#irs

#irs

[ follow ]

fromTruthout

2 weeks agoPayout for Trump's $10B Lawsuit Over Tax Return Leak Would Be Footed by Taxpayers, Bessent Says

Bessent stuttered, then said, when pushed: "It would come from Treasury.... The Treasury General Account," referring to the account that tax payments flow into that the government uses for payments and other purposes. "So, taxpayers," Gallego said. "Yes," Bessent answered. "Part of the 440,000 taxpayers whose returns were leaked. "They're not suing," the senator clarified, adding, "If the president prevails in this lawsuit, he's going to be able to pocket that money."

US politics

fromNextgov.com

4 weeks agoTreasury cancels all Booz Allen contracts

The Treasury Department has moved to cancel all contracts with Booz Allen Hamilton, two years after a former company employee pled guilty to leaking President Trump's confidential tax information without authorization. Treasury currently has 31 contracts with Booz Allen that average roughly $4.8 million in annual spending and have totaled $21 million in obligations. In a statement issued Monday, Treasury Secretary Scott Bessent cited inadequate data protection safeguards as driving the decision and specifically the disclosure of sensitive taxpayer information accessed through IRS contracts.

fromFlowingData

1 month agoDOGE hiring and non-hiring data

One agency immediately stands out: the Internal Revenue Service. In January 2025, the IRS hired 1,313 people. Over the next two months the agency laid off 11,000 workers, or about 11% of its workforce. And it hired zero people in February and March. What happened at the IRS amidst the DOGE-slashing effort that swept through the federal government is an extreme case of how Musk and his wrecking crew gutted agencies. The IRS did not respond to a request for comment.

US politics

fromwww.mediaite.com

4 months agoTrump Administration Planning to Install Allies' at the IRS to Target Major Democratic Donors' Including George Soros: WSJ

Citing unnamed sources familiar with the matter, the Wall Street Journal reported that the Trump administration has been preparing sweeping changes to the IRS which would allow the agency to pursue criminal inquiries of left-leaning groups more easily. A senior IRS official involved in the effort has drawn up a list of potential targets that includes major Democratic donors, the Journal said, with sources claiming that the administration intended to install allies of the president in the agency's criminal investigation division.

US politics

fromBusiness Insider

4 months agoThe IRS announced new federal income tax brackets for 2026. Here's what's changing.

Federal income tax brackets and the standard deduction are about to look a little bit different in the US. The Internal Revenue Service announced changes to the tax code on Thursday, driven by both inflation adjustments and President Donald Trump's "Big Beautiful Bill." The standard deduction for married couples filing jointly is set to increase to $32,200, a $700 increase from the $31,500 deduction this year.

US politics

fromWashingtonian - The website that Washington lives by.

4 months agoIRS Tells Furloughed Feds They'll Get Back Pay After Trump Says They Might Not, Trump Lands a Big Peace Deal, and Publix Is Coming to NoVa - Washingtonian

Shutshow: A day after President Trump claimed the federal government may withhold back pay from furloughed federal employees, the IRS sent furloughed employees a notice saying that a 2019 law-which Trump signed-guarantees that they'll be made whole after a shutdown. One employee notes the document may come in handy should a court case ensue. ( Government Executive) The IRS has halted most of its operations after coasting a few days on funds it received in 2022. ( Federal News Network)

