#stock-market

#stock-market

[ follow ]

#federal-reserve #nvidia #artificial-intelligence #interest-rates #earnings #treasury-yields #bitcoin #ai

fromwww.mediaite.com

1 week agoEverybody's Up, Way Up!' Trump Plays Role of Economic Hype Man at State of the Union

The Biden administration and its allies in Congress gave us the worst inflation in the history of our country. But in 12 months, my administration has driven core inflation down to the lowest level in more than five years. And in the last three months of 2025, it was down to 1.7%.

US politics

LGBT

fromLGBTQ Nation

3 weeks agoPam Bondi rages at Democrats for asking about Epstein files instead of talking about stocks - LGBTQ Nation

Attorney General Pam Bondi repeatedly dodged questions about Jeffrey Epstein at a House Judiciary Committee hearing by loudly citing stock market figures and retirement gains.

from24/7 Wall St.

3 weeks agoLive Nasdaq Composite: Stocks March Higher on Near Goldilocks Scenario

The markets are seeing green across the board amid a near Goldilocks scenario in the economy. The latest jobs report reveals that conditions are neither too not nor too cold, with 130,000 jobs added last month, surpassing economist's most bullish of estimates, while the unemployment rate edged lower to a surprising 4.3% from 4.4% month-over-month. What it means for the Fed and interest rates will depend largely on the latest inflation data, with the CPI due out at the end of the week.

Business

fromwww.theguardian.com

3 weeks agoJapanese shares hit record high as Sanae Takaichi wins landslide election victory

Japan's stock market has hit a record high after Sanae Takaichi's Liberal Democratic party (LDP) secured a comprehensive victory in Sunday's election. The LDP won 316 of the 465 seats in the country's lower house the first time a single party has secured two-thirds of the lower house since the establishment of Japan's parliament in 1947. The Japan Innovation party, the LDP's coalition partner, won 36 further seats, giving a supermajority of 352 seats.

World politics

fromKotaku

4 weeks agoWhat The Heck Is Up With Nintendo's Stock Price?

It's another edition of Morning Checkpoint, Kotaku's daily roundup of gaming news, rumors, and culture. I'm still bummed about yesterday's report that The Outer Worlds franchise is essentially on ice after last year's entry struggled to sell. It's an exceptionally solid immersive sim RPG that feels like it's on the verge of being something truly special. But those 30-percent profit margins on games given away for free on Game Pass are a killer.

Games

Business

from24/7 Wall St.

1 month agoHere Are Friday's Top Wall Street Analyst Research Calls: Broadcom, Circle Internet, Kenvue, Medtronic, Sandisk, Southwest Airlines, Spotify, and More

Stocks pulled back after a big rally; Nasdaq led declines while safe-haven demand drove Treasury yields lower and energy prices higher amid Iran concerns.

fromFortune

1 month agoTrump TACO trade roars as stocks recover half of yesterday's loss after messages over 'piece of ice' from Davos | Fortune

The U.S. stock market bounced back from its worst day since October on Wednesday after President Donald Trump said he reached the framework for a deal about Greenland, an island he's long coveted, and won't impose tariffs he had threatened on several European countries. The S&P 500 rallied 1.2% after Trump said the deal, "if consummated, will be a great one for the United States of America" and its allies in the North Atlantic region.

US politics

Media industry

fromFast Company

1 month agoVersant stock price sinks on Nasdaq trading debut as Comcast spinoff tests investor appetite for legacy cable TV

Versant's spinoff from Comcast faces market skepticism as shares tumbled amid structural decline in traditional cable subscriptions despite recent subscriber gains.

Business

fromFast Company

2 months agoQuantum computing stocks soar, then fall, in holiday week trading. What's up with D-Wave, Rigetti, and IonQ?

