from24/7 Wall St.

19 hours agoVenture

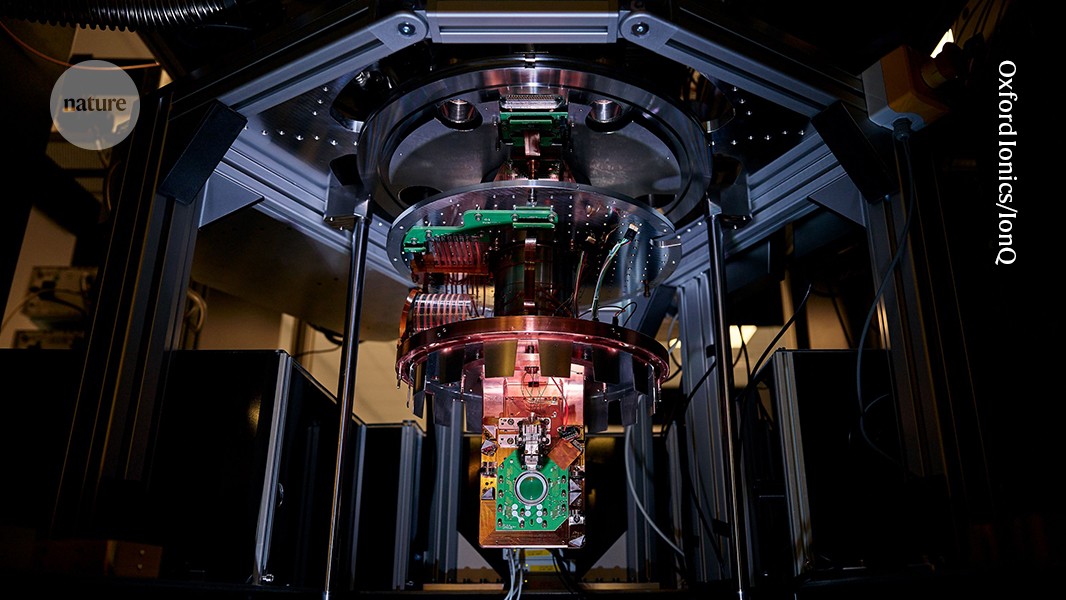

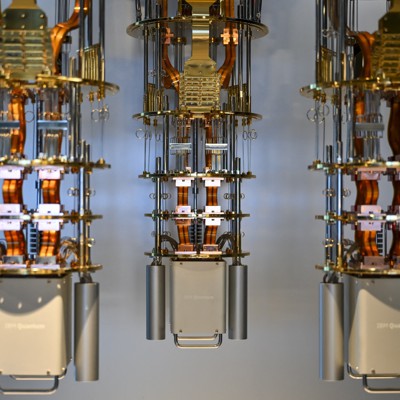

IonQ Plays Solid Defense: Is It the Only Quantum Computing Stock You Should Buy?

