fromwww.housingwire.com

1 week agoEconomic growth steady in 2025, but FHA delinquencies climb

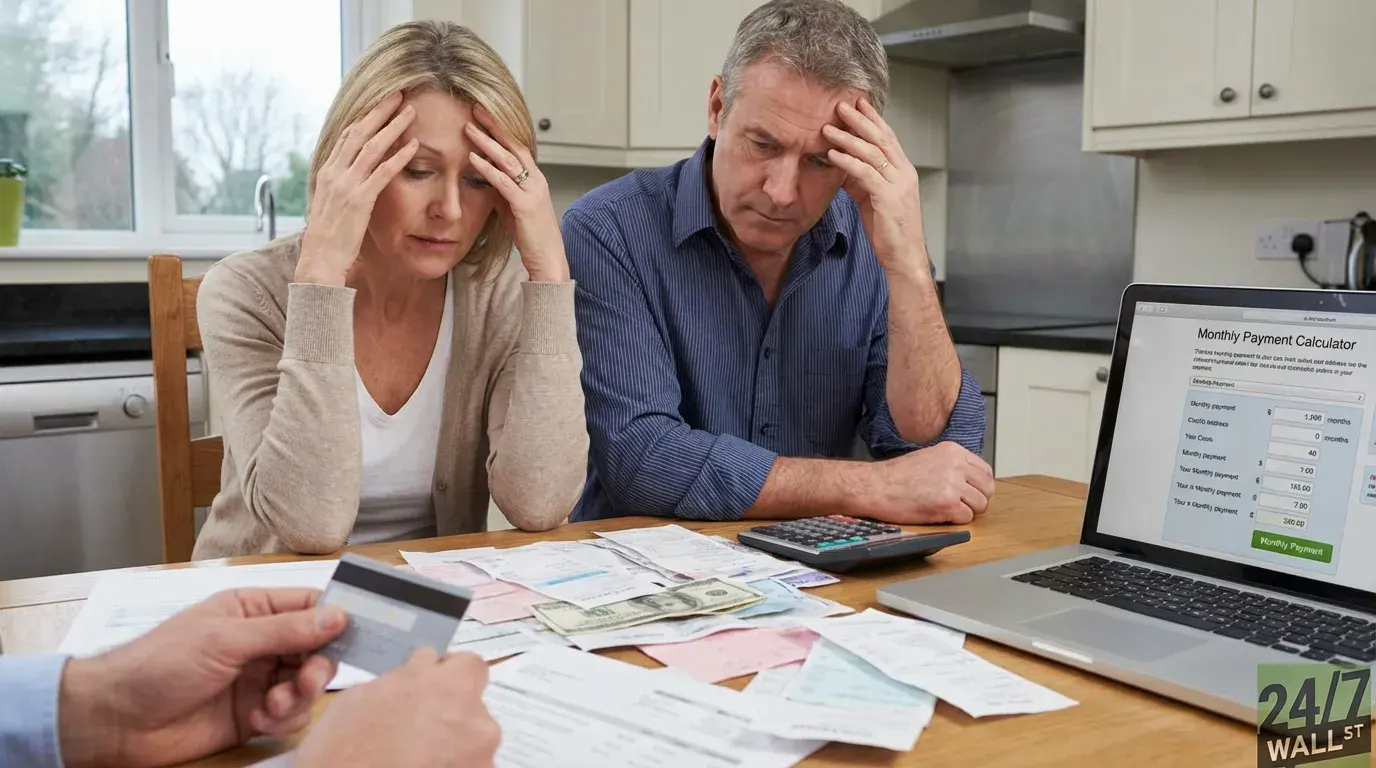

the Federal Reserve Bank of New York show student loan and auto loan balances at record highs, while credit card balances have climbed to about $1.2 trillion. Delinquencies, particularly on credit cards, are also rising, with 90-day-plus late-payment rates for credit cards more than 12% higher than in prior years. Consumers are driving a lot of growth, but there are some signs of weakness for certain parts of the economy, Kan said, adding that these pressures could spill over into housing and mortgage performance.

Real estate