#economic-forecast

#economic-forecast

[ follow ]

#mortgage-rates #housing-market #uk-economy #tariffs #public-finances #federal-reserve #global-economy #gdp-growth

Miscellaneous

fromLondon Business News | Londonlovesbusiness.com

1 month agoUK GDP growth improves in November, driven by a recovery in services activity - London Business News | Londonlovesbusiness.com

UK GDP rose 0.3% in November driven by production and services recovery, while construction declined and modest growth is forecast for 2025–2026.

fromBusiness Matters

2 months agoUK shoppers pull back on Black Friday as concerns grow over weakening economy

Fears over the strength of the UK economy appear to have kept shoppers away from high streets on Black Friday, adding to growing evidence that consumer caution will weigh heavily on growth into 2026. Footfall across all shopping destinations fell by 2% on Friday and was 7.2% lower than the equivalent days last year, according to data from monitoring firm MRI Software. Only locations close to central London offices bucked the trend, seeing a slight lift as workers browsed stores during breaks

Miscellaneous

fromFortune

3 months agoThe government shutdown won't be completely recouped-and it could cost the economy up to $14 billion, estimates say | Fortune

The shutdown could account for up to a $14 billion loss in real GDP, or the total value of goods and services produced by the economy and adjusted for inflation, which won't be recouped, the Congressional Budget Office said Wednesday. A government shutdown usually reduces real GDP temporarily, halting non-essential federal operations, delaying government payments, and cutting spending on services and salaries.

US politics

fromFortune

6 months agoTop analyst says the next 5 years could see 'no growth in workers at all' and sends a warning about the fate of the U.S. economy

With America's workforce in a demographic crunch and historic changes in immigration policy under way, it is "quite possible that the next five years will see no growth in workers at all."

US politics

Media industry

fromwww.thewrap.com

8 months agoMagna Projects Media Owners' Global Ad Revenue Will Grow 4.9% to $979 Billion in 2025

Magna forecasts global ad revenue to grow 4.9% to $979 billion in 2025, revising down from 6.1%.

Digital media has performed better than expected, showing resilience in the current market.

The global ad market is projected to grow significantly by 2026, driven by key events.

Cryptocurrency

fromBusiness Insider

8 months agoScott Bessent dismisses Jamie Dimon's debt concerns, saying none of his past predictions have been right

Jamie Dimon predicts a bond market crack due to excessive spending and easing during the pandemic, while Treasury Secretary Scott Bessent disagrees with this forecast.

London startup

fromLondon Business News | Londonlovesbusiness.com

9 months agoRetail sales growth expected through to summer, says retail think tank - London Business News | Londonlovesbusiness.com

Despite economic volatility, UK retail sales are forecast to grow in Q2, though growth will be limited and gradual.

