#buy-now-pay-later

#buy-now-pay-later

[ follow ]

#klarna #fintech #consumer-debt #ipo #e-commerce #holiday-shopping #financial-regulation #credit-scores

Miscellaneous

fromTearsheet

1 week agoHow embedded BNPL optimizes cash flow for SMBs: Inside the Intuit-Affirm partnership - Tearsheet

Fintech companies now compete for control over the moment financial decisions are made by embedding services directly into workflow platforms rather than building standalone products.

fromHuffPost

3 weeks agoThere's A Depressing Dating Trend Among Millennials And Gen Z - And It's Hard To Watch

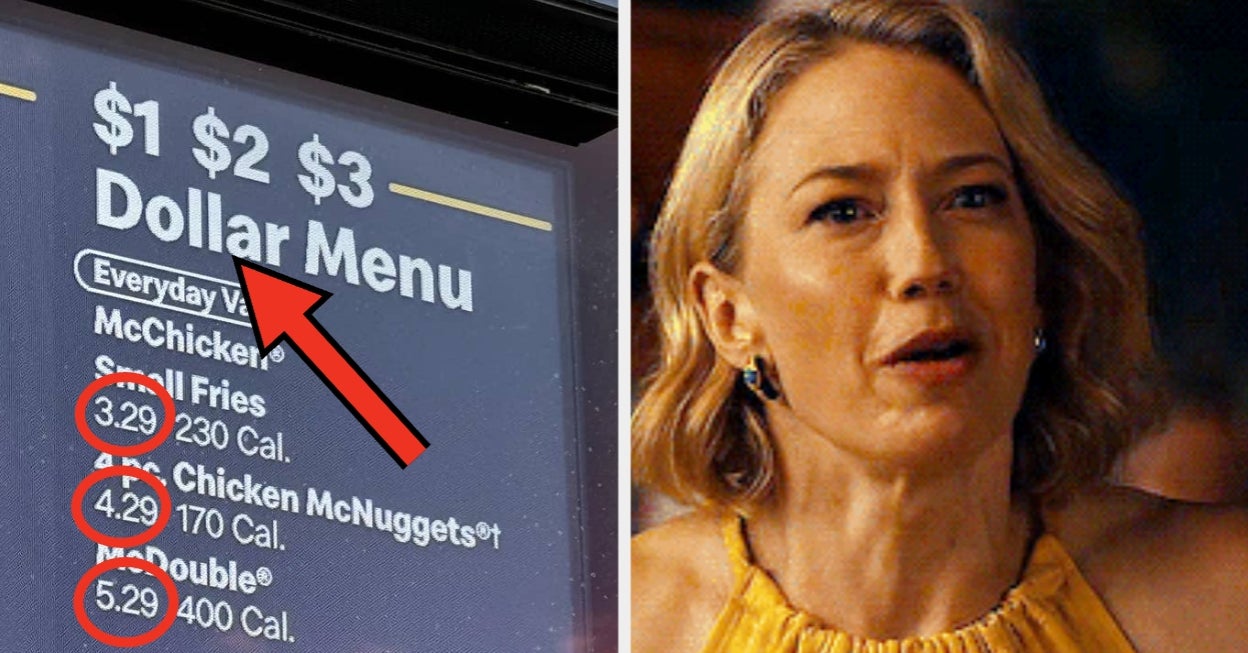

When you add up dinner, drinks and gas or ride-shares, dating can cost a small fortune these days. It's become so expensive that a startling number of Americans are willing to take on credit card debt just to afford it. According to a new "loveflation" survey from online billing site Invoice Home, one in four young Americans would consider going into credit card debt to afford dating someone they really liked.

Relationships

fromBusiness Insider

1 month agoPayPal's former president slams company, says it's lost its 'mojo'

In a long post on X, Marcus spoke about several flaws in PayPal, a San Jose-based fintech giant, across its history. Marcus left PayPal in 2014 and has since worked at Coinbase and Meta. He has also founded a payments company, Lightspark, where he is now CEO. He said he had woken up to messages from former PayPal colleagues, which pushed him to "finally speak up."

