#venture-capital

#venture-capital

[ follow ]

#artificial-intelligence #nyc-startups #ai #ai-startups #cybersecurity #startup-funding #fundraising #india

#ai-startups

Venture

fromBusiness Insider

4 hours agoWhy a former Khosla partner who was one of the first investors in Groq is striking out on her own

Sandhya Venkatachalam launched Axiom Partners with a $52 million fund to make contrarian AI infrastructure and category-defining company bets at earliest stages with $100,000 to $2.5 million checks.

Venture

fromFuturism

4 hours agoEven Tech Investors Are Getting Sick of All These AI Startups With Weak Ideas

Venture capital investors are increasingly skeptical of AI startups lacking genuine differentiation beyond user interface and automation, demanding deep workflow integration and proprietary data instead.

Venture

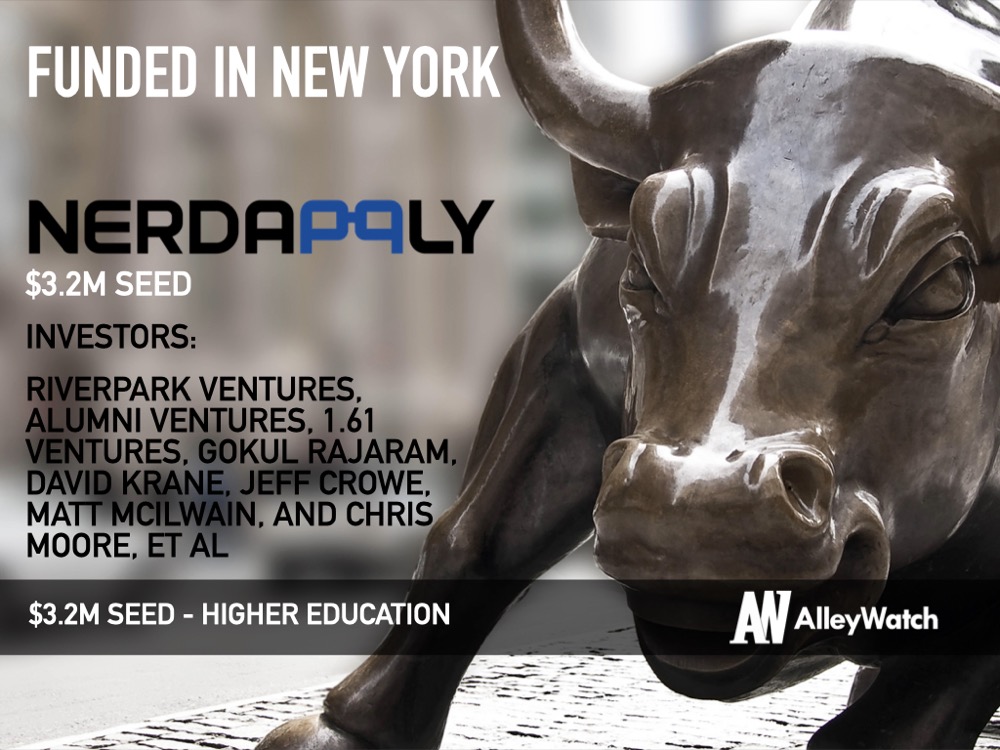

fromAlleywatch

20 hours agoThe AlleyWatch Startup Daily Funding Report: 3/4/2026

NYC startups raised significant funding on March 4, 2026, including Eight Sleep's $50M Series led by Tether Ventures, Cryptio's $44.5M back-office platform round, and Chptr's $3.25M memorial storytelling platform funding.

Boston

fromBoston.com

1 day agoBoston's innovation economy hits a new milestone in global rankings

Five Boston-area companies achieved record representation on LexisNexis's Top 100 Global Innovators list, demonstrating the region's leadership in biotech, life sciences, and consumer technology innovation.

Startup companies

fromBusiness Insider

2 days agoPittsburgh's mayor has cold-called dozens of tech CEOs to get them to relocate their companies to his city.

Pittsburgh's mayor personally cold-calls 20+ founders and CEOs weekly to attract tech talent and investment, positioning the city as an emerging tech hub beyond its steel industry legacy.

