#intel

#intel

[ follow ]

#nvidia #ai-chips #semiconductors #tsmc #foundry #chips-act #semiconductor-manufacturing #ai-infrastructure

fromwww.mercurynews.com

1 month agoIntel suffers worst decline in 17 months after bleak forecast

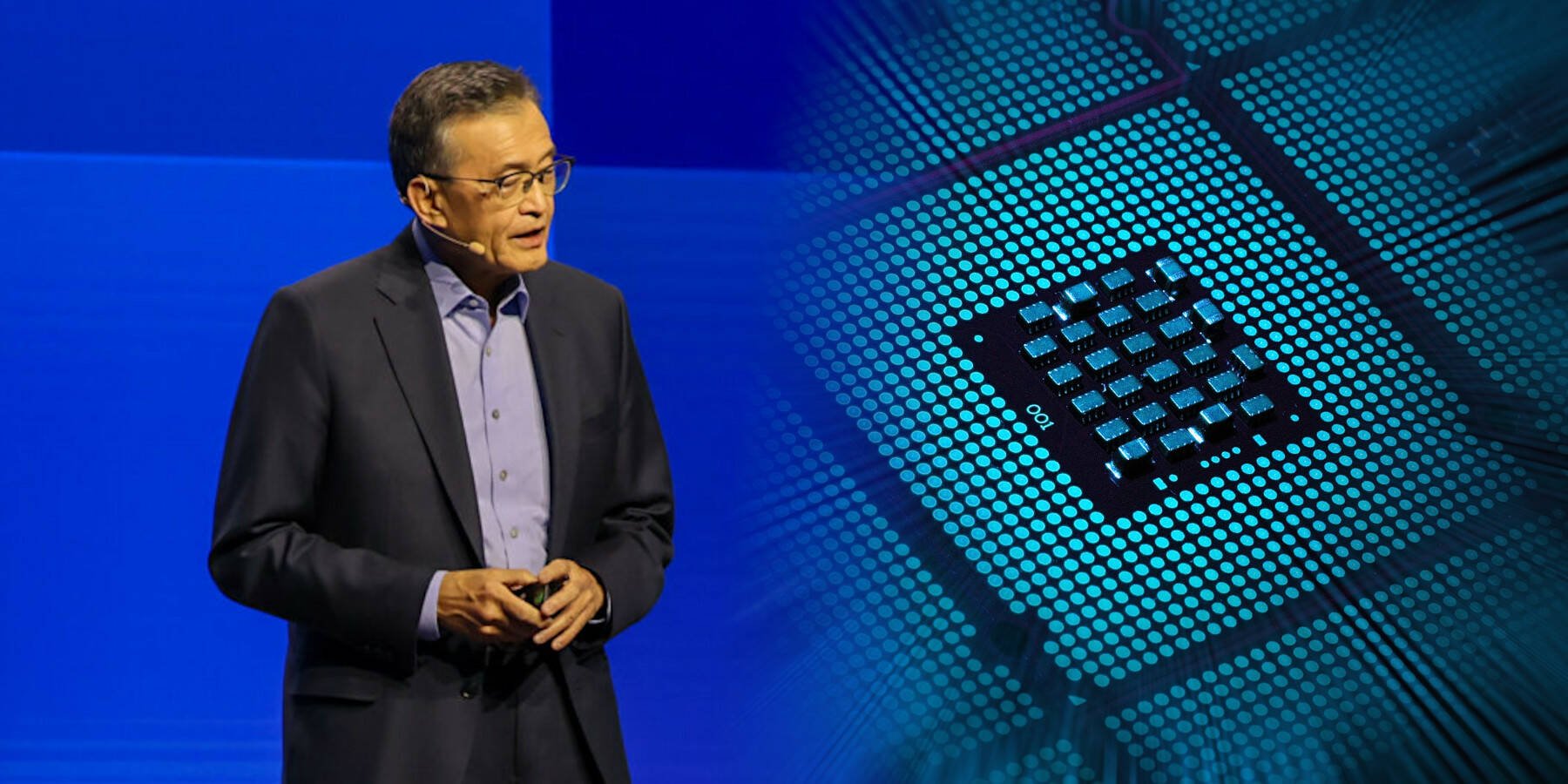

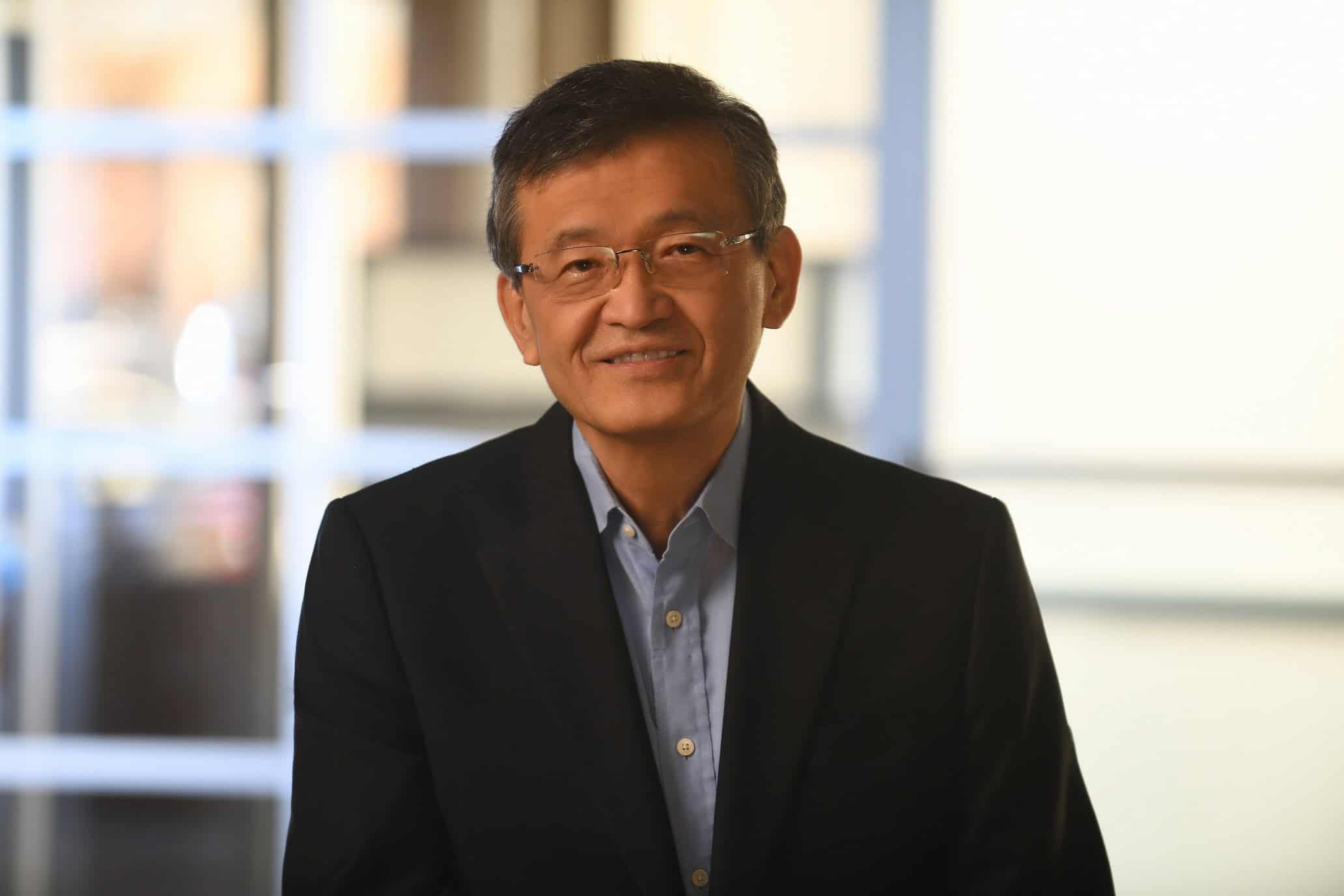

Intel Corp. shares plunged about 17% after Chief Executive Officer Lip-Bu Tan gave a lackluster forecast and warned that the chipmaker was struggling with manufacturing problems. First-quarter projections for revenue and earnings both fell well short of Wall Street estimates. And a conference call with analysts, where Tan said it would take time and resolve to turn around the company, sent the shares down further.

Tech industry

Tech industry

from24/7 Wall St.

1 month agoSold-Out AI Chips and Growing Foundry Buzz: Is Intel's Rally Just Getting Started?

Intel's operational improvements, rising 18A yields, and surging AI-driven server CPU demand are driving a strong stock rally and potential pricing power amid tight 2026 capacity.

fromTechCrunch

1 month agoIntel is building a handheld gaming platform including a dedicated chip | TechCrunch

The platform will include hardware and software, Intel vice president and general manager of PC products, Daniel Rogers, announced at CES on Monday. It will be built off of the company's Intel Core Series 3 processors, known as Panther Lake, which was announced last year and is now being rolled out in a variety of PCs. This future platform includes a chip specifically for handheld gaming devices, according to reporting from IGN, which was confirmed by TechCrunch.

