#income-investing

#income-investing

[ follow ]

#dividend-etfs #dividend-stocks #reits #dividend-aristocrats #dividend-growth #dividend-sustainability

Business intelligence

from24/7 Wall St.

2 days agoGap's Dividend Scorecard: Does the Post-Earnings Selloff Change the Income Case?

Gap raised its quarterly dividend 6% and authorized $1 billion in share buybacks despite a 9.5% stock decline, creating higher yield while management signals confidence in future earnings sustainability.

Miscellaneous

from24/7 Wall St.

4 days agoYieldMax's MSTR Is A Nightmare ETF, Despite Dreamy Dividends

MSTY's weekly distributions collapsed from $4.42 to $0.30 per share due to declining MSTR stock value, revealing that income distributions are partially funded by eroding capital rather than pure premium income.

from247wallst.com

1 week agoRetirees Are Watching AMLP as Natural Gas Prices Briefly Hit Highest Price in Years

AMLP holds a concentrated basket of midstream MLPs that earn fee-based revenue by moving oil, natural gas, and refined products through pipelines and processing facilities. These companies collect tolls on volumes transported rather than betting on commodity prices, creating relatively predictable cash flows.

Venture

from24/7 Wall St.

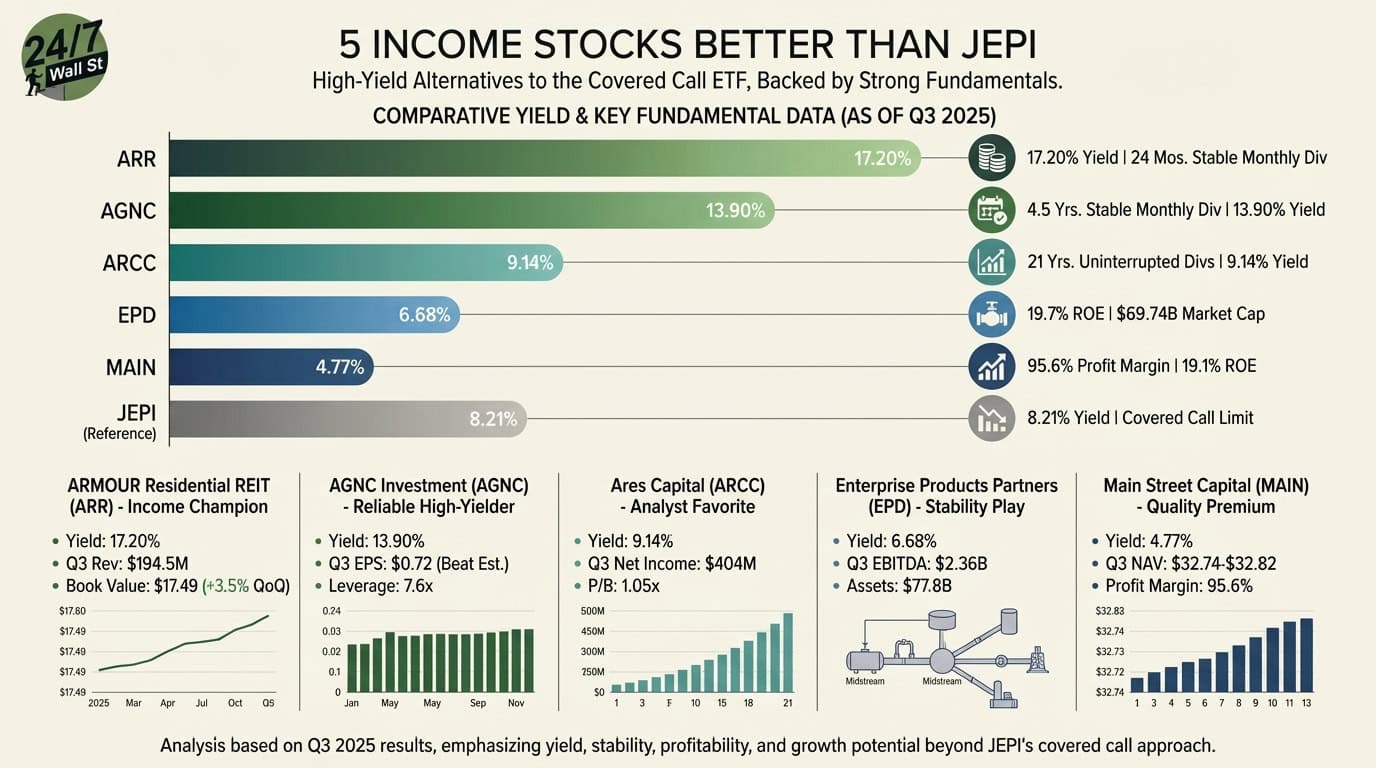

3 weeks agoRed-Hot Jobs Report Will Delay Fed Rate Cuts-Lock In These 5 Ultra-High-Yield Dividend Giants