Venture

fromSilicon Canals

5 days agoAfrican fintech startups raise $1.3B in 2025 despite global venture slowdown - Silicon Canals

African fintech startups raised $1.3 billion in 2025, demonstrating resilience while global venture capital remains subdued and early-stage startups in established markets struggle.

Non-profit organizations

fromTechCrunch

1 week agoA VC and some big-name programmers are trying to solve open source's funding problem, permanently | TechCrunch

A new nonprofit called the Open Source Endowment, backed by prominent tech leaders and investors, aims to provide sustainable funding for open-source software maintainers through an endowment model targeting $100 million in assets within seven years.

Venture

fromSilicon Canals

1 week agoOpenAI closes $40 billion funding round, becoming the most valuable private company in history - Silicon Canals

OpenAI closed a $40 billion funding round at $300 billion valuation, becoming history's most valuable private company, driven by investor belief in inevitable AI dominance.

Venture

fromSilicon Canals

1 week agoWhy the fear of missing out on AI is driving European VCs to make riskier bets than ever - Silicon Canals

European venture capitalists are investing in AI startups at unprecedented rates with higher valuations and less due diligence, driven by fear of missing out rather than greed, concentrating 40% of all funding into AI despite historical patterns preceding market corrections.

Venture

fromFortune

1 week agoThe 29-year old investor who went from selling fake IDs to backing Poppi raises a $75 million fund to invest in brands with a 'cultural edge' | Fortune

Patrick Finnegan built a career as a connector investor who uses relationships to turn small startups into cultural phenomena and launched a $75M venture fund.

Venture

fromTechCrunch

1 week agoBill Gurley says that right now, the worst thing you can do for your career is play it safe | TechCrunch

Pursuing passion as a deliberate competitive strategy helps individuals adapt to AI-driven workforce change and can be enabled by targeted financial support for risky career moves.

Artificial intelligence

fromFortune

2 weeks agoThe billion-dollar justification: why AI giants need you to fear for your job | Fortune

AI transformations shift software economics toward costly centralized infrastructure and venture-capital-driven scale, disrupting business models more than directly eliminating workers' paychecks.

fromFortune

2 weeks agoExclusive: Sen. Bill Frist's Frist Cressey Ventures raises $425 million fourth fund | Fortune

Lots of people say: 'With the policy so messed up in Washington right now, why in the world do you spend so much time thinking about it?' he told Fortune. 'It's because I have a great belief that... the only way to get to large scale is good policy. I see the power of things like the Medicare Modernization Act, which introduced prescription drugs. Believe it or not, before that, prescription drugs weren't part of Medicare at all.'

Healthcare

fromTechCrunch

2 weeks agoAfrican defensetech Terra Industries, founded by two Gen Zers, raises additional $22M in a month | TechCrunch

Just one month after raising $11.75 million in a round led by Joe Lonsdale's 8VC, African defensetech Terra Industries announced that it's raised an additional $22 million in funding, led by Lux Capital. Nathan Nwachuku, 22, and Maxwell Maduka, 24, launched Terra Industries in 2024 to design infrastructure and autonomous systems to help African nations monitor and respond to threats.

Startup companies

fromBusiness Insider

3 weeks agoMeet Molly O'Shea, the VC-turned-podcaster who gets execs like Alex Karp and Palmer Luckey talking

Molly O'Shea is a name-dropper. There's good reason for that. I count 29 big names in tech mentioned over our hourlong call. She told me about recently moderating a panel with Kalshi cofounders Tarek Mansour and Luana Lopes Lara. Ken Griffin took the stage after her. O'Shea breezily referenced talking about the state of new media with the TBPN bros in Peter Thiel's house.

Venture

Venture

fromFortune

3 weeks agoNFL legend Joe Montana lived around top VC execs as a 49er, then leveraged those ties to launch his second career as an investor | Fortune

Joe Montana transitioned from NFL star to active tech investor, founding Liquid 2 to back founders and co-invest with prominent Silicon Valley investors.

fromTechCrunch

3 weeks agoA16z VC wants founders to stop stressing over insane ARR numbers | TechCrunch

The AI investing boom (or perhaps bubble) is something Silicon Valley has seen many times before: a gold rush of VC money thrown at the Big New Thing. But one aspect of it is completely unique to these times: startups rocketing from $0 to as much as $100 million in annual recurring revenue, sometimes in a matter of months. Word on the street is that many a VC won't even look at a startup that's not on the ARR superhighway, aiming for $100 million in ARR before their Series A funding round.

