#antitrust

#antitrust

[ follow ]

#google #meta #ftc #mergers--acquisitions #ad-tech #netflix #whatsapp #monopoly #search-monopoly #merger #class-action

fromESPN.com

4 days agoSean Strickland criticizes UFC fighter pay as 'predatory'

"As far as the pay scale, when you compare it to any other sporting event, the UFC is the most f---ed up," Strickland told Complex. "Athlete pay versus what [the UFC] is making, there is no argument there. It's not fair. It's predatory."

MMA

fromwww.housingwire.com

4 days agoLawmakers press DOJ on Compass-Anywhere merger review

The lawmakers say the letter comes after reports that former assistant attorney general for antitrust Gail Slater wanted to undertake an extended review of the merger to consider any potential anticompetitive impacts. However, reports claimed that Compass and its attorneys appealed to Slater's superiors including Deputy Attorney General Todd Blanche, telling his office that any antitrust concerns could be addressed without a full-scale investigation.

US politics

fromTheregister

6 days agoQualcomm set to triumph in UK smartphone 'patent tax' case

Which? claimed that Qualcomm abused its market position as a dominant producer of processors and radio chips for smartphones, and that even Samsung and Apple felt they had no alternative but to pay inflated prices for some parts and then passed on the costs to buyers. UK consumers, the group argued, therefore paid more for certain smartphones between October 2015 and January 2024.

Gadgets

fromwww.housingwire.com

1 week agoRedfin, Zillow defend rental partnership in FTC antitrust suit

Originally filed as two separate lawsuits in late September 2025 before being consolidated in late November, the lawsuit claims that the multifamily rental syndication deal executed by Zillow and Redfin was tantamount to Zillow simply paying Redfin $100 million in exchange for it no longer competing in the multifamily rental listing space. The defendants filed a motion to dismiss the lawsuit in mid-January. A hearing on this motion is scheduled for Feb. 25.

Real estate

US politics

fromAbove the Law

1 week agoTrump DOJ Launches Bunk Investigation Of Netflix Merger As a Favor To Larry Ellison - Above the Law

The Trump DOJ opened an antitrust probe of Netflix's $82.7B Warner merger while allegedly seeking to block or leverage the deal to benefit rival bidder Larry Ellison.

Law

fromAbove the Law

1 week agoTrump Administration Bullies One Of Biglaw's Best Diversity Initiatives Out Of Existence - Above the Law

FTC scrutiny forced Diversity Lab to pause Mansfield certification, eroding a widely used law-firm diversity initiative as firms retreated under regulatory intimidation.

Intellectual property law

fromIPWatchdog.com | Patents & Intellectual Property Law

1 week agoCAFC Affirms $84.8 Million Antitrust Verdict Against Ingevity in Patent Tying Case

Immunity does not protect patent-holder conduct that unlawfully ties or exclusive-deals beyond the patent monopoly; Ingevity was found liable and trebled damages awarded.

Apple

fromDailydot

1 year ago'Apple acknowledged the issue': Expert says your Apple AirPods were sold to you with false advertising. You may be entitled to money

First-generation AirPods Pro owners may be entitled to compensation after alleged widespread sound defects causing crackling, bass loss, and increased background noise.

fromBusiness Matters

2 weeks agoApple and Google agree UK app store changes after 'effective duopoly' ruling

Sarah Cardell, the CMA's chief executive, said the agreements marked an important milestone. "These proposed commitments will boost the UK's app economy and are the first of many measures," she said. "The ability to secure immediate commitments from Apple and Google reflects the unique flexibility of the UK's digital markets competition regime and offers a practical route to swiftly address the concerns we've identified."

UK news

fromExchangewire

2 weeks agoDigest: Scope3 Makes Second Round of Layoffs; China Fines Companies for Fake AI Services; Meta Criticises EU Action Over WhatsApp AI Rivals

Scope3 makes second round of layoffs Scope3 has implemented another round of redundancies, its second in less than half a year, as the adtech firm continues to reshape its business around agentic media capabilities. The company, headed by programmatic advertising pioneer Brian O'Kelley, would not confirm the number of positions impacted but said it had made additional changes across its commercial and engineering functions in response to evolving market needs.

Artificial intelligence

fromwww.housingwire.com

2 weeks agoZillow and Redfin ordered to produce documents in $100M rental syndication antitrust case

Originally filed as two separate lawsuits in late September 2025 before being consolidated in late November, the lawsuit claims that the multifamily rental syndication deal executed by Zillow and Redfin was tantamount to Zillow simply paying Redfin $100 million in exchange for it no longer competing in the multifamily rental listing space. The defendants filed a motion to dismiss the lawsuit in mid-January. A hearing on this motion is scheduled for Feb. 25.

Real estate

Marketing tech

fromDigiday

2 weeks agoIn Graphic Detail: The scale of the challenge facing publishers, politicians eager to damage Google's adland dominance

Alphabet earned $403 billion in 2025 while facing antitrust rulings, EU scrutiny, industry dissatisfaction with ad measurement, and initiatives to reform ad-tech measurement.

Real estate

fromBoston Condos For Sale Ford Realty

2 weeks agoCompass Lost Round One To Zillow Boston Condos For Sale Ford Realty

Judge Jeannette Vargas denied Compass's preliminary injunction, allowing Zillow to continue enforcing its Listing Access Standards while the antitrust lawsuit moves to discovery.