Business

Canada news

fromwww.cbc.ca

2 months agoBuy now, pay later plans are everywhere. Here's how they're affecting debt-stressed Canadians | CBC News

Young adults under 35 face rising debt—student loans, first-time credit cards and buy-now-pay-later plans—creating financial strain and stalled progress in life.

fromLondon Business News | Londonlovesbusiness.com

2 months agoHigh interest rates push shoppers from credit to debit cards - London Business News | Londonlovesbusiness.com

This year's survey reveals a significant decline in the use of credit cards, from 14.2% of transactions to 12.6%. With higher interest rates making credit cards a more expensive way to shop, consumers turned to debit cards where usage increased from 62.0% to 64.0% of transactions. As the cost of living crisis eased, some customers returned to old habits. The weekly shop showed signs of a comeback with consumers making fewer but larger transactions.

E-Commerce

E-Commerce

fromFortune

3 months agoU.S. consumers are so financially strained they put more than $1 billion on buy-now, pay later services during Black Friday and Cyber Monday | Fortune

Consumers increasingly used BNPL over Black Friday–Cyber Monday, generating over $1.77 billion in online BNPL sales and accounting for a notable share of holiday purchases.

fromIndependent

3 months ago'If you must place a bet, do it in the bookies in person with cash' - what mortgage lenders don't want to see on your bank statement, according to money experts

From Paddy Power to Klarna, these are the bank statement red flags to avoid when applying for a mortgage

Real estate

fromFuturism

5 months agoCEO Says He's Showing His Engineers How to Get Things Done by Sending Them Stuff He Vibe Coded

infamously boasting that the tech was doing the work of " 700 full-time agents" last year - only to regret his decision months later, admitting that humans play an important role after all.

Artificial intelligence

fromModern Retail

5 months agoModern Retail Podcast: Affirm's in-store Apple Pay play, Kroger's coupon revival, and WTF is a retail media network

On this week's Modern Retail Podcast, senior reporter Melissa Daniels is joined by executive editor Anna Hensel. First, they discuss Affirm's new rollout with Apple Pay to provide its buy-now, pay-later services in-store. Then they unpack the trend of paper coupons making a comeback in some retail environments, with Kroger announcing it has been bringing back paper coupons to help appeal to value-minded shoppers or those who aren't comfortable with more digital savings programs.

E-Commerce

fromPitchfork

5 months agoWhy Do I Keep Getting Mad at Coachella Lineups? What's Wrong With Me?

but the California concert promoter has already released the lineup for the 2026 Coachella Valley Music and Arts Festival, the earliest announcement since the event's inception in 1999. We're expected to know, before the leaves begin to turn, if we want to snag tickets at the "early bird" "discount" price of $650 (Weekend One) or $550 (Weekend Two) to see Kaskade, the DJ my EDM-curious dad once called "Ajax" by mistake (they're both cleaning supplies, after all).

Music

fromFortune

5 months agoSwedish BNPL giant Klarna jumps nearly 15% in biggest IPO of 2025 on NYSE | Fortune

Klarna made a solid debut on the New York Stock Exchange, with shares of the Swedish buy now, pay later company rising nearly 15%. Klarna stock opened at $52 a share Wednesday, a 30% premium to the company's $40 pricing. It took roughly three-and-a-half hours for the specialists on the floor of the NYSE to manually price the first batch of trades of the company. The shares rose as high as $57 before losing some momentum and ending at $45.82, up 14.6%.

Startup companies

Miscellaneous

fromFortune

5 months agoKlarna goes public as 3 in 4 Americans are relying on buy-now, pay-later and experts worry its snowballing 'quickly into a serious financial burden' | Fortune

Klarna's $1.37B IPO values the company at $15B amid BNPL expansion, while consumers face rising debt and credit-score risks.

[ Load more ]