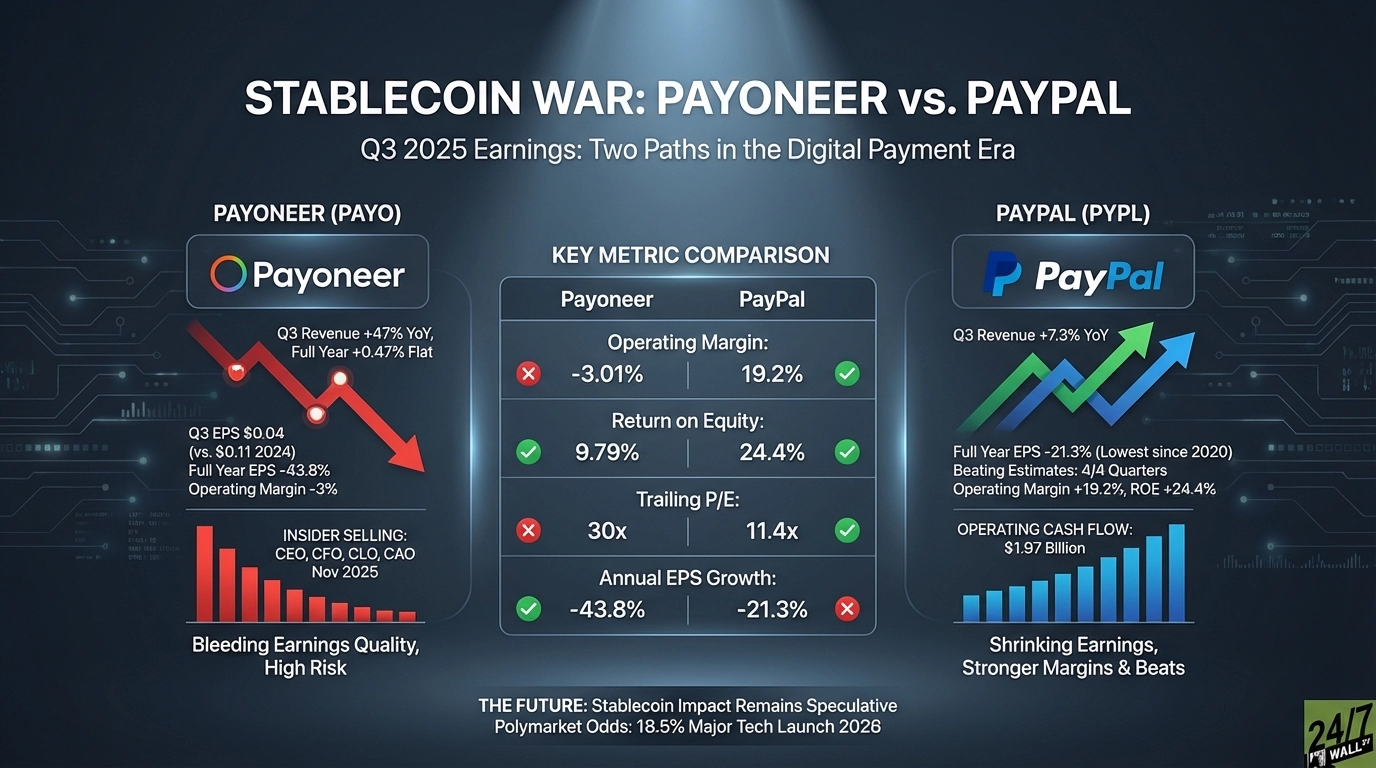

"Payoneer posted Q3 revenue of $270.9 million, up 47% year-over-year. That sounds strong until you see the full-year picture. Annual revenue growth for 2025 was just 0.47%, essentially flat. Quarterly earnings per share collapsed from $0.11 in Q3 2024 to $0.04 in Q3 2025. Full-year EPS fell 43.8% from $0.33 in 2024 to $0.19 in 2025. The company missed analyst estimates in three of four quarters this year, with Q3 delivering a 33% negative surprise."

"PayPal reported Q3 revenue of $8.42 billion, up 7.3% year-over-year. Full-year EPS fell 21.3% from $4.98 in 2024 to $3.92 in 2025, the lowest since 2020. But unlike Payoneer, PayPal beat analyst estimates in all four quarters of 2025, with Q3 delivering a 14% positive surprise at $1.30 per share versus the $1.14 estimate. Operating margin is 19.2%, and return"

Payoneer reported a strong Q3 revenue figure driven by quarter-over-quarter growth but showed nearly flat full-year revenue growth of 0.47% for 2025. Quarterly EPS fell sharply and full-year EPS declined 43.8%, with operating margin at negative 3% and return on assets at 1.08%. Insider selling occurred amid a 48% annual stock decline. PayPal posted moderate revenue growth and beat estimates each quarter, despite a 21.3% drop in full-year EPS to $3.92. PayPal maintains a healthy operating margin near 19.2% and leverages a large consumer base for crypto initiatives.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]