"The ETF generates income by writing call options against these holdings. When you sell a covered call, you collect a premium from the buyer in exchange for agreeing to sell your shares at a specific strike price if the stock rises above that level. This strategy transforms low-yielding growth stocks into income generators, but caps upside potential when stocks surge above strike prices."

"Over the past 12 months, FEPI distributed approximately $11.61 per share through monthly payments ranging from $0.82 to $1.05. These distributions fluctuate based on options market conditions-specifically, how much premium the fund can collect depends on implied volatility and where strike prices are set relative to current stock prices. The sustainability concern centers on total return. While FEPI delivered 25.7% in distributions over the past year, the ETF's price gained only 14.9%, bringing total return to roughly 40%."

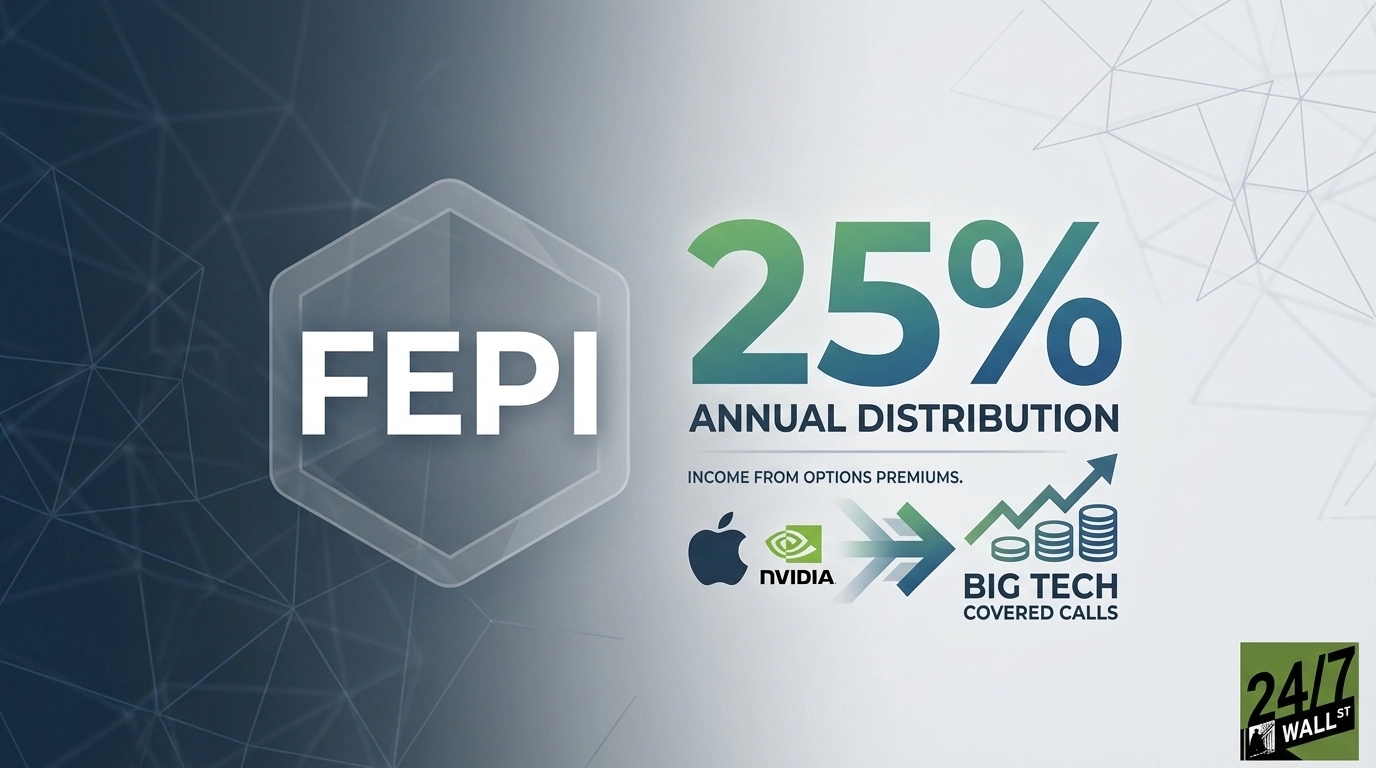

"REX FANG & Innovation Equity Premium Income ETF (NYSEARCA:FEPI) delivers a 25% annual distribution from tech stocks that barely pay dividends. The ETF achieves this by selling covered call options on holdings like NVIDIA (NASDAQ:NVDA), Apple (NASDAQ:AAPL), and Tesla (NASDAQ:TSLA), collecting premiums distributed to shareholders monthly. FEPI holds 15 major technology and innovation stocks in roughly equal weight, with positions ranging from 5% to 8% each. Top holdings include Micron Technology (NASDAQ:MU) at 8.2%, Alphabet (NASDAQ:GOOGL) at 7.7%, Amazon (NASDAQ:AMZN) at 7.5%."

FEPI holds 15 major technology and innovation stocks in roughly equal weight, using covered-call writing to generate large monthly distributions. The fund sells call options on holdings such as NVIDIA, Apple, and Tesla to collect premiums that are paid out as distributions. Top positions include Micron, Alphabet, Amazon, and Apple, while many constituents pay minimal or no dividends. Distributions depend on options market conditions, implied volatility, and strike selection, so monthly payouts fluctuate. High distribution yield has produced substantial cash income but reduced price appreciation relative to an unencumbered benchmark, raising sustainability and total-return trade-off concerns.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]