#real-estate-market

#real-estate-market

[ follow ]

#mortgage-rates #housing-affordability #home-prices #home-sales #luxury-real-estate #homeownership #real-estate

San Francisco

fromLos Angeles Times

23 years agoSan Pedro: Blue-collar soul with ocean views

San Pedro offers affordable oceanside living with dramatic Catalina Island views, rugged bluffs, and diverse neighborhoods ranging from $200,000 to $800,000, appealing to budget-conscious buyers seeking character over polish.

#celebrity-real-estate

Boston real estate

fromLos Angeles Times

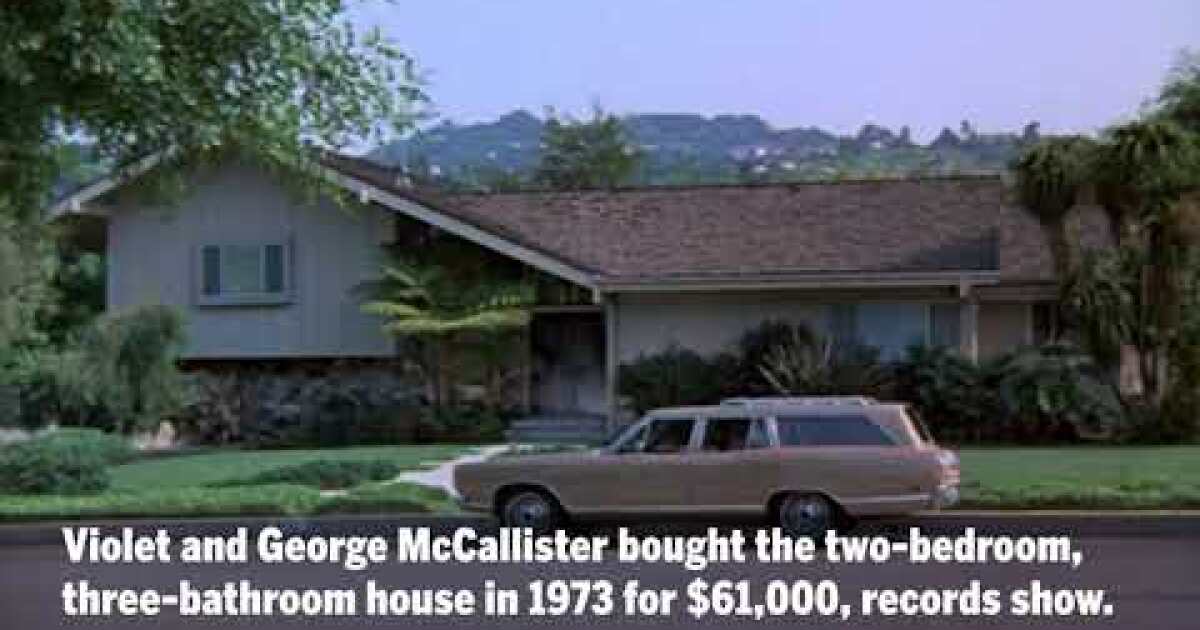

7 years agoIn a battle between celebrities and reality TV for the 'Brady Bunch' house, TV won - at twice asking price

HGTV purchased the iconic 'Brady Bunch' house for $3.5 million, nearly double the $1.885 million asking price, after competing against eight other bidders including celebrities and producers.

fromLos Angeles Times

10 years agoHome of the Day: A multi-level contemporary in Mar Vista

This contemporary residence offers a clean look with wire-brushed wood floors, LED lighting and a modern kitchen with a tiled backsplash and custom cabinetry. A glass-enclosed staircase leads up three floors to a private rooftop deck plumbed for a gas barbecue and a spa.

Boston real estate

Silicon Valley real estate

fromLos Angeles Times

31 years agoAT HOME : Charming Coastal Area Packs Them In : Corona del Mar: Despite small lots and high home prices, community of older beach homes is one of the most desirable in Southland.

Corona del Mar's real estate market commands premium prices, with homes in the mid-$700,000s and higher, reflecting Southern California's expensive coastal housing market despite small lot sizes and close proximity to neighbors.

Miami

fromBusiness Insider

1 week agoWhy California's billionaires are dreaming of going to Miami

California's proposed wealth tax on billionaires is driving ultra-wealthy residents to purchase luxury real estate in Miami, with ultramansion sales surging from one to nineteen properties over $30 million annually.

fromLos Angeles Times

30 years agoPomona's 'Best-Kept Secret' : Ganesha Hills has family living in rural setting

Ganesha Hills is a neighborhood of some 500 homes described by one resident as 'the San Gabriel Valley's best-kept secret.' Named for the elephant-headed Hindu god of good fortune, Ganesha Hills is situated in the rolling hills north of the San Bernardino Freeway (10), just east of the Orange (57) Freeway. The community of single-family homes in a variety of architectural styles set amid chaparral and oaks is in the northwestern section of Pomona bordering La Verne and San Dimas.

