#economic-indicators

#economic-indicators

[ follow ]

#federal-reserve #housing-market #inflation #stock-market #labor-market #mortgage-rates #job-growth #real-estate

fromBusiness Matters

2 months agoForex Trading Indicators Every Business-Minded Investor Should Understand

Trading in forex markets is something that many business-minded investors turn to, not least of all because it aligns with their existing macroeconomic knowledge. The key point here is that no market exists in isolation because economic events in seemingly disconnected markets can influence any other market; it's just that the level of interconnectivity and resulting influence may not always be readily apparent.

Business

fromTravel + Leisure

3 months agoThis Is the Happiest State in the U.S.-and It Some of the Best Beaches in the Nation, Too

The personal finance website evaluated all 50 states using 30 metrics, including depression rate, income growth, and unemployment rate, along with other factors that can contribute to overall happiness and satisfaction in the population. After crunching the numbers, Hawaii tops WalletHub's annual ranking of the happiest states in the country. According to WalletHub's data, Hawaii residents "have the longest life expectancy in the U.S., and nearly 72 percent of adults in the state report being active and productive on a daily basis."

US news

fromview.nl.npr.org

4 months agoIn 1975, New York City ran out of money. For a decade it had managed to pay for its hundreds of thousands of city employees and robust social services by taking on billions of dollars in debt. But eventually investors were no longer willing to lend the city any more money. New York teetered on the edge of bankruptcy the city shuttered more than a dozen firehouses, teachers went on strike and garbage piled up in the streets.

fromBusiness Insider

5 months agoUnited's CEO says travel demand has roared back like a 'light switch coming on'

Travel demand has soared back in the second half of the year, and that's good news for the economy at large, too, according to United Airlines' CEO. Scott Kirby told CNBC's "Squawk Box" on Tuesday that demand significantly improved at the beginning of July. "It was like a light switch coming on," he added. The summer travel period is key for airlines, while Labor Day and Thanksgiving are also significant revenue drivers.

Business

fromLondon Business News | Londonlovesbusiness.com

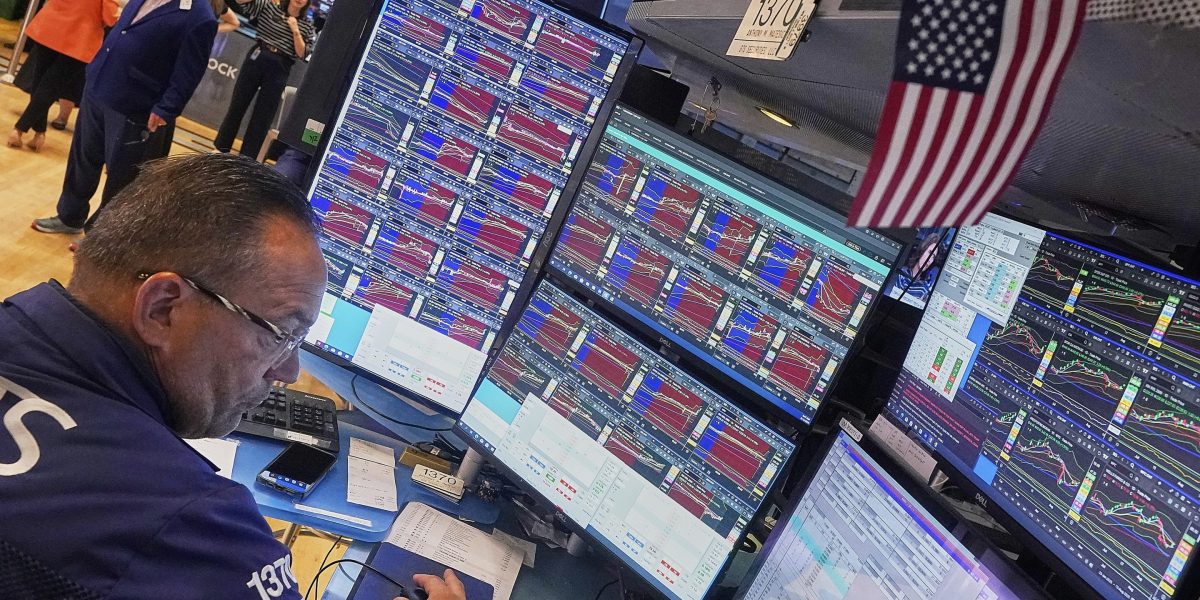

7 months agoS&P 500 maintains its uptrend despite growing caution amid geopolitical risk - London Business News | Londonlovesbusiness.com

June's Consumer Price Index (CPI) rose by 0.3% month-over-month and 2.7% year-over-year-higher than expected-while the Producer Price Index (PPI) unexpectedly stalled at 0.0%. These figures suggest that while price pressures remain on the consumer end, they may be easing on the production side.

US politics

Cryptocurrency

fromLondon Business News | Londonlovesbusiness.com

7 months agoBitcoin shows short-term weakness amid macro headwinds - London Business News | Londonlovesbusiness.com

Bitcoin is experiencing a mild pullback after setting a new all-time high, with market sentiment cautious due to mixed economic indicators.

#social-security

Retirement

fromwww.housingwire.com

9 months agoSocial Security sees 'dramatic' spike of 276,000 applications

Significant increase in Social Security applications amid economic concerns, with a 13% rise this fiscal year compared to last.

Early benefit claims raise alarm among policy experts due to potential long-term financial impact on recipients.

fromLondon Business News | Londonlovesbusiness.com

7 months agoTrade tensions weigh on Euro, German bond yield rises - London Business News | Londonlovesbusiness.com

The euro was at a three-week low against the US dollar as renewed trade tensions, fueled by President Trump's tariff announcement, weighed on the common currency.

Europe news

Startup companies

from24/7 Wall St.

8 months agoThe Fed Could Cut Rates in September: 3 Ultra-High-Yield Dividend Stocks Could Explode Higher

Investors favor ultra-high-yield dividend stocks for income and total return potential.

Potential rate cuts by the Federal Reserve due to slowing economic conditions may impact investment strategies.

European startups

fromLondon Business News | Londonlovesbusiness.com

8 months agoSouth African equities open higher, PMI data shows improvements - London Business News | Londonlovesbusiness.com

South African equities gain as JSE FTSE All Share Index surpasses 96,000, supported by positive sector performance despite economic challenges.

US news

fromwww.housingwire.com

9 months agoThe key to mortgage rates: Fed phone calls?

U.S. job growth remains steady despite signs of labor softness, with specific sectors experiencing growth and others facing declines.

Overall economic indicators show a mixed labor market situation as potential recession risks loom.

[ Load more ]