Artificial intelligence

from24/7 Wall St.

6 days agoBOTZ Is A Robotics ETF That Quietly Bets Big on AI Chips

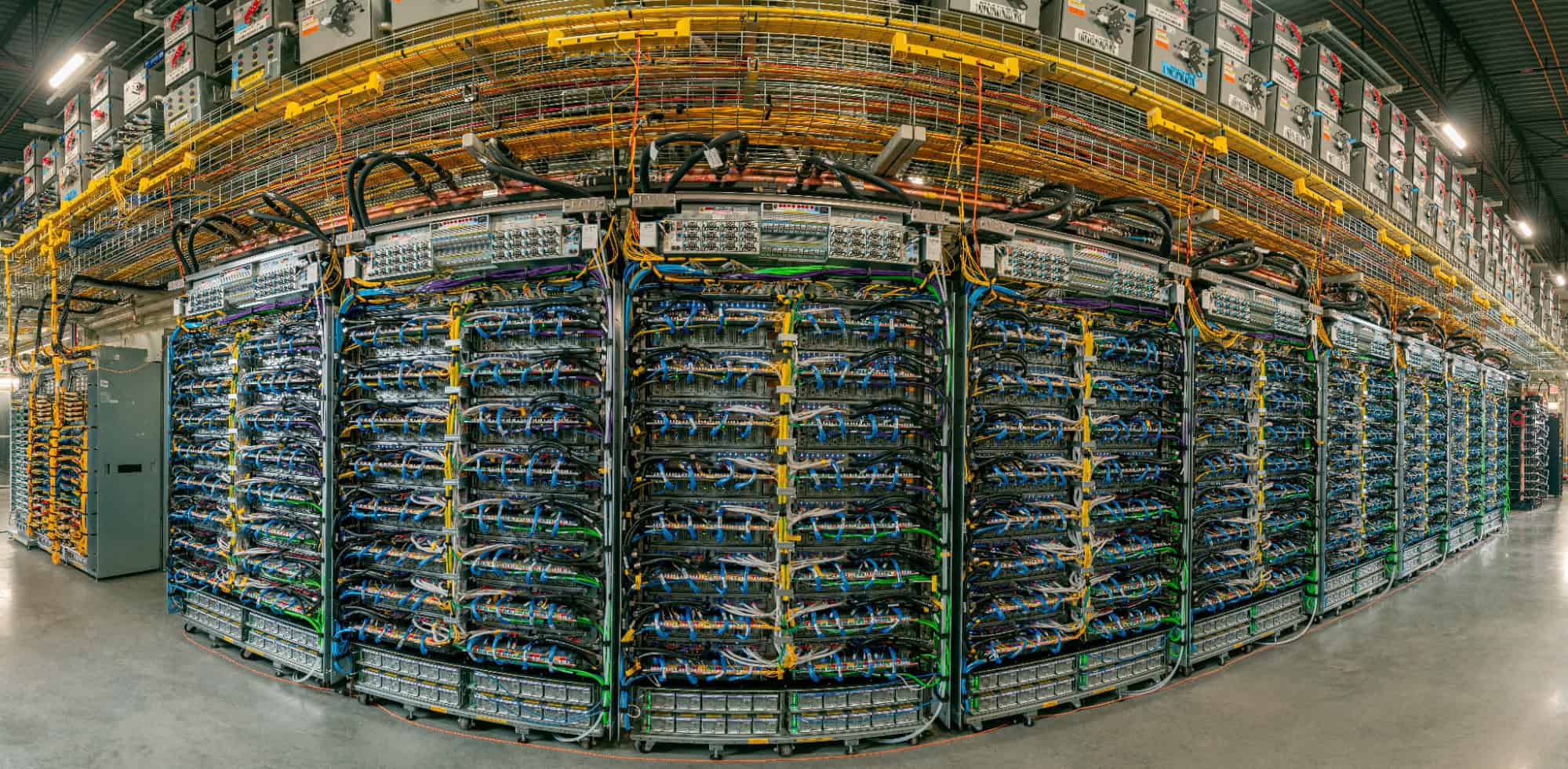