In addition, if the January consumer price index number, to be posted on Friday, comes in below expectations, there may be no rate cuts until the summer, if then. The best move for growth and income investors seeking solid passive income is to start adding top companies now, as interest rates will rise with no help from the Federal Reserve.

Business

from24/7 Wall St.

3 weeks ago$9.8 Billion Utilities ETF Is A 3% Yielding Backdoor Bet on AI's Explosive Growth

The Vanguard Utilities Index Fund ETF Shares ( NYSEARCA:VPU) generates its 2.73% dividend yield by holding a diversified portfolio of 67 utility companies across the electric, gas, and water sectors. Investors receive quarterly distributions funded by the dividends these underlying holdings pay out. VPU manages $9.8 billion in assets while charging just 0.09% in annual fees, making it one of the most cost-efficient ways to access utility sector income.

Business

fromForbes

1 month agoGet Paid To Buy META Stock?

With Meta Platforms (NASDAQ: META) trading at approximately $659 per share, it is currently about 16% lower than its 52-week high. Do you believe that META stock is a solid long-term investment at its current price? How do you feel about buying it at a 30% discount for around $460 per share? If you see that as a bargain and have some funds ready, consider this trading opportunity.

from24/7 Wall St.

1 month ago3 International Dividend Stocks Offering 6%+ Yields US Investors Are Missing

Most U.S. investors never look beyond domestic stocks for dividend income, and the reasoning, at least on the surface, seems logical. Given currency risk, unfamiliar names, differing accounting standards, and the perception that international markets are riskier and/or less transparent, this lack of consideration seems reasonable. However, as a result of this same consideration, this bias ultimately leaves money on the table, and while US dividend stocks infrequently reach 4-5% yields without serious risk, international markets offer established companies with sustainable business models

Business

from24/7 Wall St.

2 months ago3 Income ETFs With the Stability to Last the Next Decade

One of the most important things to remember is that if you want to build up wealth, it's different than retirement income, and if you're on the former side, you want to start accumulating money now. If you're trying to live off your portfolio now, volatility can become highly personal, as a 20% drop in the market over time isn't a buying opportunity, it's actually the money you need for rent and living.

Business

from24/7 Wall St.

2 months agoMost High Yield ETFs Stink, But JEPQ Pays 10.1% And Is Up Big The Last 6 Months

If you've got sidelined capital ready to put to work, you might want to consider the high-yielding JPMorgan Nasdaq Equity Premium Income ETF (JEPQ), operating on all cylinders. With a high yield of 10.1% that far exceeds the broader market on top of $32.6 billion in total assets under management, JEPQ has delivered a double-digit percentage return over the past six months alone of approximately 11%.

Business

from24/7 Wall St.

2 months ago3 Monthly Income ETFs to Buy Before The Next Rate Cut

As new bonds get issued at lower rates and cash rates decline, investors start to quickly look for ways they can rotate out of these asset classes and move somewhere else that pays income. Enter the income-generating monthly ETF, which often benefits twice in these kinds of environments as its yields stay competitive and the share price tends to rise as demand increases. In other words, investors win on both sides as they get a shareholder boost thanks to growth, all while receiving monthly "paychecks."

Business

from24/7 Wall St.

2 months agoThe Monthly Income ETFs I'd Buy Today For Retirement

If you're a retiree or nearing retirement, you should be thinking about investments with steady income streams. Ideally, you'll reinvest that income, but you also have the option of cashing out your dividends if needed. This passive income can supplement your retirement account withdrawals and Social Security. Some retirees will use dividends to cover ongoing costs such as housing and groceries.

Business

from24/7 Wall St.