Quantum computing stocks surged, with D-Wave up almost 15% and other firms gaining, reflecting CES-related news and growing investor enthusiasm and large YTD gains.

fromFast Company

2 months agoRocket Lab stock price soars: Why the SpaceX rival is blasting off today

Shares in Rocket Lab Corp were heading for their second day of gains on Monday after the aerospace manufacturer was named as one of four companies that will build tracking satellites for the U.S. Space Development Agency (SDA). The stock (Nasdaq: RKLB) was up more than 4% in premarket trading on Monday as of this writing. That's in addition to a jump of 17% on Friday when the news was announced. Share are now trading at record highs.

Science

fromFast Company

2 months agoTrump Media stock price skyrockets on surprise announcement of merger with TAE Technologies

The company will merge with TAE Technologies-a privately held fusion energy firm that's backed by Alphabet, Chevron Technology Ventures, and others-in a deal that's worth more than $6 billion. It's an all-stock deal, which is expected to close sometime next year, and is a huge and eyebrow-raising move for Trump Media, which is best known as the owner of President Trump's social media platform, Truth Social.

US politics

fromFast Company

2 months agoPot stocks pop on Schedule 3 hopes: Tilray Brands, Trulieve Cannabis, Cresco Labs: How high will they go?

Reports first emerged last week that the Trump administration might change marijuana from a Schedule I drug to a Schedule III drug, which would lessen restrictions on it. On Monday, President Trump told reporters that he was "considering" the reclassification. "We are considering that because a lot of people want to see it-the reclassification, because it leads to tremendous amounts of research that can't be done unless you reclassify," Trump stated, according to CNN. "So, we are looking at that very strongly."

US politics

fromTESLARATI

2 months agoTesla stock closes at all-time high on heels of Robotaxi progress

Tesla stock ( NASDAQ: TSLA) closed at an all-time high on Tuesday, jumping over 3 percent during the day and finishing at $489.88. The price beats the previous record close, which was $479.86. Shares have had a crazy year, dipping more than 40 percent from the start of the year. The stock then started to recover once again around late April, when its price started to climb back up from the low $200 level.

US news

Business

from24/7 Wall St.

2 months agoStock Market Live December 5: S&P 500 (SPY) Heads for Another Winning Day

Markets rallied on strong rate-cut expectations after softer-than-expected US PCE inflation and rising job-cut reports while Netflix agreed to buy Warner Bros. Discovery assets for $72 billion.

US politics

fromFortune

3 months agoThe S&P 500 could hit 7,000 this week, while Trump hints at a Fed chair pick and Washington eyes this special election | Fortune

Markets rallied on renewed rate-cut expectations while Trump's pending Fed chair pick and a Tennessee special election could shift monetary outlook and congressional balance.

from24/7 Wall St.

3 months agoHere's How I'd Allocate $100,000 in Capital In This Topsy-Turvy Market

The current dynamics playing out in the stock market are really hard to describe right now. On the one hand, there are pockets of the economy that are red-hot, with hundreds of billions of dollars flowing into high-powered growth trends like AI that are clearly propping up valuations across the board. On the other hand, the vast majority of stocks in the overall market may already be in bear market territory. That's representative of a weakening consumer, and the view that valuations may have gotten a bit too distorted in the post-pandemic era.

Business

from24/7 Wall St.

3 months agoStock Market Live November 28: S&P 500 (SPY) Running Higher on Black Friday

As we get ready to jump into the final month of 2025, S&P 500 futures are rallying. Up about 11 points, it's getting set to wrap up what's been a very volatile month. Meanwhile, the SPDR S&P 500 (SPY) is up about $1.65 this morning. The Dow Jones is up about 53, with the NASDAQ up about 72. Granted, we had a rough start to the day. All after CME trading came to a standstill following a cooling issue at one of its data centers.

E-Commerce

from24/7 Wall St.

