bring in someone who's licensed and skilled.

Business

fromBusiness Insider

2 months agoI visited Japan for a week. From missed experiences to money mistakes, I should've done these 6 things differently.

This year, I finally fulfilled my dream of visiting Japan, spending a week in the country with two friends. About a month before, I purchased a round-trip ticket from New York City to Tokyo for $1,000. We chose to visit in early December - the month isn't as popular with tourists, and we hoped to catch the tail end of the area's peak fall foliage.

Travel

fromwww.mercurynews.com

2 months agoHarriette Cole: My parents are coming to visit, and I'm panicking

I tried to plan everything myself to make the visit special, but I ended up waiting too long. Now the prices are sky-high completely out of my budget and I'm panicking. I feel embarrassed because I had plenty of time to prepare, and I don't want my parents to think I'm irresponsible or that I don't care about making their trip enjoyable.

Relationships

fromBustle

2 months agoYour Tarot Reading For The Week Of December 15 - 21

Your card for the week is the Two of Pentacles, which represents balance, flexibility, and the need to adapt. It's the perfect card to keep in mind during the holiday season, especially if you feel like you're being pulled in multiple directions. When this card pops up in a tarot reading, it's often a sign that you have two (or more) important things to juggle.

Relationships

Food & drink

fromApartment Therapy

2 months agoMy Neighbor's Clever Tip for Spending Less on Groceries (It's Financial Expert Approved!)

Following a simple, consistent curated grocery plan—focusing weekly on a protein, vegetables, and grains—saves money while allowing flexible, varied meals with sale and seasonal items.

Real estate

fromLondon Business News | Londonlovesbusiness.com

2 months agoEssential tips every first-time buyer needs for a smooth process - London Business News | Londonlovesbusiness.com

Prepare finances early, obtain mortgage pre-approval, budget for all purchase and ongoing costs, and work with an experienced conveyancing solicitor to simplify the first-time homebuying process.

Retirement

fromBusiness Insider

2 months agoWe're high earners with student debt and kids. Here's how we continue to build wealth.

High-earning households can preserve and build wealth through strict budgeting, automating finances, regular investing, resisting lifestyle inflation, and pursuing passive income.

Real estate

fromRedfin | Real Estate Tips for Home Buying, Selling & More

3 months agoBuying a House in Retirement: Pros, Cons, and How to Choose the Right Home

Plan retirement home purchases around a sustainable budget, lifestyle needs, accessibility, taxes, maintenance, and estate planning; verify mortgage options and long-term fit before buying.

Fundraising

fromNonprofit Quarterly | Civic News. Empowering Nonprofits. Advancing Justice.

3 months agoNonprofit Budgeting in a Maelstrom | Nonprofit Quarterly | Civic News. Empowering Nonprofits. Advancing Justice.

Nonprofit financial stability faces deliberate federal destabilization in 2025, requiring strategic budgets and risk assessment to survive funding cuts, investigations, and loss of tax status.

fromBusiness Insider

3 months agoWe are on day 37 of no paycheck for my husband. We've cut all our subscriptions and have a shopping ban to make it through the shutdown.

Most of our family's income comes from federal funds. My husband and I both have military retirement checks, and he's a federal civilian. Our retirement pensions are not affected by the government shutdown, but my husband's paycheck is. We're on day 37 without his income, and honestly, it's surreal. While our retirements and my job will get us through, the loss of a paycheck has prompted some adjustments in our spending.

Retirement

Relationships

fromHuffPost

3 months agoThis Seemingly Harmless Pre-Wedding Tradition Is Destroying Friendships Left And Right

Attending modern bachelorette parties often requires significant personal expense, prompting compromises and honest budget discussions among bridesmaids to enable participation.

fromBusiness Insider

4 months agoOur kids only participate in one activity at a time, here's why

Our entire family sits down to have a meal together several times a week. We ask each other questions, find out what's going on in our kids' lives, and share funny stories. Though mealtime can sometimes be chaotic, with bickering and typical exhaustion, we also relish in the limited opportunities we have to sit, face-to-face, and share a meal. We also have some family time on Sunday mornings, attending church together, and the occasional Friday night, where we can watch a movie.

Parenting

fromESPN.com

4 months agoFantasy basketball: How to ace your salary cap draft

Shai Gilgeous-Alexander is undeniably awesome. So is Victor Wembanyama. Yet, in a traditional snake draft, getting both is essentially impossible given both are found firmly in the first round. There is a draft format, however, that absolutely allows you to pair SGA and Wemby. Or Nikola Jokic and Stephen Curry, Luka Doncic and Giannis Antetokounmpo... you get the idea. Salary cap drafts afford you the ability to assemble compelling collections of superstars.

National Basketball Association

Business

fromBusiness Insider

4 months agoI live with my parents and work a remote job. From student loans to 'fun money,' here's where every penny of my paycheck goes.

Living rent-free with parents enables rapid saving, aggressive student-loan repayment, Roth IRA contributions, diversified small investments, and modest discretionary spending.

fromBustle

4 months agoIf You Struggle To Stick To A Budget, Open A Second Checking Account

When you're busy swiping your card and paying bills, all coming out of one account, you may be more likely to get to the end of the month with nothing left - and definitely without any extra money to set aside in savings. "Everything's just flying out everywhere," @hermoneymastery said, pointing to subscriptions, groceries, bills, and rent, as well as all the little snacks and food delivery you might buy throughout the week.

Business

from24/7 Wall St.