Tech industry

fromEngadget

2 months agoIntel loses its latest challenge to 16-year-old EU antitrust case

The case began in 2009, when mobile computing was in its infancy and netbooks ( remember those?) were all the rage in the PC space. At the time, the EU ruled that Intel violated antitrust laws on multiple fronts. First, it used illegal hidden rebates to push rivals out of the PC processor market. Second, it paid manufacturers to delay or stop production of AMD-powered products.

Miscellaneous

fromTechzine Global

2 months agoIntel decides not to sell network division after all

Intel will retain its Networking and Edge (NEX) division after reviewing its strategic options. The chip giant had considered selling various parts of the business, but has now concluded that keeping NEX in-house offers advantages for the integration of hardware, software, and systems. Intel announced on Wednesday that the networking group will remain within the company. The decision is based on an evaluation of the strategic options for various business units.

Silicon Valley

fromTheregister

3 months agoAMD outpaces Intel in x86 shipments as market goes flat

AMD continues to claw market share away from Intel in CPU shipments, growing faster than its rival in most segments. Meanwhile business in the x86 processor arena is unusually flat overall, likely due to stockpiling over tariff fears. PC component market watcher Mercury Research says AMD's shipments during the third quarter of 2025 outpaced Intel's compared with the same quarter last year.

Silicon Valley

fromwww.mercurynews.com

4 months agoIntel rallies after forecast signals a comeback Is underway

Intel Corp. shares jumped after the chipmaker returned to profitability and gave an upbeat revenue forecast, suggesting that it's making progress on a long and challenging comeback attempt. Fourth-quarter sales will be roughly $13.3 billion, the company said in a statement Thursday. Though that was just below Wall Street's average estimate, some analysts were still including revenue from a unit that Intel just spun off money that wasn't part of the company's forecast.

Business

from24/7 Wall St.

4 months agoIntel Shares Surge 8% After Q3 Earnings: Everything You Need to Know

Intel (Nasdaq: INTC) reported Q3 earnings after the bell, and investors like what they see. Here are the key things to know from earnings. The Good: Adjusted EPS of $.23 beat Wall Street expectations of $.01. Revenue of $13.7 billion also beat expectations of $13.4 billion Intel's Client Computing and Data Center and AI groups both soundly exceeded expectations. Intel's CFO said "Current demand is outpacing supply, a trend we expect will persist into 2026."

Tech industry

US politics

fromFortune

5 months agoI'm the VC researcher who helped uncover Intel's close ties to China. Its nationalization just exposes a corporate governance crisis | Fortune

Corporate boards surrendered America's technological supremacy by mismanaging Intel, leading to government acquisition of a 9.9% stake.

fromFortune

5 months agoIt's time for Intel to go private, former board members say | Fortune

The next step is for the government to arrange for Intel to go private. Without the pressure of delivering quarterly earnings for the stockholders of today, a private Intel could divide itself into parts that no longer make sense to be conjoined. One new company should focus on manufacturing chips for all global firms with the goal of matching or exceeding performance levels that only TSMC can provide today.

Tech industry

Tech industry

fromTechCrunch

5 months agoIntel's chief executive of products departs among other leadership changes | TechCrunch

Intel reorganized senior leadership, created a central engineering group, made multiple executive hires, and adjusted foundry-related roles amid a proposed U.S. government 10% equity stake.

fromTechzine Global

5 months ago2026 will be a pivotal year for Intel's Foundry

Zinsner emphasizes that the construction of 14A production capacity will only proceed if there are sufficient commitments from external customers. According to Zinsner, this is purely financial common sense. The chip manufacturer wants to avoid making billions in investments without guaranteed sales.

Business

fromIntelligencer

6 months agoIntel and Beyond: What's the Meaning of Trump's Private-Sector Power Grab?

[T]he truce came with a cost: In return for Trump's support, the administration proposed taking an equity stake in the company. It decided to convert nearly $9 billion in grants-promised to Intel as part of the 2022 Chips Act-into a 10% equity stake in the company, an unusual arrangement that makes the government Intel's biggest shareholder. The meeting was the pivot point in a frenzied period for Intel, once one of America's most venerated technology companies, now stuck in a yearslong downward spiral.

US politics

fromFortune

6 months agoRepublicans discover socialism isn't so bad when they do it, with Trump vowing more deals like Intel to come

Donald Trump has a message for critics who think turning the U.S. government into a major stockholder of Intel is a "socialist" move: More is coming. "I will make deals like that for our Country all day long," the president posted on Truth Social after critics piled on, adding later about future ownership stakes, "I want to try and get as much as I can."

US politics

[ Load more ]