Portland

fromPortland Mercury

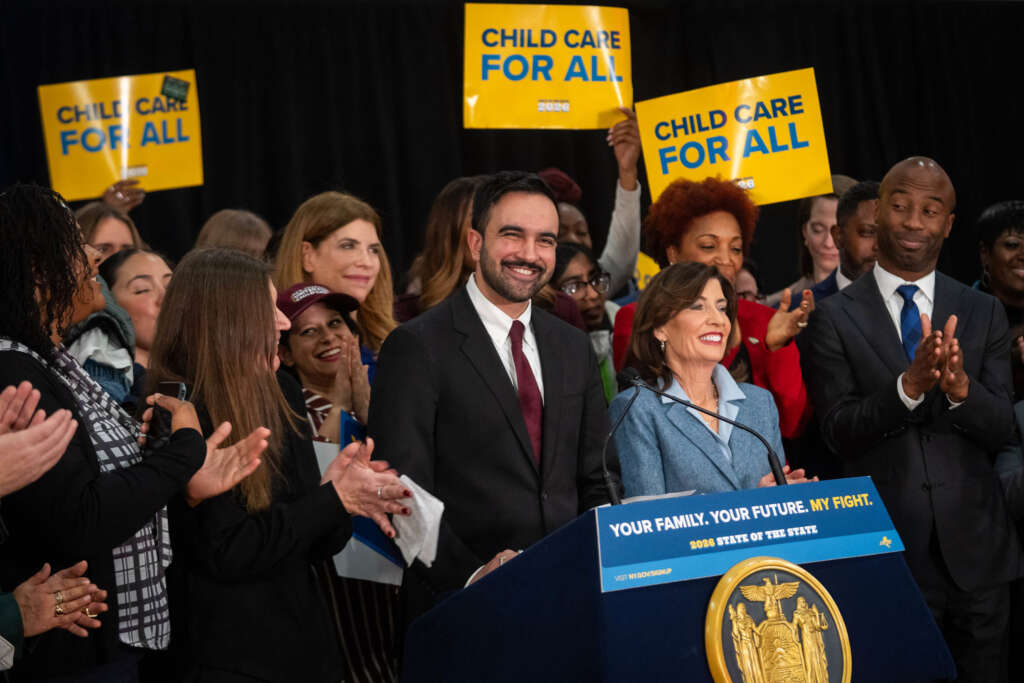

21 minutes agoGood Morning, News: Preschool for All Tax Update, Oregon Legislature Looks to Slash Safe Routes to School Funding, and Kristi Noem is OUT

New 2024 tax data shows high-income earners in Multnomah County increased, challenging claims that wealthy residents are fleeing due to the Preschool for All tax.