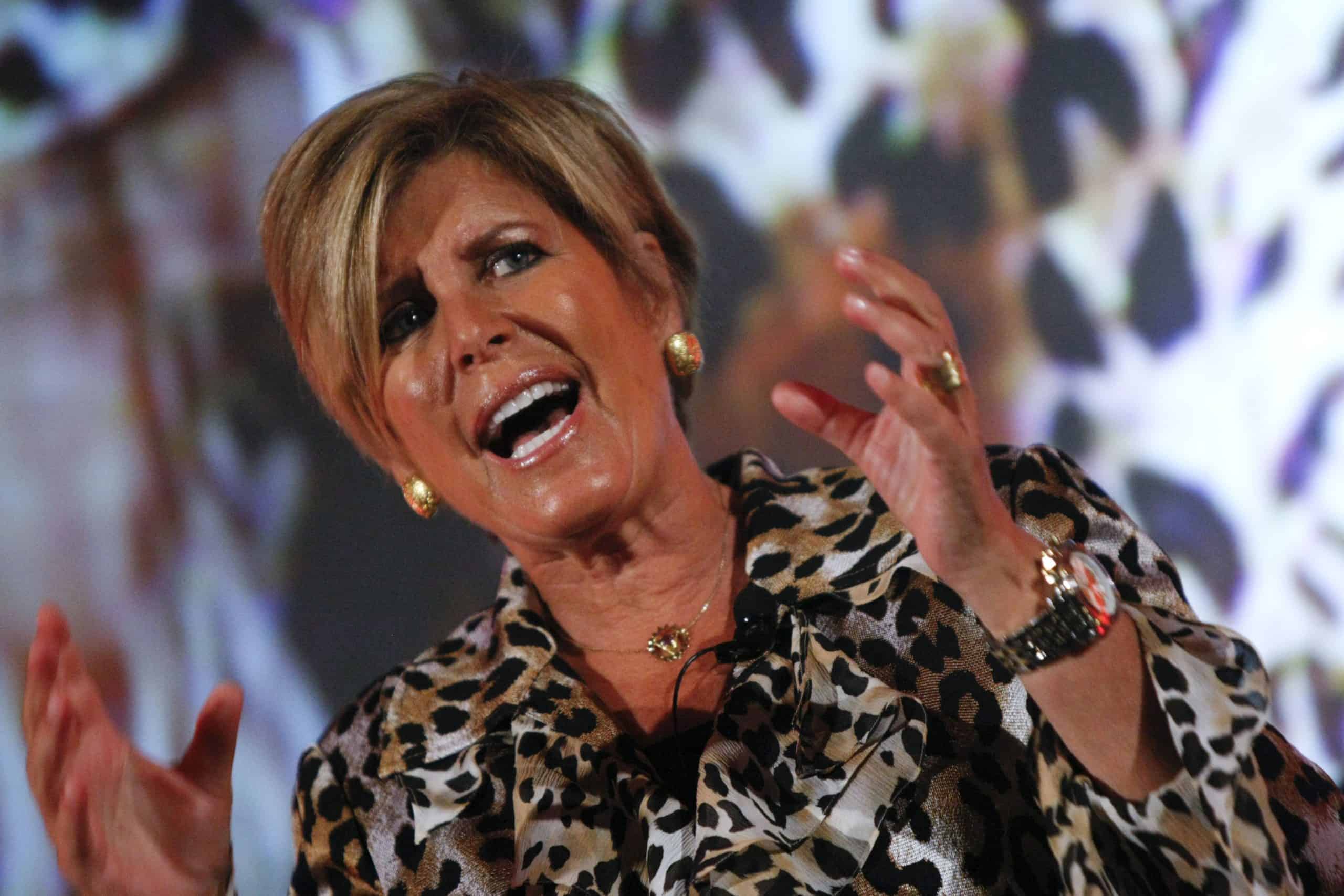

4 months agoForget the Fancy Cars: Dave Ramsey Says Live Below Your Means, Even When You're Rich

Dave Ramsey is a radio personality and finance guru, well-known for helping Americans join the debt-free ranks. Dave Ramsey founded The Lampo Group, Inc. in 1992, which was later rebranded as Ramsey Solutions in 2014. He has written multiple books, including his best-seller The Total Money Makeover. Dave Ramsey's program has reached millions through The Ramsey Show, books, courses, and Financial Peace University.

Business

fromTasting Table

5 months agoWhat It Means To 'Slow Renovate' Your Kitchen, And Why It Might Be The Low-Stress Method You Need - Tasting Table

A kitchen renovation doesn't have to be a stressful project completed at a breakneck pace. If you aren't about to sell your home (or aren't making emergency repairs), it may be worth it to take your time. A slow renovation is a more intentional, gradual, and mindful approach to addressing challenges or concerns in your kitchen or just making tasteful upgrades. To get a better handle on the process, we spoke with Carmine Argano, owner of Creative Design Ceramic Tile & Bath, to get his tips for putting this trend into practice during a kitchen renovation.

Remodel

Real estate

fromIndependent

5 months agoEoin McGee answers: 'We cleared our mortgage early. Should we buy an investment property or invest the extra money?'

Mortgage cleared, freeing €1,150 monthly for a child-free couple in their early 50s to allocate toward savings, investments, or lifestyle choices.

Cars

fromLondon Business News | Londonlovesbusiness.com

5 months agoCar finance and insurance: How to keep the costs under control in 2025 - London Business News | Londonlovesbusiness.com

Monthly car finance payments obscure additional costs like insurance, tax, servicing, and maintenance that can significantly increase total car ownership expenses.

[ Load more ]