#warner-bros-discovery

#warner-bros-discovery

[ follow ]

#paramount-skydance #mergers--acquisitions #netflix #paramount #media-acquisition #streaming-industry

fromBusiness Insider

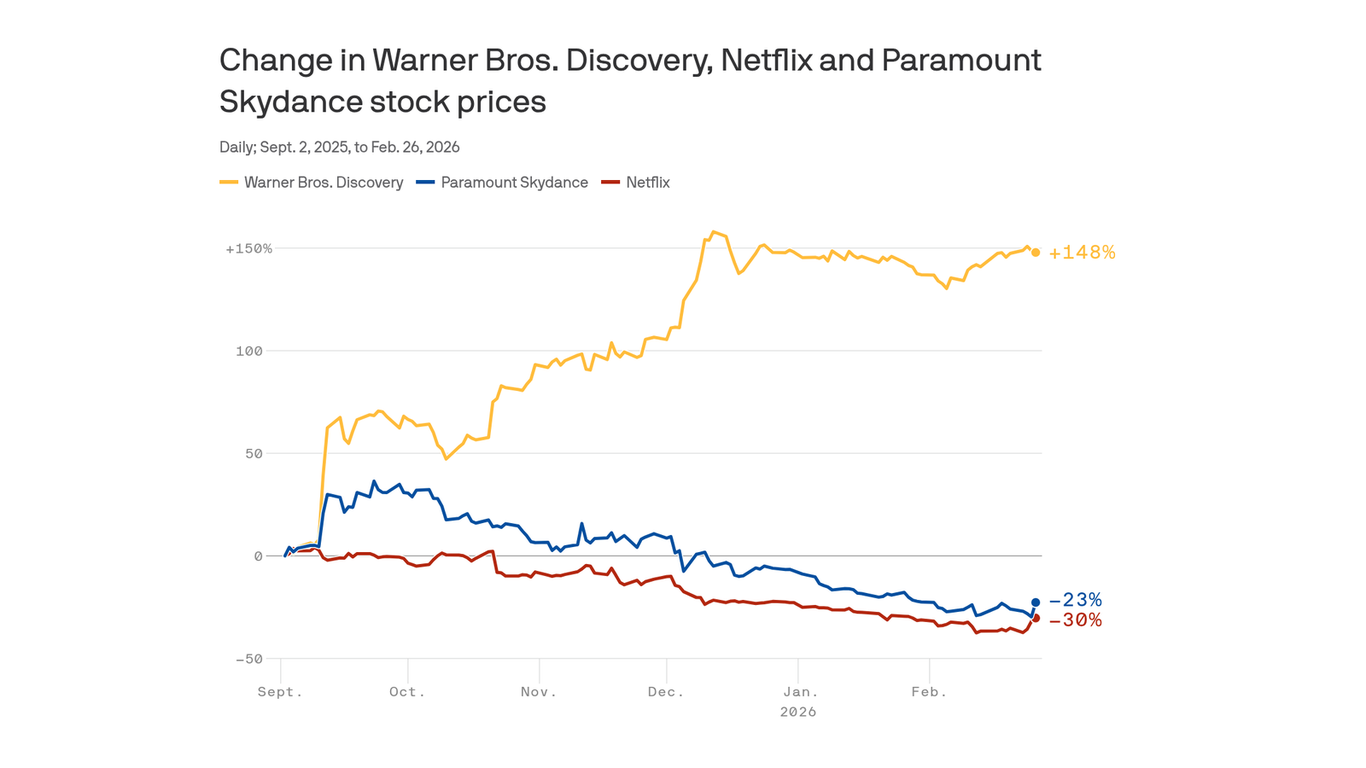

1 week agoOn Wall Street, even the losers are winners in the battle for Warner Bros. Discovery

The battle for WBD played out amid a pivotal backdrop for Wall Street: a period investment banks hope will mark a full-throated M&A rebound, in which just landing a role on a deal of this size is as useful for one's street cred as actually winning it. Even advisers on the losing side will walk away with hefty fees, boardroom credibility, and proof they belong on the biggest mandates of the coming year.

Media industry

fromBusiness Insider

2 weeks agoA Hollywood insider dishes on Warner Bros., AI, and the state of the industry

Hollywood is in trouble. The streaming boom that fueled a ton of production in the last decade-plus is gone, and lots of the remaining work is going overseas. No one really knows how AI will affect the movie and TV business, but there's lots of fear it won't be good. And barring something truly surprising, Warner Bros., one of Hollywood's most important movie and TV studios, is going to get swallowed up in the next year or so, which will mean even more consolidation.

Film

US politics

fromBusiness Insider

1 month agoTrump says he's staying out of the fight between Netflix and Paramount to take over Warner Bros. Discovery

Donald Trump received calls from Netflix and Paramount Skydance about their dispute with Warner Bros. Discovery and declined involvement, leaving the Justice Department to handle it.

fromBusiness Insider

1 month agoWhy Warner Bros. Discovery dialed up the heat in its latest rejection of Paramount

WBD used pointed language, calling Paramount's bid the "largest leveraged buyout in history by a wide margin" and tying its potential failure to previous big LBOs that didn't close on the initially agreed-upon terms. In its new filing, WBD also described Paramount's financial condition as "not strong," noting that its credit was already rated "junk" by S&P before the "extraordinary amount of debt financing" required by the deal.

Media industry

Business

fromArs Technica

1 month agoWarner Bros. sticks with Netflix merger, calls Paramount's $108B bid "illusory"

Warner Bros. Discovery's board unanimously rejected Paramount's $108.4B hostile bid and supports Netflix's $82.7B acquisition plus a cable division spinoff due to financing and execution concerns.

fromBusiness Insider

1 month agoRead the memo WBD CEO David Zaslav sent employees after rejecting Paramount for the 8th time

Team, As we begin the year, I want to share an update on where things stand and where we are focused. Following a thorough review, the Warner Bros. Discovery Board of Directors has completed its consideration of Paramount Skydance's most recent proposal. After careful evaluation, the Board has determined not to pursue that proposal.

Business

fromwww.mediaite.com

1 month agoWarner Bros. Discovery Board Shuts Down Paramount's Revised Hostile Takeover Push

Warner Bros. Discovery board members delivered a blunt rejection of Paramount's revised hostile takeover bid on Wednesday, warning investors the offer was inadequate and still too risky. In a letter to shareholders on Wednesday, obtained and first reported by CNN, the WBD board rejected Paramount's revamped bid, insisting it falls well short of the certainty offered by its existing deal with Netflix. To effect the transaction, it intends to incur an extraordinary amount of incremental debt more than $50 billion through arrangements with multiple financing partners, the board wrote.

Business

Television

fromFortune

2 months agoThe Netflix-Paramount saga caps a 2025 turning point, S&P says: Cable TV is in the 'decline stage,' with a long, slow bleedout ahead | Fortune

U.S. cable networks have entered a structural decline with falling revenues, shrinking viewership, and legacy assets being restructured amid streaming-driven consolidation.

[ Load more ]