3 months agoHere Are Wednesday's Top Wall Street Analyst Research Calls: DoorDash, Freeport-McMoRan, GitLab, Home Depot, Medtronic, Molson-Coors, and More

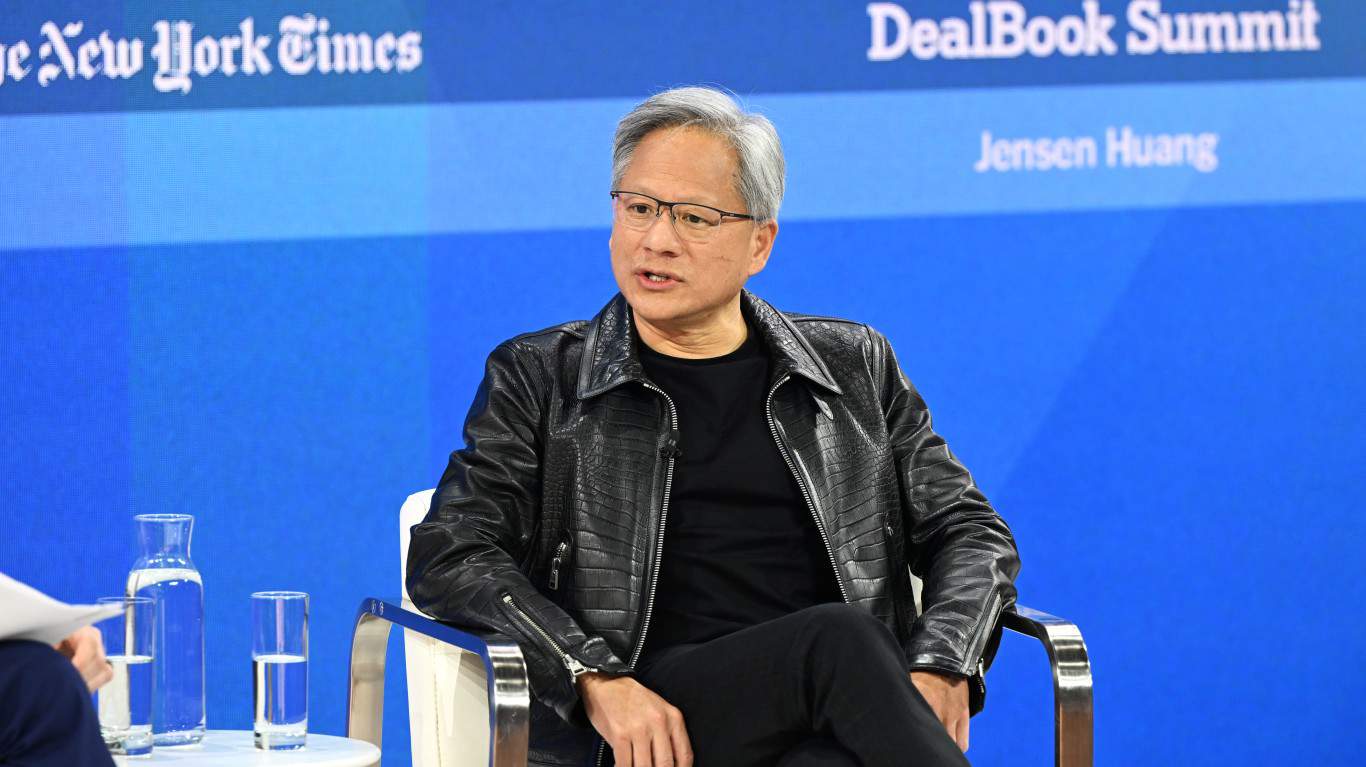

The day of truth has finally come for the stock market and the AI/Datacenter/Hyperscaler trade, at least for now. NVIDIA Corp. ( NASDAQ: NVDA) will release perhaps the most anticipated set of quarterly results in the last 25 years or more at 5 PM EST today after the close. Wall Street is looking for earnings per share of $1.25 and a median revenue of $55 billion.

Business

[ Load more ]