LA real estate

fromwww.mercurynews.com

1 week agoSan Jose towers that may invigorate downtown attract brisk interest

We have about 500 people on the waiting list to buy condos, said John Tashjian, managing partner with Centurion Real Estate. That's unheard-of interest. I've had 50, I've had 100. But I've never seen anything like this before.

San Jose Sharks

Boston real estate

fromBoston Condos For Sale Ford Realty

1 month agoStory Of Boston Condo Sale Broker Waiting For Spring Boston Condos For Sale Ford Realty

A frigid, slow Boston condo market creates a bleak brokerage atmosphere until an unexpected phone call suggests a possible early spring market pickup.

Real estate

fromRedfin | Real Estate Tips for Home Buying, Selling & More

1 month agoWhat Factors Affect How Quickly a House Sells?

Speed of home sale depends primarily on accurate pricing, market supply/demand, property condition and marketing, with days on market signaling demand and pricing accuracy.

fromCurbed

2 months ago'Concrete Hand Grenades,' Ghost Floors, and More Supertall Drama

they still draw our attention, our praise, and sometimes our scorn. Sometimes it's for their wacky design choices, like Extell's torch on Eighth Avenue, or their market failures, like the overpriced, more than half-empty condos of Brooklyn Tower. Occasionally, they become sagas in and of themselves, like 432 Park, with its crumbling façade, a swaying stack of luxury condos haunted by howling winds where billionaires get trapped in the elevators.

Brooklyn

fromwww.housingwire.com

3 months agoHow a 50-year mortgage could affect equity and monthly payments

The idea of the 50-year mortgages flooded the news recently. It is the newest attempt by the Trump Administration to bring down housing costs, but I don't think it was thought through entirely. On paper, it seems like a crazy but good idea. 50 years is a long time, but at least it would allow people to enter into the housing market. But as soon as you dive into the numbers, you realize how the 50-year mortgage could ruin the real estate market forever.

US politics

from24/7 Wall St.

3 months agoOpendoor's CEO Sprung a Big Trap for Short Sellers. Should You Buy?

What began as a near-death experience for the online home-flipping platform - trading as a penny stock amid a brutal housing market downturn - transformed into one of the year's biggest rallies. Shares have skyrocketed nearly 900% in the past six months, fueled by retail investor enthusiasm, social media campaigns, and a leadership shakeup that brought fresh optimism. High short interest, exceeding 22% of the float, made it a prime target for squeezes.

Real estate

fromSFGATE

4 months agoHow Flood Map Changes Impact Home Sales

The expiration of the National Flood Insurance Program during the recent federal government shutdown has put coverage for millions of homes at risk, affecting home closings and buyers in flood-prone areas. An analysis in Miami and Tampa shows that homes with lower flood risk have seen faster price appreciation over the past decade, highlighting changing buyer preferences. Market trends indicate a shift toward prioritizing flood risk data in home-buying decisions, with younger buyers leading the change.

Real estate

Real estate

fromTravel + Leisure

4 months agoThis Florida City Was Named Best Hidden Gem Housing Market for Its Affordability-and It Has White Sand Beaches and Small Town Charm

Pensacola offers significantly lower housing costs, balanced market conditions, strong household income, and Gulf Coast amenities making it an affordable, attractive Florida location.

fromwww.housingwire.com

5 months agoTitle insurance premiums rise to $4.5B in Q2

The title insurance industry continues to demonstrate resilience and reliability, even as the broader real estate market faces headwinds, said ALTA CEO Chris Morton. These results reflect not only strong financial performance, but also the vital role title professionals play in commercial real estate transactions alongside the residential housing market. Residential buyers, lenders and commercial real estate sectors all benefit from the stability and certainty title insurance protections provide every day.

Real estate

fromSFGATE

5 months agoBeverly, MA Homeowners Can Expect a Cool and Dry Fall, Says The Old Farmer's Almanac