US politics

fromFortune

2 weeks agoNetflix co-CEO Ted Sarandos argues its Warner Bros. deal won't hurt consumers. If so, they can cancel with one click | Fortune

Netflix's proposed acquisition of Warner Bros. Discovery will not harm customers and subscribers can cancel if they perceive insufficient value.

fromwww.housingwire.com

2 weeks agoJudge denies Compass injunction against Zillow listing policy

In denying Compass's motion, Judge Vargas appears to say that Compass did not adequately show that the policy has caused it irreparable harm. During the hearing, an expert witness for Compass testified that Zillow's policy harms competition because it suppresses competing platforms, which Compass claims Compass.com is. Other witnesses for Compass testified that Zillow's policy had resulted in a decline in both engagement and users on its platform,

Real estate

US news

fromInside Higher Ed | Higher Education News, Events and Jobs

2 weeks agoAntitrust Lawsuit Against Academic Publishers Dismissed

A federal judge dismissed researchers' antitrust lawsuit against six major academic publishers and STM, finding insufficient evidence of a publishing industry conspiracy.

US politics

fromwww.theguardian.com

2 weeks agoMichigan accuses big oil of being cartel' that fuels climate crisis and high energy costs

Michigan sued BP, Shell, Chevron, ExxonMobil and the API, alleging cartel-like collusion that raised utility costs, suppressed renewables and impeded electric vehicle adoption.

US politics

fromExchangewire

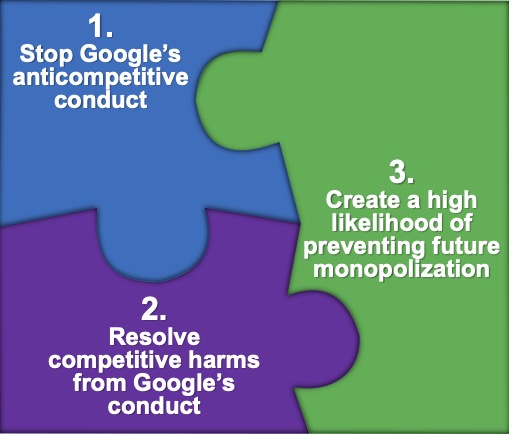

2 weeks agoDigest: DOJ Appeals Google Search Monopoly Ruling; WeChat Blocks Tencent AI Chatbot Giveaway; Netflix and Warner Bros Struggle on Merger

DOJ is appealing aspects of the remedies in its antitrust ruling against Google, while WeChat blocks Tencent's AI chatbot promotion and Netflix faces merger scrutiny.

fromArs Technica

3 weeks agoGoogle court filings suggest ChromeOS has an expiration date

The documents suggest that Google will wash its hands of ChromeOS once the current support window closes. Google promises 10 years of Chromebook support, but that's not counted from the date of purchase-Chromebooks are based on a handful of hardware platforms dictated by Google, with the most recent launching in 2023. That means Google has to support the newest devices through 2033. The "timeline to phase out ChromeOS is 2034," says the filing.

Tech industry

fromwww.bbc.com

4 weeks agoLegal action over 'unfair' Steam game store prices given go ahead

The lawsuit - filed at the Competition Appeal Tribunal in London - alleges Valve "forces" game publishers to sign up to conditions which prevents them from selling their titles earlier or for less on rival platforms. It claims that as Valve requires users to buy all additional content through Steam, if they've bought the initial game through the platform it is essentially "locking in" users to continue making purchases there.

Miscellaneous

fromwww.theguardian.com

1 month agoCampaigner launches 1.5bn legal action in UK against Apple over wallet's hidden fees'

The financial campaigner James Daley has launched a 1.5bn class action lawsuit against Apple over its mobile phone wallet, claiming the US tech company blocked competition and charged hidden fees that ultimately harmed 50 million UK consumers. The lawsuit takes aim at Apple Pay, which they say has been the only contactless payment service available for iPhone users in Britain over the past decade.

Apple

fromThe Verge

1 month agoIs this the end of Epic and Google's feud?

Epic sued Google over five years ago in August 2020, and in December 2023 a jury unanimously handed it the win. An appeals court upheld that verdict, and the US Supreme Court didn't step in to save Google from the immediate consequences. Judge Donato ordered Google to crack open Android in the United States, forcing Google to eventually host rival app stores inside its own store, among many other punishments.

Tech industry

Intellectual property law

fromIPWatchdog.com | Patents & Intellectual Property Law

9 months agoOther Barks & Bites for Friday, May 16: USPTO Wants Comments on E-Commerce Counterfeiting; Bayh-Dole Coalition Honors Faces of Innovation; Google Takes Top Spot in U.S. Patent Filings for Generative AI

IP and AI developments: USPTO OECD roundtable, Federal Circuit conception standard correction, Google now leads generative AI patents, Microsoft commits to unbundle Office bundles.

fromDigiday

1 month agoAs U.S. courts near a remedy, Europe puts Google's ad tech concessions under the microscope

The crunch moment in Google's antitrust battles with the Justice Department over its ad tech stack looms ever closer, with Justice Leonie Brinkema expected to issue her remedies ruling by the close of Q1. While these deliberations take place in the chambers of a courtroom in the Eastern District of Virginia, developments elsewhere underscore the political undercurrents at play, namely the push to limit Big Tech's power.

Miscellaneous

fromLawSites

1 month agoAlexi Fires Back at Fastcase Lawsuit with Counterclaims Alleging Anticompetitive Conduct Following Clio's $1B Acquisition

Alexi Technologies has filed its answer and counterclaim against Fastcase, vLex, and Clio, accusing the newly merged legal technology giant of manufacturing breach-of-contract allegations as a pretext to eliminate a competitor in the AI legal research market. In December, , sued Fastcase, now owned by ClioAlexi in the U.S. District Court for the District of Columbia, alleging breach of contract, trademark infringement and trade secret misappropriation, all relating to Alexi's use of data licensed from Fastcase.

Law

[ Load more ]