"The talks come amid a flurry of new investment in Intel, which kicked off in August when Japanese investment bank SoftBank sank $2 billion into the ailing chipmaker. Less than a week later, the Trump administration was shaking down Intel for roughly $11 billion worth of stock options, equivalent to 10 percent of the company, in exchange for $8.9 billion in CHIPS Act funding Washington had already awarded."

"Then last week, Nvidia joined in on the fun, announcing plans to plow $5 billion into Intel shares. As part of the deal, the two companies formed a co-development initiative that would see Nvidia extend its GPU empire by integrating its graphics tech into Intel CPUs. Intel meanwhile secured a place for its Xeon processors in Nvidia's future rack systems."

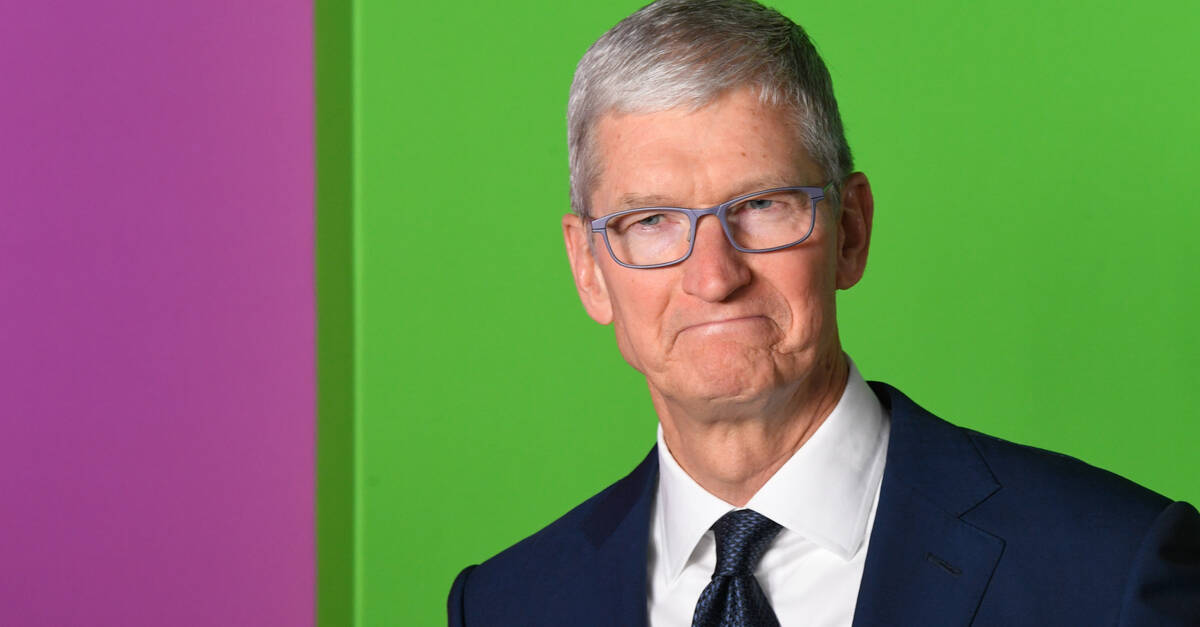

"Since transitioning to its homegrown M-series silicon in late 2020, Apple has gone from key Intel partner to direct competitor. Many of Intel's recent products have not been stellar, leading it to lose market share across the server and PC markets in recent years. It's therefore hard to see CEO Tim Cook giving up on Apple Silicon any time soon."

Intel is pursuing Apple as an investor and potential contract-manufacturing customer after recent financial turbulence and new injections of capital. SoftBank invested $2 billion, the U.S. government sought roughly $11 billion in stock options tied to CHIPS Act funding, and Nvidia announced a $5 billion equity investment plus a co-development initiative integrating Nvidia GPUs into Intel CPUs while placing Intel Xeon processors in future Nvidia rack systems. Apple shifted to its M-series chips and became a competitor, but Apple could invest in Intel and use Intel's fabs to manufacture future Apple chips amid U.S. domestic production priorities.

Read at Theregister

Unable to calculate read time

Collection

[

|

...

]