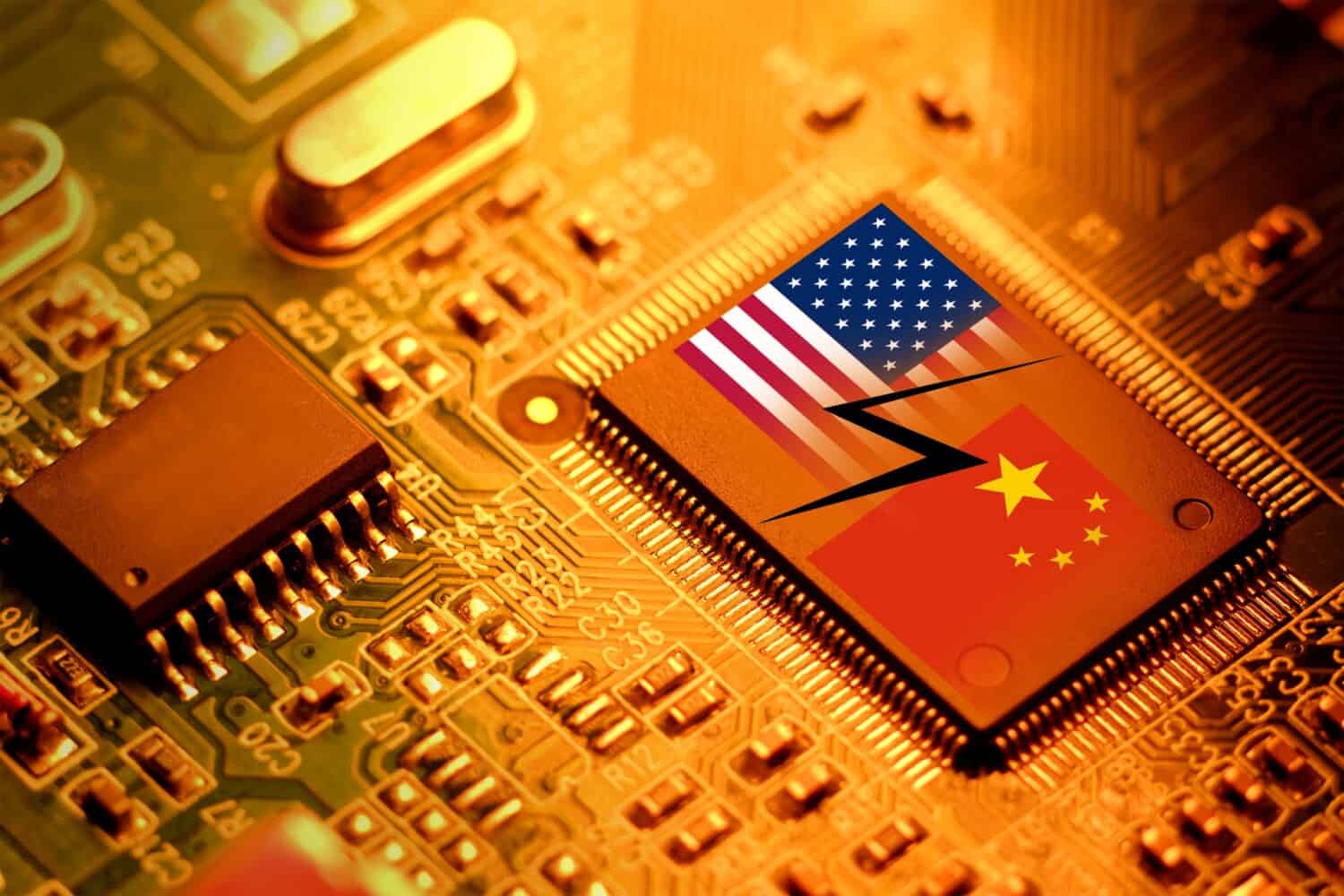

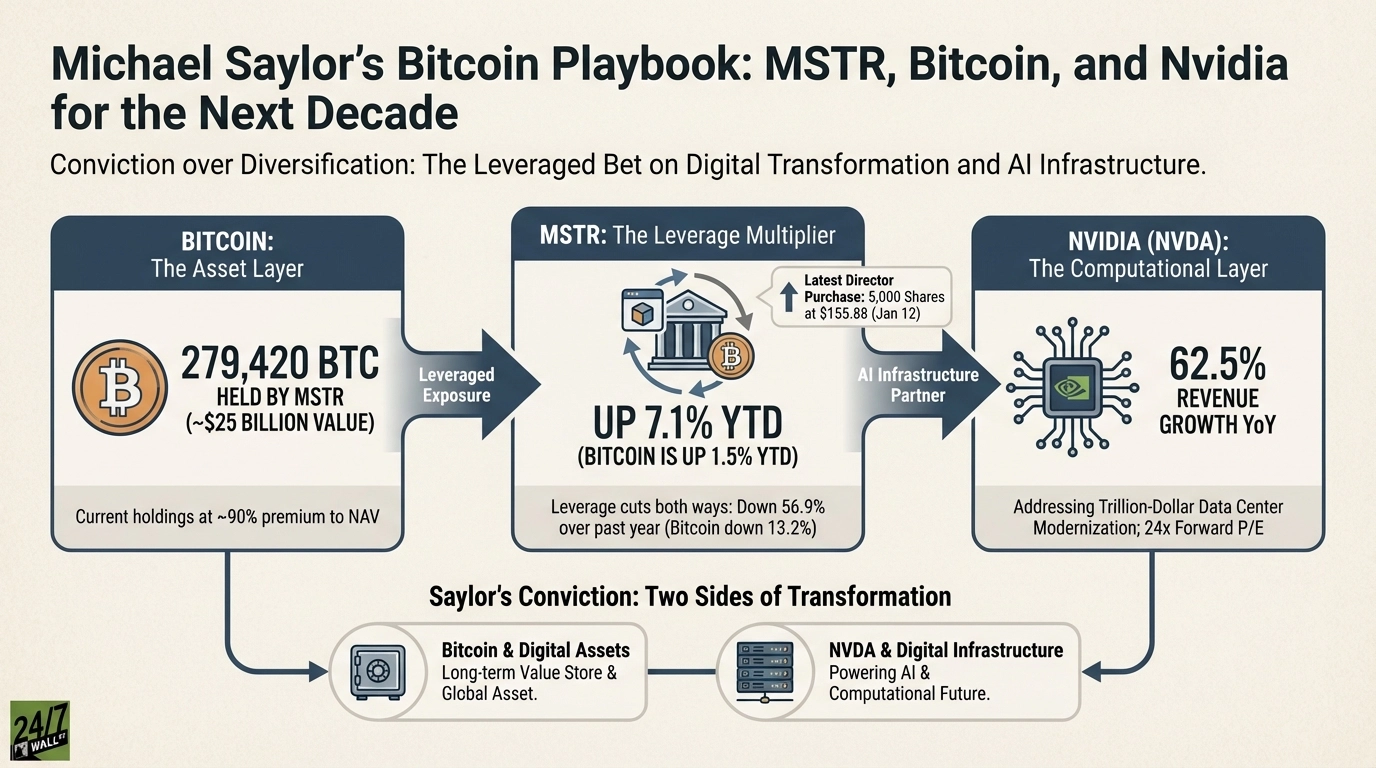

BOTZ's returns are primarily driven by AI infrastructure spending rather than robotics, with nearly one-third concentrated in three holdings including NVIDIA, making macro AI capex cycles the dominant performance factor.