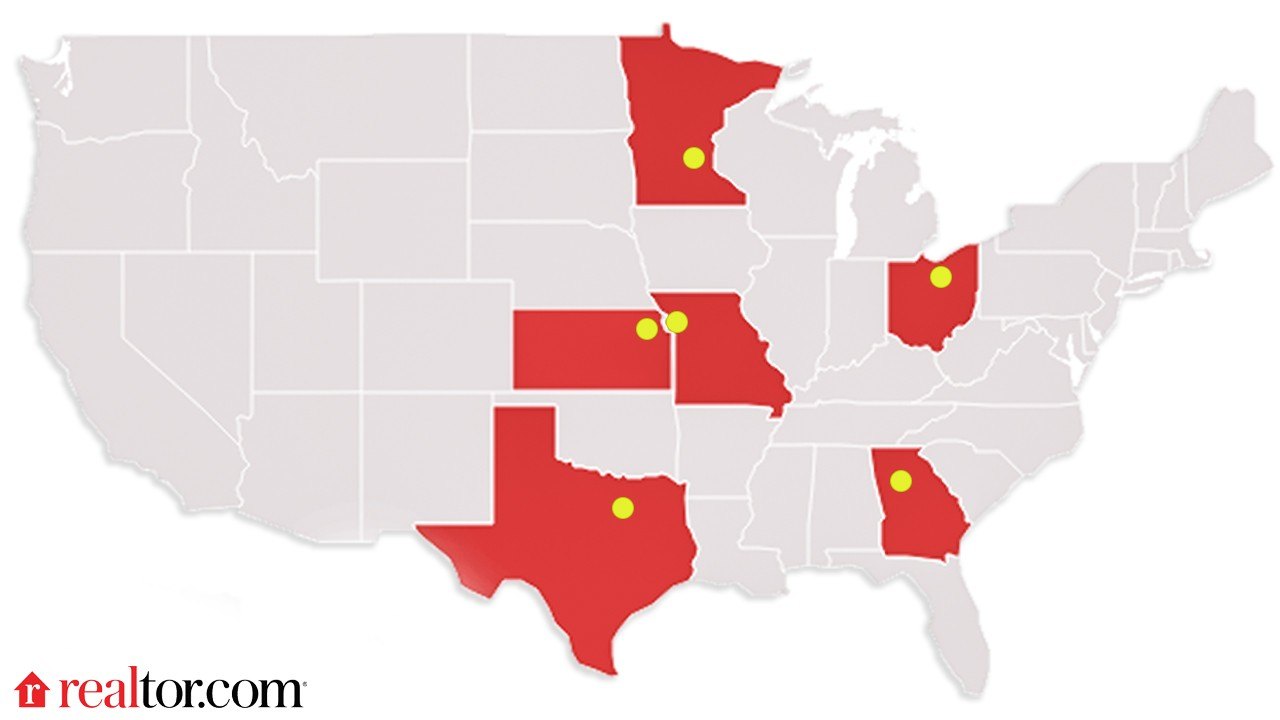

The Old Farmer's Almanac has released its Fall 2025 Weather Predictions, and while much of the country will see warmer-than-average conditions, New England is forecasted for a crisp, classic autumn. Article continues below this ad At the same time, Beverly has captured national recognition as the nation's top-ranked market on the Realtor.com® list of 2025 Hottest ZIP Codes, making it a red hot market despite the chill in the air.

Real estate

fromBoston Condos For Sale Ford Realty

5 months agoHow Long Will It Be When AI Search Overtakes Traditional Goolge Searaches Boston Condos For Sale Ford Realty

Some might dismiss this as hype, but history shows us how quickly consumer behaviour can flip. I'm old enough to remember back to when we first relied on the Yellow Pages, then shifted almost overnight to Google. We're already starting to see a shift towards AI-driven search, where instead of scrolling through endless pages of results you're presented with just a handful of carefully curated answers, drawn from multiple sources.

Boston real estate

#homeownership

SF real estate

fromwww.bostonherald.com

10 months agoHomeownership further out of reach as rising prices, high mortgage rates widen affordability gap

Homeownership increasingly unaffordable for many Americans due to rising mortgage rates and home prices.

Median income required to buy a home has increased dramatically in recent years.

fromSFGATE

8 months agoChip and Joanna-Approved! Magnolia Network Designer Turns 'Collapsing' Hudson Valley Home Into Stunning $685K Retreat

"It was functioning as a two-family home with one apartment downstairs and one upstairs when we bought it. We had to do a lot of work to reconfigure it to a single-family home and bring it back to what it once was, which was a really big undertaking."

Renovation

fromSFGATE

8 months agoThe Most Affordable Places Across the U.S. To Invest in a Lake House

Lake Norman, the largest lake in North Carolina, is a human-made freshwater lake spanning 32,000 acres and bordering four counties: Catawba, Iredell, Lincoln, and Mecklenburg. However, despite its growth and some rising prices, it remains an attractive destination for homebuyers year-round.

SF real estate

fromSFGATE

9 months agoCanadian Homebuyers Are Turning Their Backs on the U.S. After Trump's Tariffs-These Cities Are Being Hit the Hardest

Escalating political tensions between the U.S. and Canada, particularly from tariff policies under President Trump, have significantly affected Canadian interest in U.S. real estate.

Canada news

Retirement

fromwww.housingwire.com

10 months agoUS home equity has reached $35 trillion. It's a blessing and a curse

High home equity can reduce college financial aid eligibility while homeowners face financial strain and hesitancy to sell.

Market volatility and rising property taxes complicate home equity utilization and home sales.

[ Load more ]