"I've been bullish on gold for years. But what I'm seeing now keeps me up at night,"

"When people line up in the streets to buy an asset, when the narrative becomes one-sided, when the trade gets this crowded-that's your signal,"

"However painful it may feel for latecomers to the gold rally, the metal could withstand a 10% correction to around USD 3,973 without breaking its bullish narrative,"

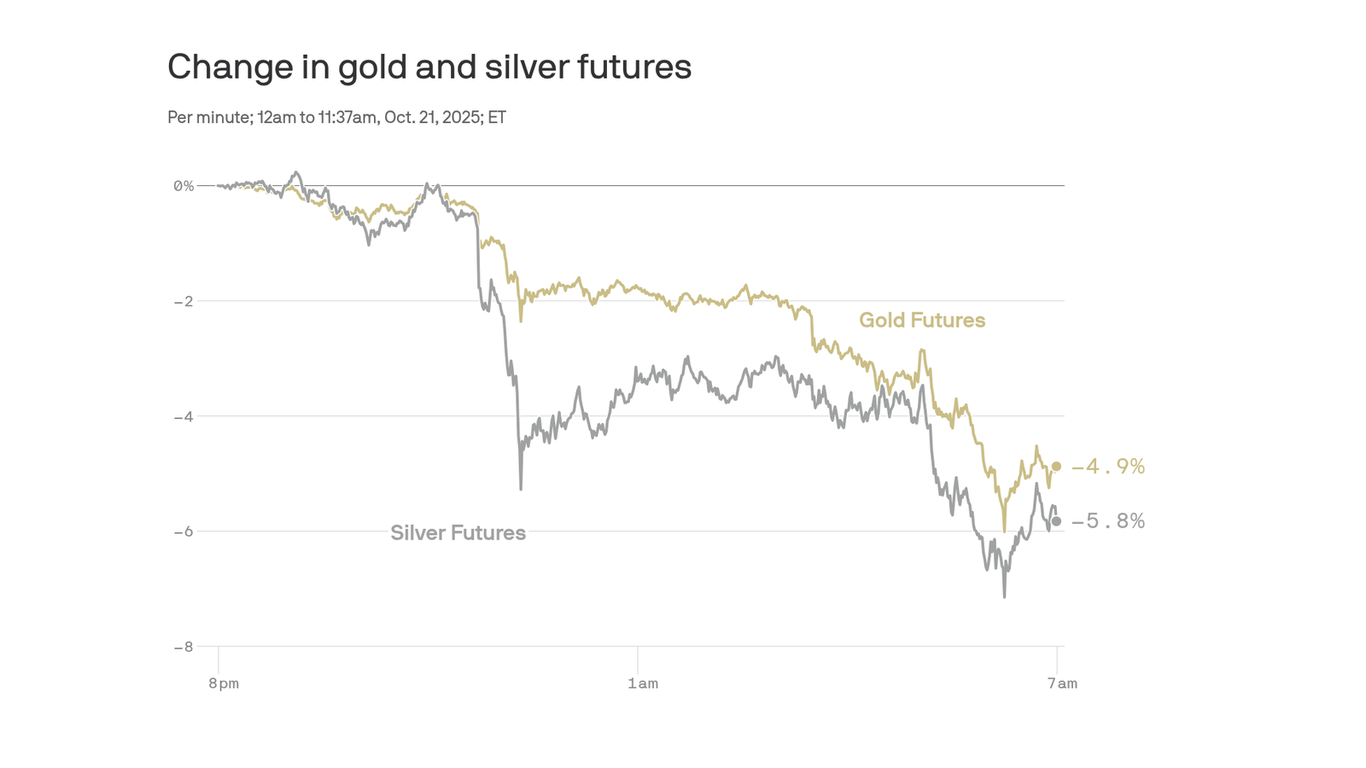

Gold futures fell about 5% late morning while silver futures dropped nearly 7%. Before the decline, both metals had risen roughly 60% year-to-date. Dow Jones data showed gold had not fallen 5% in a single trading day since June 2013. Reports described people lining up in Australia to buy gold, raising concerns of a crowded, one-sided trade. The sell-off coincided with rallies in the U.S. dollar and bitcoin, the latter gaining almost 5% in two hours. Stock markets were roughly flat midday, while miners and metal ETFs posted sharp losses. Saxo Bank noted a 10% correction to around USD 3,973 could be absorbed without breaking the bullish case.

Read at Axios

Unable to calculate read time

Collection

[

|

...

]