fromLondon Business News | Londonlovesbusiness.com

1 month agoDollar struggle and monetary policy shape the next phase - London Business News | Londonlovesbusiness.com

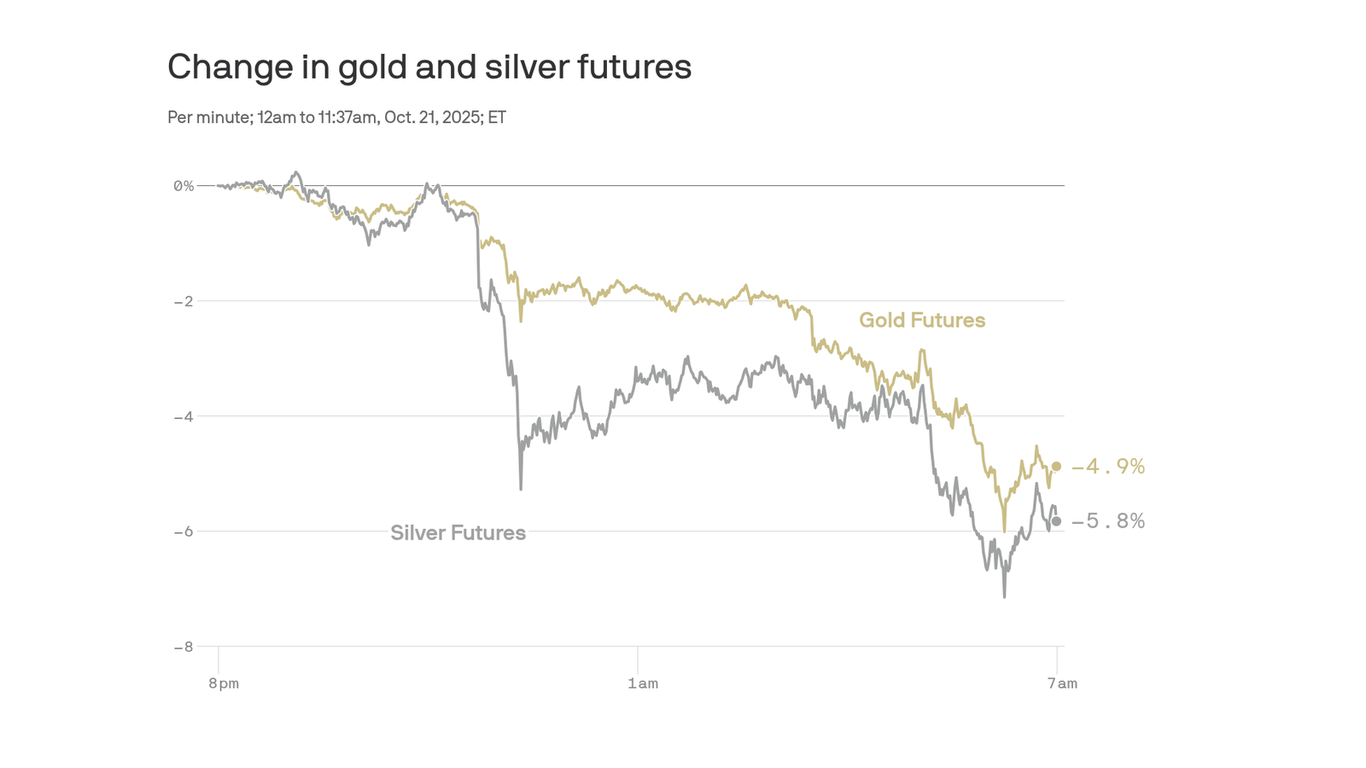

The resilience of gold above $4,800 per ounce at this stage reflects a delicate and complex balance between traditional supporting factors and emerging pressures-one that cannot be superficially interpreted or reduced to the movement of the dollar alone.

It is true that the U.S. dollar's retreat from its recent peaks, after failing to sustain its recovery momentum from a four-year low, provided gold with a short-term breather and attracted some buyers.