#covered-calls

#covered-calls

[ follow ]

#high-yield-etfs #dividend-etfs #income-investing #etfs #retirement-income #nasdaq-100 #income-etf #high-yield-etf

from24/7 Wall St.

1 week agoCan You Really Get 55% Yield from the YieldMax AMD Option Income Strategy ETF (AMDY)?

Don't Expect Any Guarantees Without a doubt, what attracts investors to the YieldMax AMD Option Income Strategy ETF ( NYSEARCA:AMDY) is its advertised 54.65% annualized distribution rate. Since AMD stock doesn't pay any dividends or cash distributions at all, the AMDY ETF seems like a much better choice. Not only that, but the YieldMax AMD Option Income Strategy ETF pays out cash distributions on a weekly basis. Just imagine how much passive income you could earn through compounding if you reinvested the distributions every week.

Artificial intelligence

from24/7 Wall St.

5 months agoBlackrock's Science and Technology Term Trust (BSTZ) Pays 11.9% Dividends

Blade Runner (1982) was a sci-fi noir film starring Harrison Ford and Rutger Hauer that has since become hailed as a classic. It featured Hauer as Roy Batty, a Replicant, with the appearance of a normal man to a casual observer, but is actually a genetically created Super-Soldier designed for combat missions, who has an "expiration date", i.e., when he is predestined to die.

Film

from24/7 Wall St.