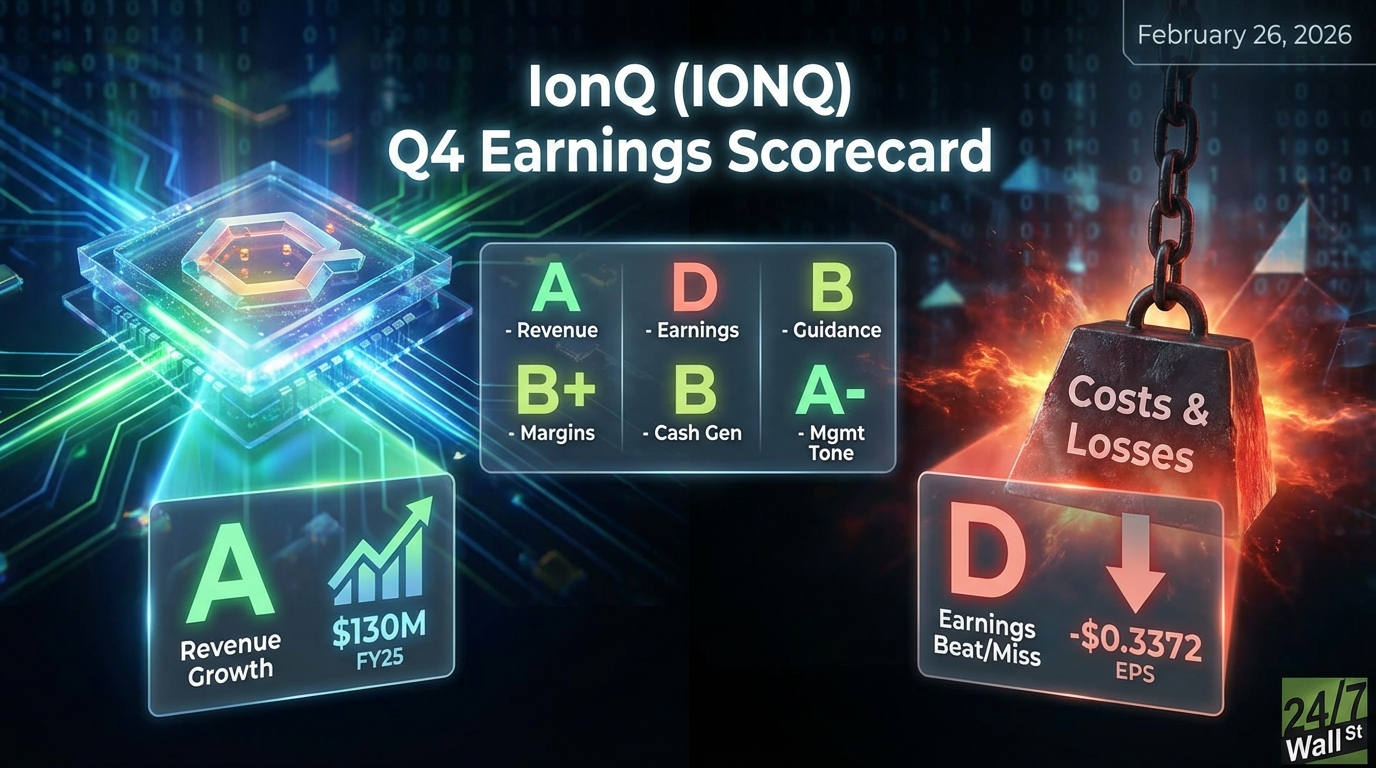

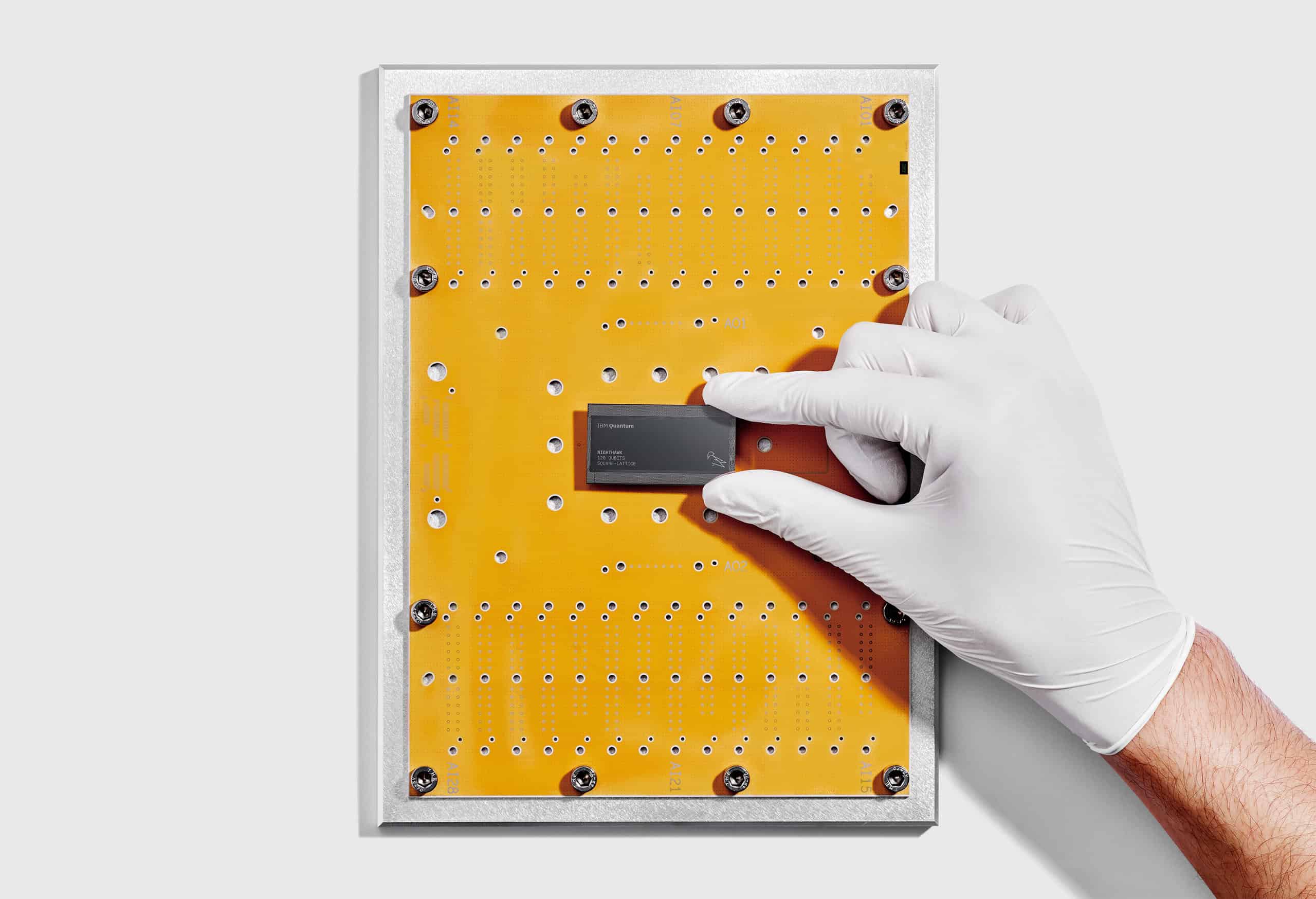

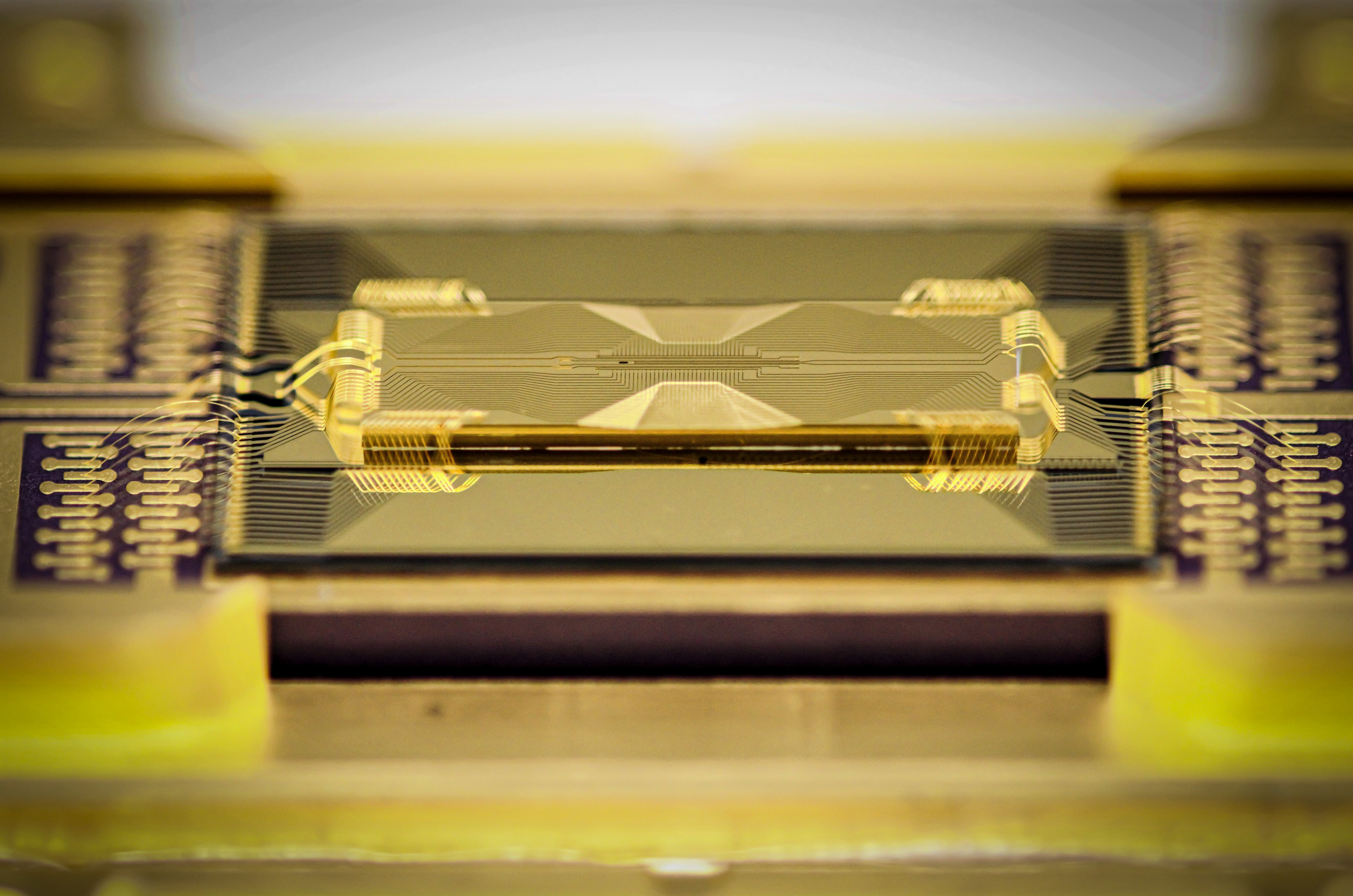

