#US-China relations

#US-China relations

[ follow ]

#us-china-relations #taiwan #tariffs #tiktok #export-controls #rare-earths #national-security #trade-war #nvidia

World news

fromFortune

2 weeks agoWhat happened at Davos was a warning to CEOs: their companies are designed for a world that no longer exists | Fortune

CEOs must redesign corporate strategies because geopolitics, state-driven economic policies, and US-China dynamics now directly shape commercial risks and market alignment.

fromTechCrunch

4 weeks agoHere's what you should know about the US TikTok deal | TechCrunch

TikTok, owned by the Chinese company ByteDance, has been at the center of controversy in the U.S. for years now due to concerns about user data potentially being accessed by the Chinese government. As a result, U.S. users have often found themselves caught in the middle of this tension. Last year, the app experienced a temporary outage in the U.S. that left millions of users in suspense before it was quickly restored.

US politics

US politics

fromFuturism

1 month agoThere's Something So Embarrassing About Homeland Security's New Drone Video That We're Gonna Have to Sit Down for a Minute

A DHS promotional video touting American air superiority shows agents using a DJI controller, indicating use of Chinese-made drones despite US restrictions.

fromThe Verge

1 month agoDid America just lose the AI race to China?

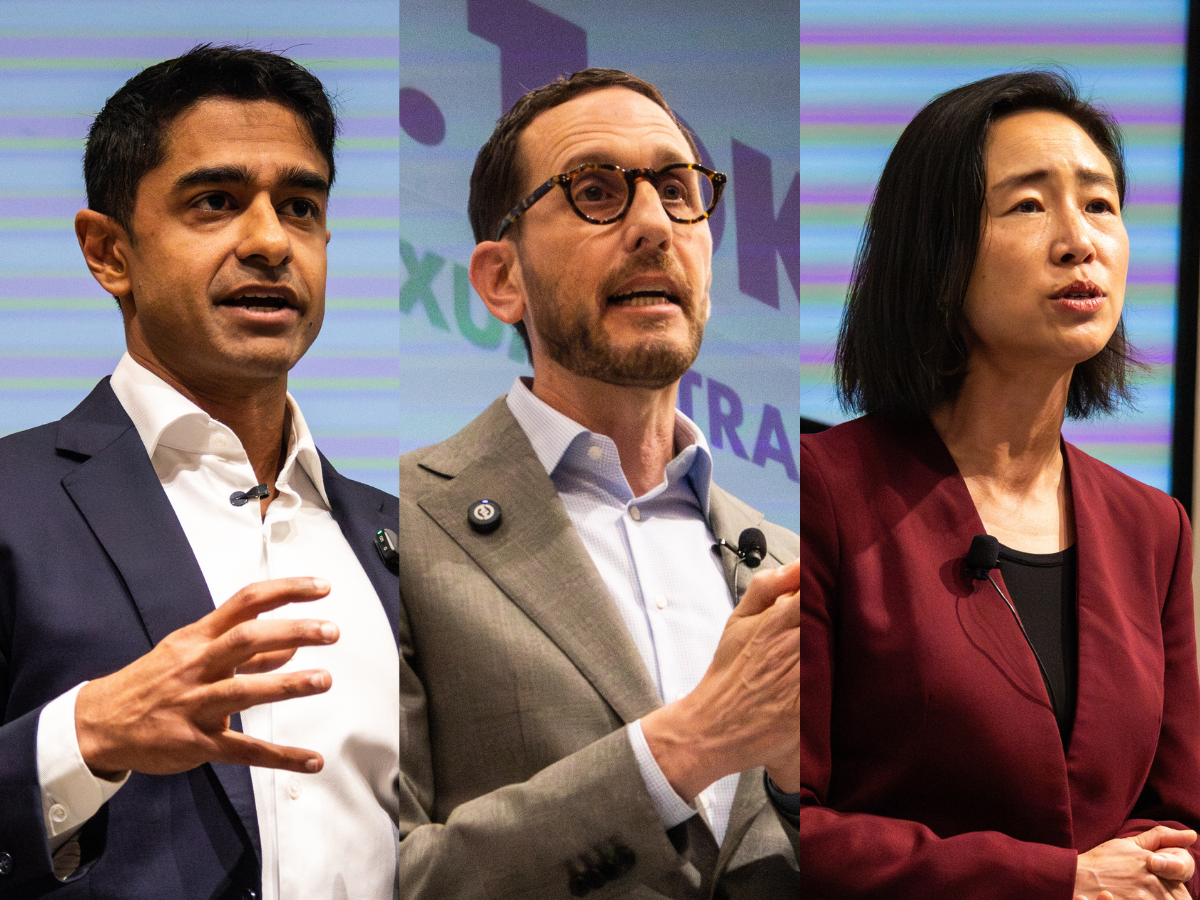

In 2022, Jake Sullivan, then national security adviser under President Joe Biden and a powerful figure in the White House's foreign policy team, assembled an interagency planning exercise out of the Situation Room: What were all the possible circumstances and outcomes of an AI arms race between the US and China - from trade wars to real wars, possibly even the arrival of AGI - and how would the federal government respond?

US politics

fromSocial Media Today

1 month agoChinese Officials Weigh US TikTok Proposal

TikTok was technically banned in the U.S. as of January 19th, 2025, as part of the Senate-approved " Protecting Americans from Foreign Adversary Controlled Applications Act." But upon his inauguration as President on January 20th, President Trump issued an Executive Order to withhold enforcement of the bill, in order to give his team an opportunity to potentially re-negotiate the details.

US politics

World news

fromFortune

1 month agoAnduril founder Palmer Luckey is among the U.S. defense execs and companies sanctioned by China over arms sales to Taiwan | Fortune

Beijing sanctioned 20 U.S. defense companies and 10 executives, froze their China assets, and barred dealings in retaliation for U.S. arms sales to Taiwan.

fromFortune

2 months agoChina makes history with $1 trillion trade surplus for first time ever | Fortune