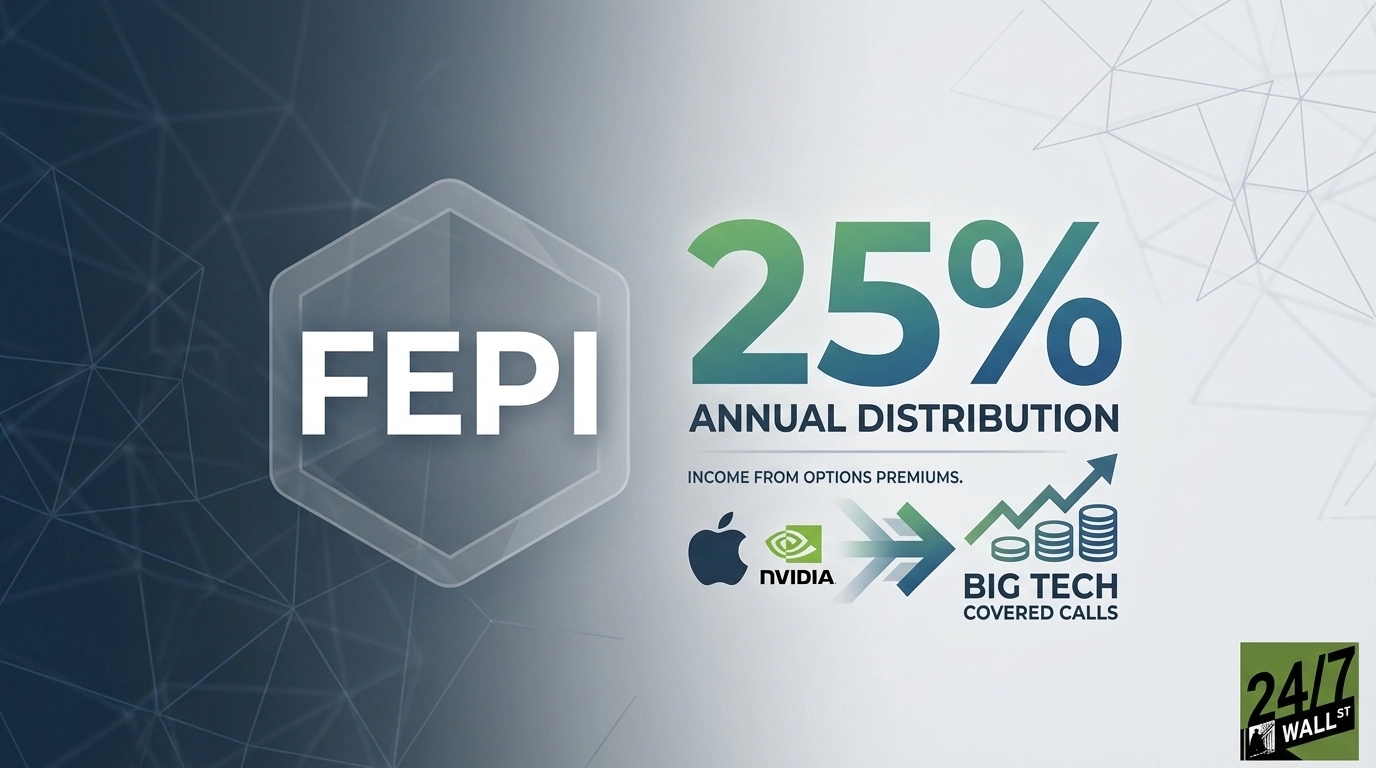

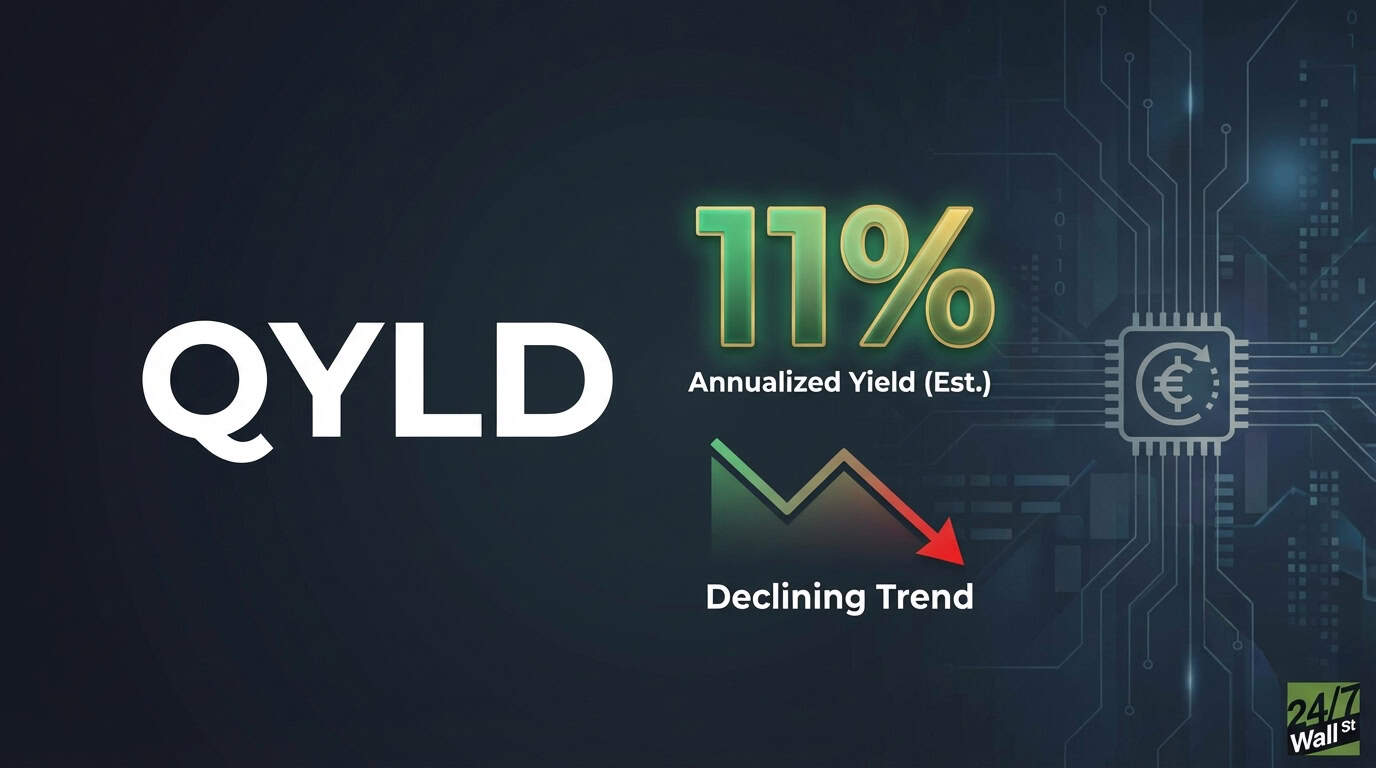

5 months ago3 Income ETFs Every Boomer Should Own Before Age 70

Turning 70 used to be the finish line for portfolio building, but with life expectancy stretching toward the eighties and healthcare inflation outpacing the CPI, the real race is making sure the checks outlive you rather than the other way around. The sweet spot for soon-to-be retirees is no longer the 2% yield. The economy is volatile, and trade policies are being changed rapidly. And there's a risk that the next administration will undo these changes and spark a decades-long

Business

[ Load more ]