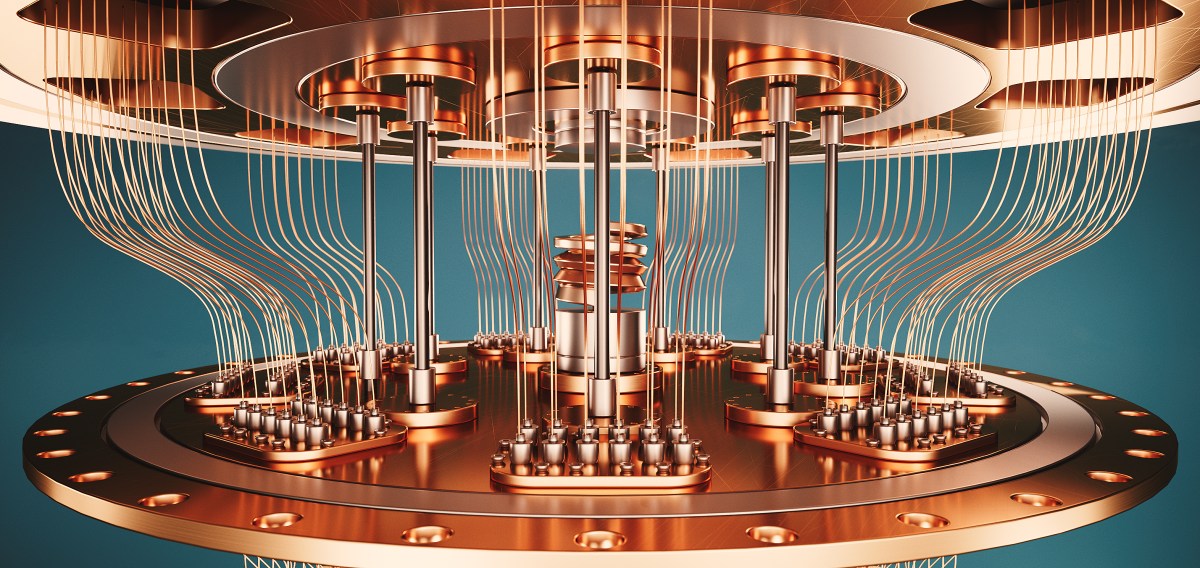

IonQ became the first publicly traded quantum computing company to exceed $100 million in annual revenue, with commercial customers representing over 60% of sales and aggressive expansion plans targeting $225-245 million revenue in 2026.