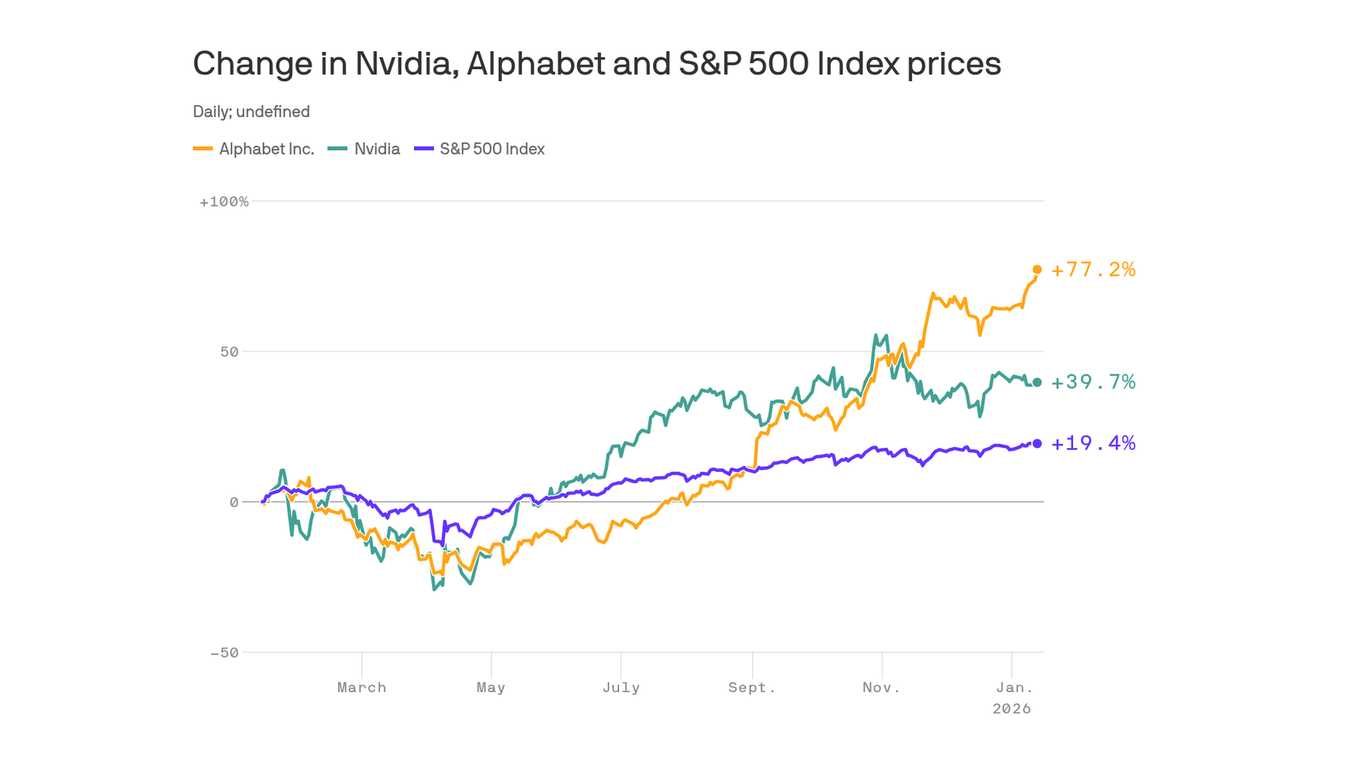

"Alphabet's market cap hit $4 trillion Monday after two major partnerships were announced. Apple confirmed it would use Alphabet's large language model, Gemini, to run Siri, and Walmart will use Gemini as part of an AI-powered shopping effort. Flashback: Alphabet's stock was under pressure throughout early 2025 as investors worried about headwinds ranging from an antitrust case to fierce competition from OpenAI and Anthropic."

"The company's market cap rose by over $230 billion after avoiding a DOJ breakup. Since last fall, investors have become more discerning about the winners and losers of the AI buildout, rewarding companies practicing responsible spending that can lead to measurable returns. That sentiment shift helped Alphabet become the top-performing Big Tech stock of the year. Between the lines: Alphabet is showing investors the kind of real-world, measurable AI-application-goodness Wall Street wanted to see this year."

"What they're saying: Having real world, tangible applications for AI is a "very big deal," Trevor Slaven, global head of asset allocation at Barings, told Axios. Slaven thinks the market could rally significantly (again) this year, but there will be volatility along the way. Continued questions about an AI bubble could weigh on the tech sector, and mixed policy from Washington could cause broader volatility even if stocks continue to grind higher."

Having real world, tangible applications for AI is a very big deal. The market could rally significantly this year but with volatility along the way. Continued questions about an AI bubble and mixed Washington policy could weigh on the tech sector and cause broader volatility even if stocks trend higher. Alphabet reached a $4 trillion market cap after partnerships that put Gemini into Siri and Walmart shopping, reversing earlier investor concerns about antitrust and competition. Investors have rewarded companies that practice responsible spending and generate measurable returns; firms using AI to drive revenue or cut costs may see shareholder gains.

Read at Axios

Unable to calculate read time

Collection

[

|

...

]