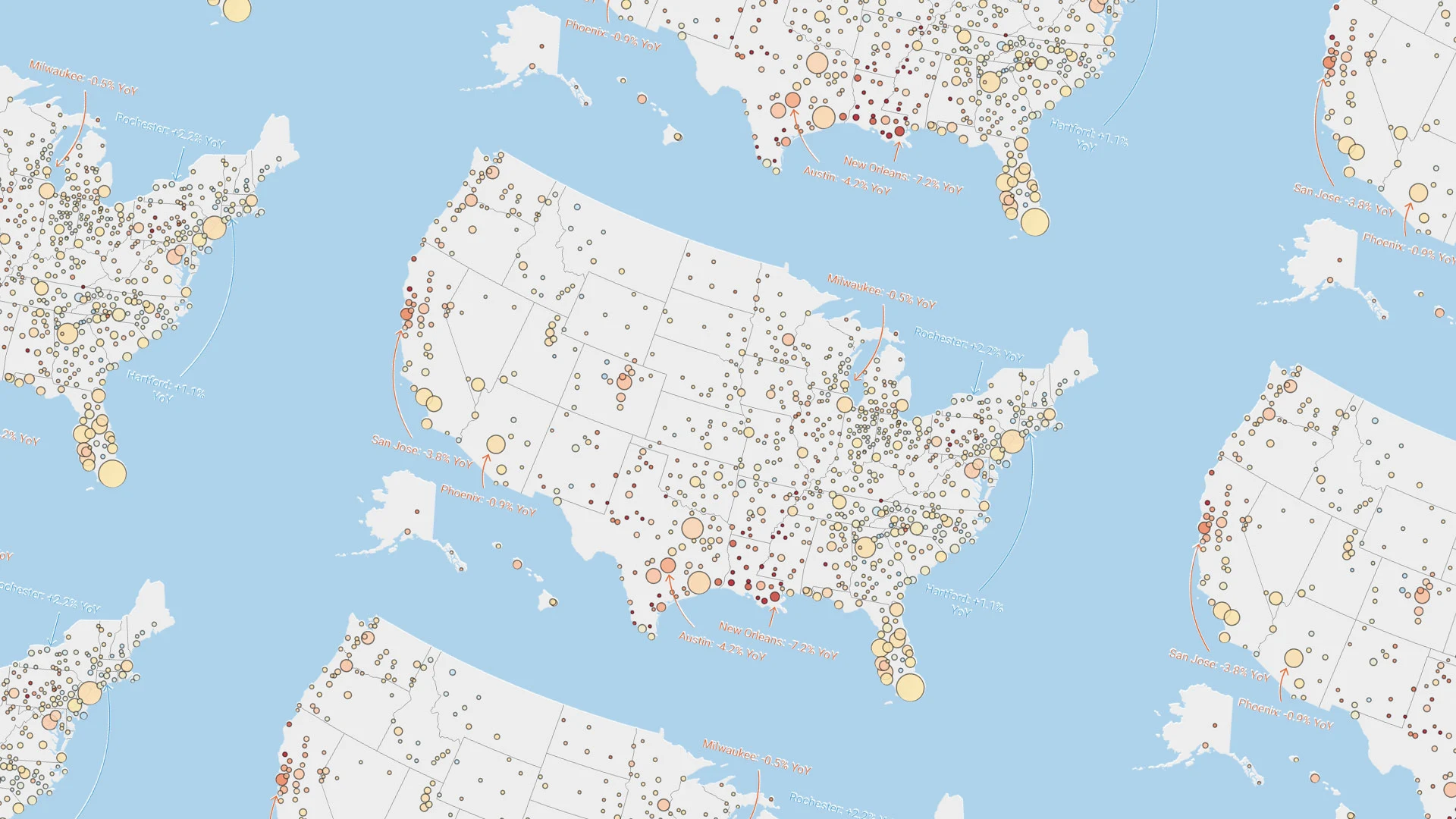

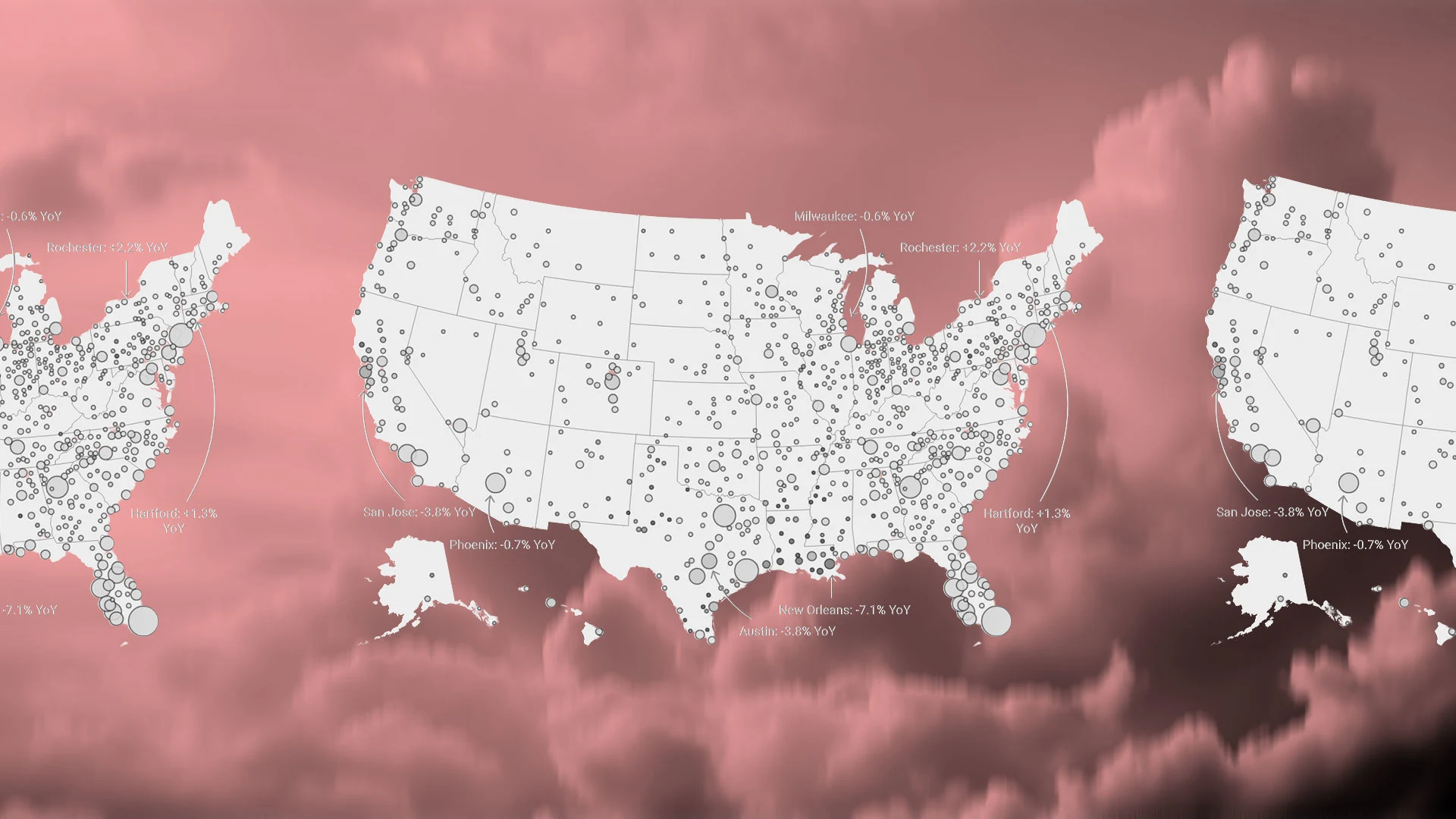

SF real estate

fromwww.housingwire.com

10 months agoFannie Mae survey: Home-price growth expected to level out this year

National home-price growth has been revised down, reflecting economic uncertainties and a changing mortgage rate outlook.

The spring home-selling season appears to be gaining traction despite challenges.

[ Load more ]