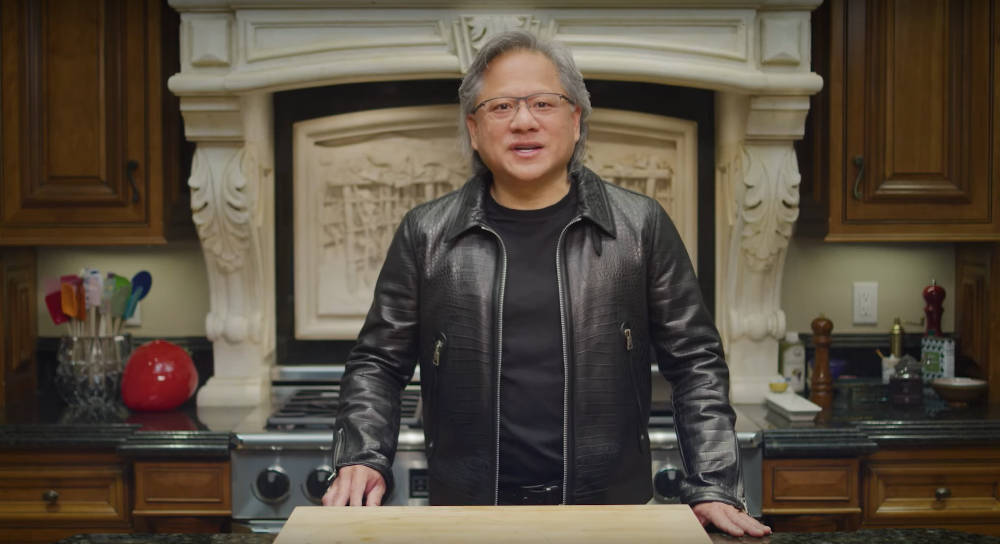

"Nvidia's $5 billion Intel stock purchase is already worth $7.58 billion, turning the recently approved bailout of its rival into a shrewd financial play. Nvidia had locked in a purchase price of $23.28 per share for Intel when Nvidia CEO Jensen Huang and Intel CEO Lip-Bu Tan struck a deal in September. The deal had been under scrutiny by the U.S. Federal Trade Commission, which was examining whether Nvidia's potential 4 percent ownership stake could run afoul of antitrust laws."

"Under the terms of the deal, Nvidia and Intel will jointly develop "multiple generations" of chips for datacenter and PC in a move to capture share across the entire chip customer base from consumer to hyperscale customers. The two companies will work on connecting their chips via the incredibly fast NVLink, which reaches 1.8 TB/s of bandwidth (900 GB/s in each direction) per GPU - about 14x the bandwidth of a PCIe 5.0 x16 slot."

Nvidia purchased 214 million Intel shares at a locked-in price of $23.28 per share, closing the $5 billion stake on Dec. 26 after FTC approval on Dec. 18. Intel shares traded at $36.68, valuing the stake at about $7.58 billion. Nvidia and Intel will jointly develop multiple generations of datacenter and PC chips and link their chips with NVLink, offering 1.8 TB/s per GPU. Intel will build Nvidia-custom x86 CPUs for Nvidia's AI infrastructure and x86 SOCs integrating Nvidia RTX GPU chiplets to power integrated CPU/GPU PCs. The partnership echoes past regulatory concerns surrounding Nvidia's failed Arm acquisition attempt in 2021.

Read at Theregister

Unable to calculate read time

Collection

[

|

...

]