US politics

US politics

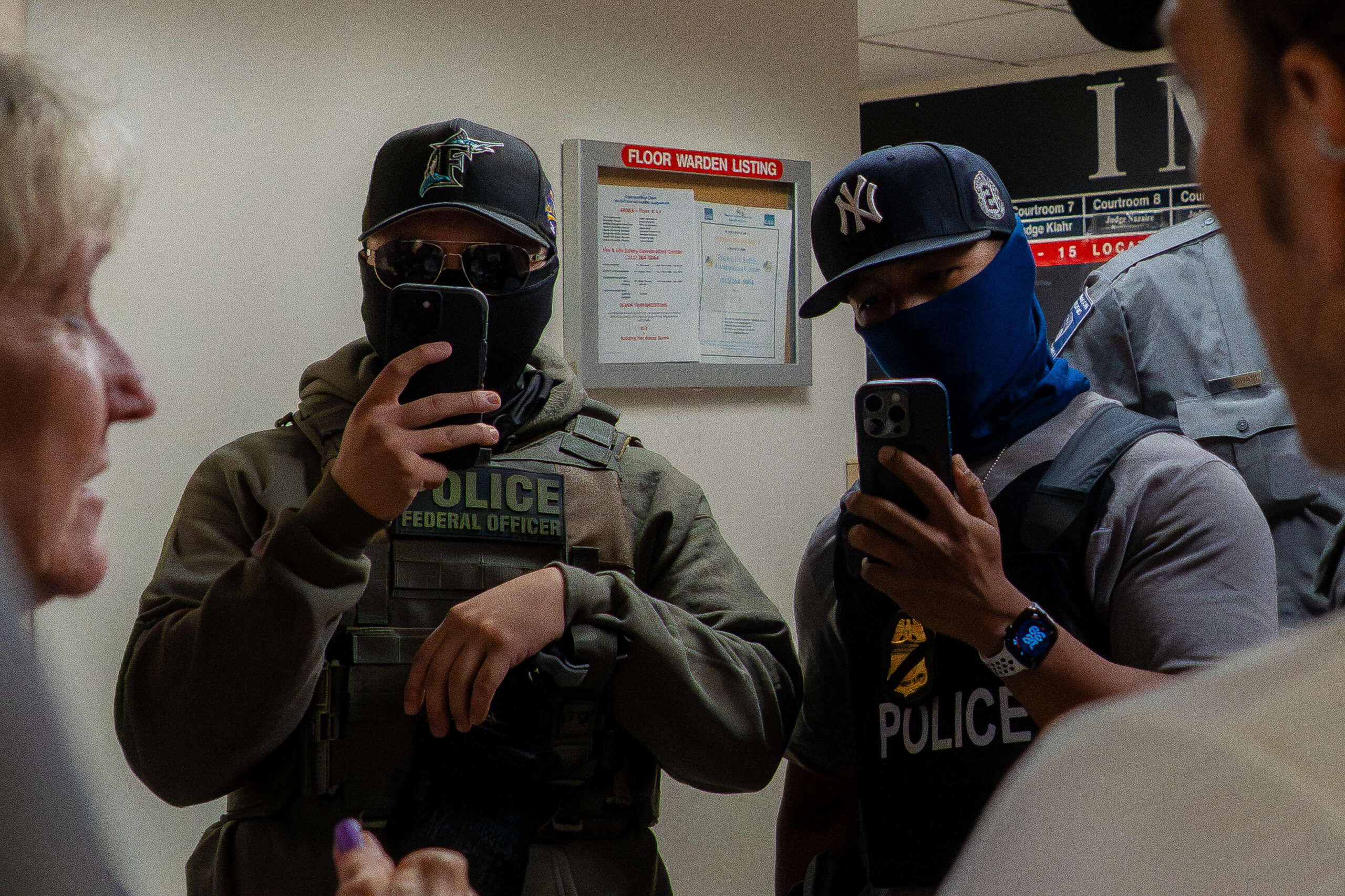

fromwww.orlandosentinel.com

4 months agoSocial Security Administrator Frank Bisignano is named to the newly created position of IRS CEO

Frank Bisignano will serve as Social Security Administration commissioner and newly created CEO of the IRS, overseeing day-to-day IRS operations and reporting to Treasury.

fromNextgov.com

5 months agoIRS announces the phased end of paper check refunds

The federal government has been trying to rid itself of paper checks and reap the cost benefits of electronic payments for years. "Electronic payments such as direct deposit are safer than checks, allow quicker access to funds, and have less risk of fraud," Fiscal Service Chief Disbursing Officer Linda Chero has said previously. "With paper checks over 16 times more likely to get lost, stolen, altered, or delayed, we encourage those still receiving paper checks to make the switch today."

US politics

fromTruthout

6 months agoTrump's Scandal-Plagued IRS Head Ousted After Less Than 2 Months on the Job

From the minute Trump announced Billy Long as his IRS pick it was obvious this would end badly, but every Senate Republican voted to confirm his nomination anyway. He didn't even last two months on the job.

US politics

fromIntelligencer

7 months agoIRS Approves Endorsing Candidates From Church Pulpits

The I.R.S. said on Monday that churches and other houses of worship can endorse political candidates to their congregations, carving out an exemption in a decades-old ban on political activity by tax-exempt nonprofits.

US politics

fromElectronic Frontier Foundation

7 months agoEFF to US Court of Appeals: Protect Taxpayer Privacy

Given the historical context, and decades of subsequent agency promises to protect taxpayer confidentiality and taxpayer reliance on those promises, the Administration's abrupt decision to re-interpret §6103 to allow sharing with ICE whenever a potential 'criminal proceeding' can be posited, is a textbook example of an arbitrary and capricious action even if the statute can be read to be ambiguous.

Privacy professionals

fromAbove the Law

7 months agoMorning Docket: 07.08.25 - Above the Law

In recent courtroom decisions, judges expressed frustration with the constant reference to Moore's Federal Practice, suggesting it should not be a primary resource for legal staff. The expectation is for professionals to rely more on precedent and case law rather than textbooks.

Privacy professionals

fromBrooklyn Paper

7 months agoIRS workers, pols rally against 'disgraceful' conditions and mistreatment at Brooklyn office building * Brooklyn Paper

Elected officials expressed strong concern regarding the deplorable office conditions faced by IRS employees, citing overcrowded spaces, insufficient supplies, and safety hazards from exposed wires.

Brooklyn

fromAbove the Law

8 months agoIRS Issues Memorandum Stating That Taxpayers Who Were Scammed Out Of Their Money Online Could Be Eligible To Claim A Theft Loss Deduction - Above the Law

The IRS recently clarified that victims of certain online scams can claim a theft loss deduction, addressing prior complexities with capital losses related to cryptocurrencies.

Cryptocurrency

California

fromwww.mercurynews.com

9 months agoElias: America won't be able to survive without undocumented migrants

The IRS will now share tax data with immigration agencies, breaking confidentiality promises.

Undocumented immigrants contribute significantly to Social Security without benefiting from it.

#harvard-university

Right-wing politics

fromNew York Post

9 months agoZip it, Mr. President - IRS must revoke Harvard's tax status without your meddling

Harvard's tax-exempt status is challenged due to allegations of discrimination and violations of civil rights.

The call to revoke Harvard's tax status is framed as a moral and legal obligation.

Artificial intelligence

fromTheregister

9 months agoFired IRS agents will be replaced with AI, says Treasury Sec

IRS plans to use AI to enhance tax collection amid staff cuts.

AI is expected to compensate for reduced enforcement workforce.

More than 11,000 IRS employees have been laid off.

The agency's effectiveness hinges on the experience of replacement staff.

fromwww.mediaite.com

10 months agoIt Was WWE': Elon Musk Reportedly Got into a Loud' Shouting Match With Trump's Treasury Secretary in the West Wing

The clash with both men in each other's face showed how much Musk's personality and style have rankled some senior administration officials since he began running roughshod through agencies.

US politics

[ Load more ]