China's exports rebounded in November after an unexpected contraction the previous month, pushing its trade surplus past $1 trillion for the first time, according to data released Monday. Exports climbed 5.9% from a year earlier in November while imports rose just under 2%. The customs data released on Monday also showed that shipments to the U.S. dropped nearly 29% year-on-year. But as trade with the U.S. weakens, China is diversifying its export markets throughout Southeast Asia, Africa, Europe and Latin America.

World news

fromenglish.elpais.com

2 months agoTikTok's first data center in Latin America will be in Brazil and will run entirely on wind power

TikTok, one of the world's most popular social media platforms, announced Wednesday that it will build its first data center in Latin America in Brazil, near the city of Fortaleza. The project represents a $38 billion investment. The Chinese company's supercomputers, which have revolutionized the internet with their short videos that are followed by hundreds of millions of users, will be operational in 2027 and will be powered exclusively by 100% renewable energy, according to a TikTok statement.

World news

fromInside Higher Ed | Higher Education News, Events and Jobs

3 months agoTrump Defends Enrolling International Students

You don't want to cut half of the people, half of the students from all over the world that are coming into our country-destroy our entire university and college system-I don't want to do that,

US politics

US politics

fromwww.mediaite.com

3 months agoTrump Defends Plan to Bring in Hundreds of Thousands of Chinese Students: I Know What MAGA Wants Better Than Anybody Else'

Trump defended admitting large numbers of Chinese students, arguing international enrollment is necessary to sustain many U.S. colleges and universities.

fromBusiness Matters

3 months agoUS and China agree final TikTok sale deal as part of wider trade framework

Speaking on CBS's Face the Nation, Bessent said the transaction would be formally endorsed by President Donald Trump and China's President Xi Jinping during a bilateral meeting in Korea later this week. "We reached a final deal on TikTok," Bessent said. "We reached it in Madrid, and I believe all the details are ironed out. It will be for the two leaders to consummate that transaction."

US politics

fromLondon Business News | Londonlovesbusiness.com

3 months agoNikkei 225 Index surpasses 50,000 - London Business News | Londonlovesbusiness.com

In my view, the easing of tensions between the United States and China has been the primary catalyst behind this surge, since markets have long considered the trade relationship between the world's two largest economies a direct threat to global trade flows and supply chains, especially when tariff rhetoric dominated the scene. The recent agreement between U.S. and Chinese negotiators on key issues gives markets a long-awaited breather and paves the way for a meeting between Trump and Xi that could cement these understandings.

World news

[ Load more ]