2 months agoRetirees Banking on Quarterly Income Choose HDV Over Growth Funds for Its Defensive Holdings

When income matters more than growth, retirees turn to funds that deliver quarterly checks without volatility. The iShares Core High Dividend ETF ( NYSEARCA:HDV) yields 3.3%, triple the S&P 500's 1.03%. That difference translates to predictable cash flow for investors who need their portfolio to pay bills. Built for Income, Not Speculation HDV tracks 75 U.S. companies screened for dividend sustainability and financial health. The fund concentrates in defensive sectors where cash flow holds up when growth stocks stumble.

Business

from24/7 Wall St.

2 months ago3 Consistent Dividend Appreciation ETFs Investors Are Largely Ignoring, But They Shouldn't

Sure, there are some products that pay out increasing amounts over time (such as annuities and other structured products). But for investors holding more traditional portfolios consisting of a mix of stocks and bonds, the bond portion of one's portfolio is typically fixed or fluctuates alongside interest rate movements over time. In contrast, investing in dividend-paying stocks with a track record of raising their dividend distributions over time can provide passive income streams with inflation protection.

Business

from24/7 Wall St.

2 months ago2 High Yield ETFs To Buy Before 2026

2025 has seen some record levels set by the Dow Jones Average and the S&P 500, but income based solutions, especially those depending on prevailing interest rates, were artificially high yielding due to glaring missteps by the Federal Reserve to cut rates during the massive double digit inflation under Bidenomics, and its stubborn refusal to cut rates during the Trump economic resurgence, which massive cut inflation and fuel prices, among other things.

Real estate

from24/7 Wall St.

