fromEntrepreneur

18 hours agoWhy the Payments Industry Is Being Rebuilt From the Inside

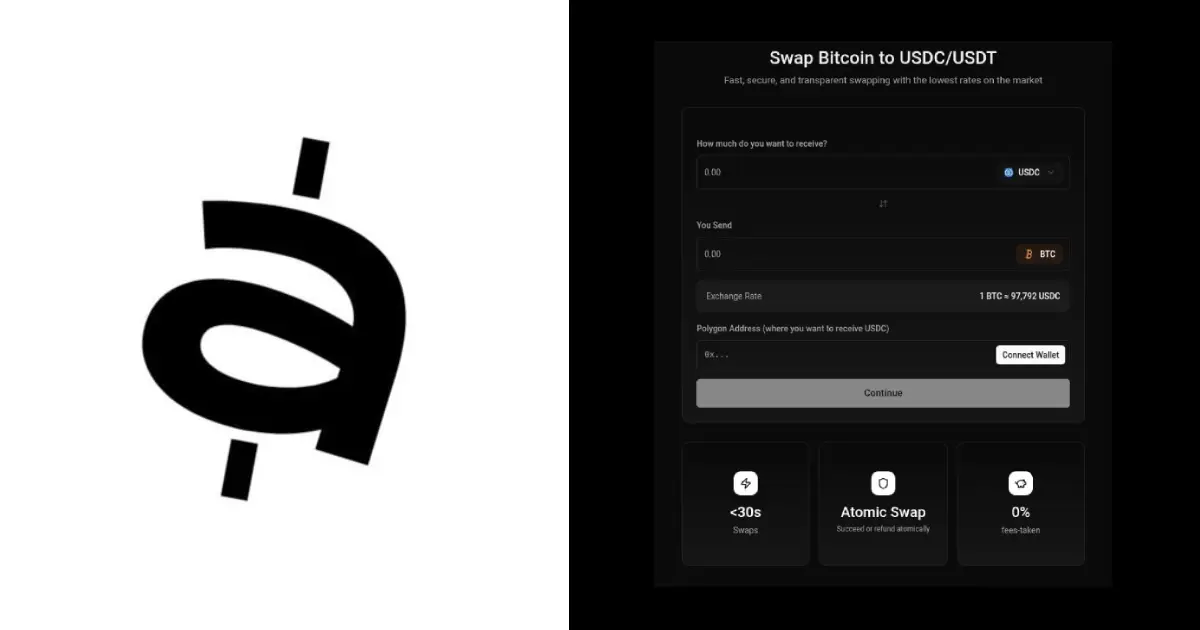

The problem was not growth or demand or even competition. It was settlement. Payments took days to clear. Reconciliation took weeks. Cash piled up in the wrong places. Finance teams spent their time explaining why the numbers did not match instead of planning what came next.

Miscellaneous