Venture

fromTechCrunch

4 weeks agoSNAK Venture Partners raises $50M fund to back vertical marketplaces | TechCrunch

SNAK Venture Partners announced Wednesday the close of its oversubsubscribed $50 million debut fund, anchored by the investment firm Pritzker Group (founded by Illinois governor JB Pritzker and his brother, Tony). SNAK founders Sonia Nagar and Adam Koopersmith worked at the firm and helped lead investments in companies like the auto marketplace Backlot Cars and TicketsNow (exited to Ticketmaster). The duo decided to break out on their own and, earlier this year, launched their firm to back digital marketplaces.

Venture

Venture

fromBusiness Insider

4 weeks agoVenture capital is in reset mode. These are the investors rising fastest now.

Early-career venture capitalists are gaining prominence as market shifts favor rigorous diligence and founder relationships, especially in AI-driven startups focused on customers and revenue.

fromBusiness Insider

1 month agoWatch live: BI's Rising Stars of VC list

This year, 37 up-and-coming investors made the list of rising stars of venture capital. In this live Q&A, hear how the list is put together and learn about the hottest trends in venture capital. Plus, catch an interview with one of this year's winners. Scroll down for the live video on Tuesday at 1:30 p.m. ET.

Venture

fromFortune

1 month agoSilicon Valley legend Kleiner Perkins was written off. Then an unlikely VC showed up | Fortune

Independently and immediately, a flood of people reached the same conclusion: This had to be a mistake. It was the summer of 2017, and as word spread that Mamoon Hamid was joining venture capital firm Kleiner Perkins, some people wondered if it was a joke, or "fake news." And they didn't hold back. "I got calls from friends in the venture business, other GPs [general partners], asking: 'Are you sure this is happening? Is this real?'" Hamid recounts.

Venture

fromFortune

1 month agoEscape Velocity raises a $62 million fund to bet on 'DePIN' crypto networks for telescopes, solar energy, and more | Fortune

While Bitcoin treads water to start 2026, sentiment for other niches in crypto has soured even more-especially DePIN, or decentralized physical infrastructure. Tokens for the decentralized cellphone service Helium and the decentralized mapping network Hivemapper, for example, are near all-time lows. Still, some investors remain bullish on the concept, including the upstart venture firm Escape Velocity, which has raised $61.74 million for a second fund to back founders in DePIN and crypto more broadly.

Venture

fromAlleywatch

1 month agoThe AlleyWatch Startup Daily Funding Report: 1/28/2026

FLORA - $42M Series A CREATIVE AI FLORA, a creative AI tool with an infinite canvas for generating and refining text, image, and video outputs, has raised $42M in Series A funding led by Redpoint. Founded by Alexi Li and Weber Wong in 2024, FLORA has now raised a total of $52M in reported equity funding. Slice Global - $25M Series A

Venture

fromTechCrunch

1 month agoAI security startup Outtake raises $40M from Iconiq, Satya Nadella, Bill Ackman and other big names | TechCrunch

Outtake, founded in 2023 by a former Palantir engineer, Alex Dhillon, has found a way to automate what has largely been the manual problem of spotting and taking down digital identity posers: impersonation accounts, malicious domains posing as the company's, rogue apps, fraudulent ads, and more. This problem has grown even more difficult because AI has enabled attackers to be more convincing and faster in their efforts.

Artificial intelligence

Pets

fromFortune

1 month agoAs vet bills jump 40% in recent years, startup Snout raises $110 million for its 'membership' model to defray costs | Fortune

U.S. households now more often have pets than children, driving demand for pet-focused financial products like Snout’s preventative-care memberships and veterinary financing.

Venture

fromLondon Business News | Londonlovesbusiness.com

1 month agoLitestream Ventures saw $78m in non-binding investor pledges during Davos - London Business News | Londonlovesbusiness.com

Litestream Ventures' Davos forum enabled $78.1M in non-binding investor pledges for 12 companies and a charity using proprietary pledge-signalling technology.

[ Load more ]