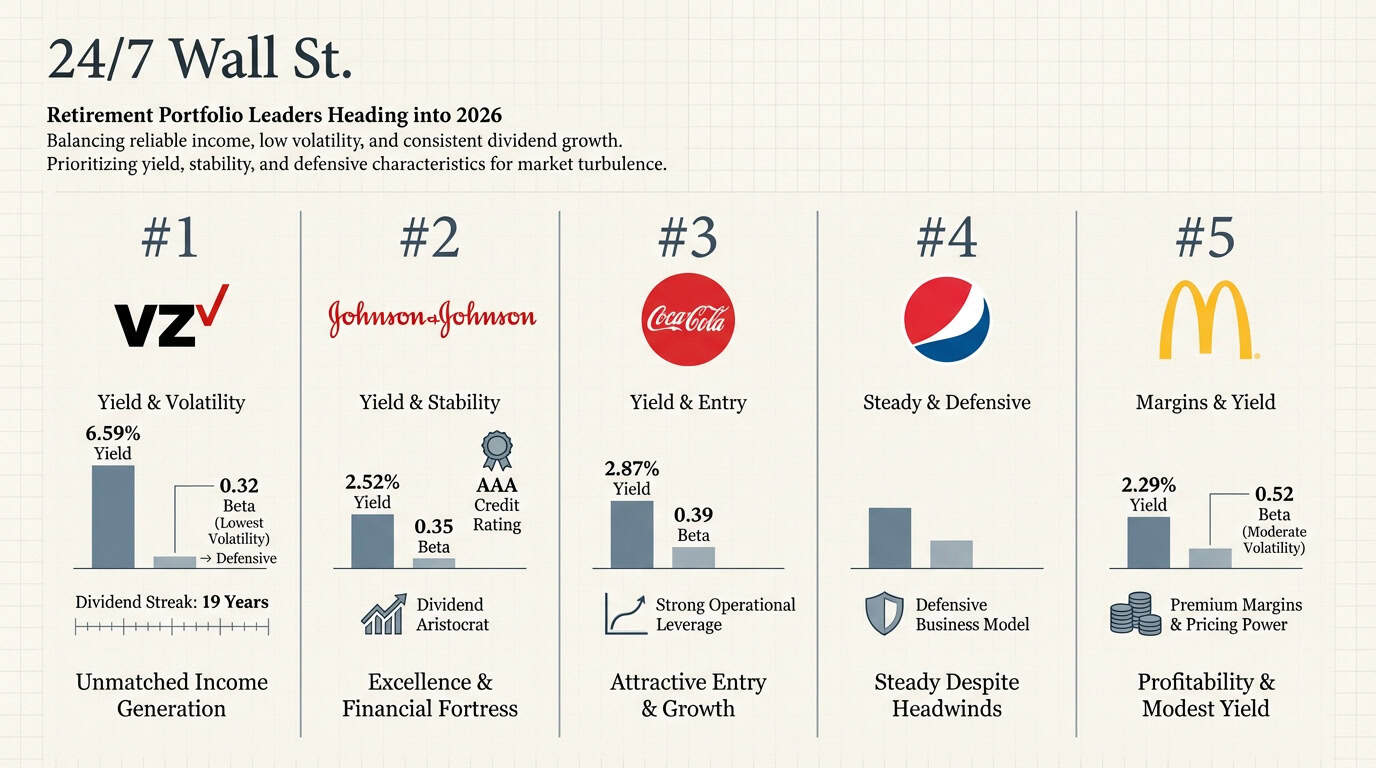

2 months agoWhy 2026 Could Be the Breakout Year for Dividend Growth Investors

Dividend growth investing has always had an appeal to people who are looking to boost their income, find stability in another unstable market, and build long-term wealth. However, 2026 is shaping up to be something of a turning point as a breakout year for this growing investment philosophy. Between market conditions, earnings trends, and a shift in investor sentiment, 2026 is setting up to be an environment where companies that raise their dividends annually will take a step back into the limelight.

Business

from24/7 Wall St.

3 months agoI'm Holding This Dividend ETF in My Retirement Portfolio and Not Letting it Go

First, if you're not familiar with ETFs, or exchange-traded funds, they're funds that invest in a bucket of assets. In the case of SCHD, the fund tracks the Dow Jones U.S. Dividend 100 Index. That index is comprised of high-quality U.S. businesses with at least 10 years of consistent dividend payments, and dividend payments that are deemed to be sustainable.

Business

Real estate

from24/7 Wall St.

3 months ago5 High Yielding Goldman Sachs Conviction List Picks Deliver Safe Passive Income

Goldman Sachs Conviction List highlights high-dividend, low-risk stocks — including Brixmor — that offer reliable passive income and strong total-return potential amid Fed rate cuts.

from24/7 Wall St.

3 months agoWant $3,500 per Year in Monthly Passive Income? Invest Just $2,500 in These Generous Dividend Stocks

Listen up, dividend overachievers! With a mere $2,500 per stock or exchange traded fund (ETF), it's entirely possible to bring in $3,500 worth of passive income per year. To sweeten the deal, we can build out a master plan that will get you paid on a monthly basis and maybe even on a weekly basis. The trick is to look into the realm of real estate, where the stocks can pay surprisingly high yields.

Real estate

from24/7 Wall St.

3 months agoThe Safer Way to Earn 5%+ Yields Without Chasing Risk

The bigger question isn't whether you can earn a 5% yield, you can, but it's more of a question as to how to do so safely. This doesn't mean safe, like keeping your cash under a mattress safe, since there is no interest earned. On the other hand, you have to think about what your risk level truly is, and while you don't want to chase too much risk, you can't avoid it at all.

Real estate

from24/7 Wall St.

3 months ago3 AI-Driven Dividend Stocks That Still Offer Real Value

Even as the investing world continues to debate whether we are or are not in an "AI bubble," there shouldn't be any question whether AI-driven dividend stocks are still enjoying a moment. As artificial intelligence dominates much of the daily conversation in the tech world, these stocks and their shareholders are all enjoying outstanding returns. The good news is that not every AI-driven dividend stock is under the microscope as part of the bubble.

Business

from24/7 Wall St.

4 months agoNeed Income? These 3 Dividend ETFs Pay You 52 Times Per Year

Most dividend exchange-traded funds pay out every quarter. For many retirees, this does not align with how they spend money or budget, so it's worth looking into weekly ETFs like Roundhill Magnificent Seven Covered Call ETF (BATS:MAGY ) , and Nicholas Crypto Income ETF (NYSEARCA:BLOX ) . Weekly dividend ETFs are in very few people's bucket lists. They're a rare type of ETF, but they've done outstandingly well in the current environment.

Business

from24/7 Wall St.

4 months agoI have invested in dividends for 20 years. These stocks are my top dividend compounders of all time

There is no question that this market is obsessed with fast growth and flashy returns, something you can learn just by going online and looking at websites like Reddit and other trading forums. The thing is, dividend compounders win by doing the opposite of flashy, as it rewards patience. Instead of chasing the hype, the best dividend earners forget it and quietly reinvest profits through DRIP.

Business

[ Load more ]