#one-big-beautiful-bill-act

#one-big-beautiful-bill-act

[ follow ]

#trump #legislation #social-security #medicaid-cuts #government-shutdown #tax-reform #student-loans #tax-policy

fromwww.mercurynews.com

1 month agoNicki Minaj holds hands with Trump, calls herself his No. 1 fan'

Minaj also said she plans to pledge between $150,000 and $300,000 to support the new Trump Accounts. Created under Trump's One Big Beautiful Bill Act, the program provides savings accounts of $1,000 for every child born between 2025 and 2028. That money is then invested in the stock market by private firms, and made accessible to the child when they turn 18.

US politics

fromwww.npr.org

1 month agoHow ICE grew to be the highest-funded U.S. law enforcement agency

Just 10 years ago, the annual budget for Immigration and Customs Enforcement, or ICE, was less than $6 billion notably smaller than other agencies within the Department of Homeland Security. But ICE's budget has skyrocketed during President Trump's second term, becoming the highest-funded U.S. law enforcement agency, with $85 billion now at its disposal. The windfall is thanks to the One Big Beautiful Bill Act, enacted last July. After hovering around the $10 billion mark for years, ICE's budget suddenly benefited from a meteoric spike.

US politics

fromBusiness Insider

4 months agoICE agents are getting a 'super check' today. Here's who is and isn't getting paid as the shutdown drags on.

Select federal law enforcement officers will see a "super check" in the bank by Wednesday, while most of their colleagues in government are approaching their fourth week without pay during the government shutdown.

US politics

fromBoston.com

4 months agoWhat to know about November 2025 SNAP payments

Supplemental Nutrition Assistance Program (SNAP) payments will still go out in November, but the ongoing government shutdown and the recently enacted One Big Beautiful Bill Act are bringing a few significant changes to how recipients can access benefits beginning next month.

US news

from24/7 Wall St.

5 months agoSuze Orman Shares The Truth on Social Security After New Tax Law

Before the passage of the One Big Beautiful Bill Act, retirees started to get hit with tax on part of their Social Security benefits after their provisional income hit a specific threshold. That threshold is $25,000 for single tax filers and $32,000 for married joint tax filers. The income that's counted in provisional income for determining if you meet the threshold includes a limited amount of non-taxable income (like MUNI bond interest), all your taxable income, and half your Social Security.

Retirement

fromSlate Magazine

6 months agoThis Issue Could Be Democrats' Secret Weapon, if They Can Figure Out How to Use It

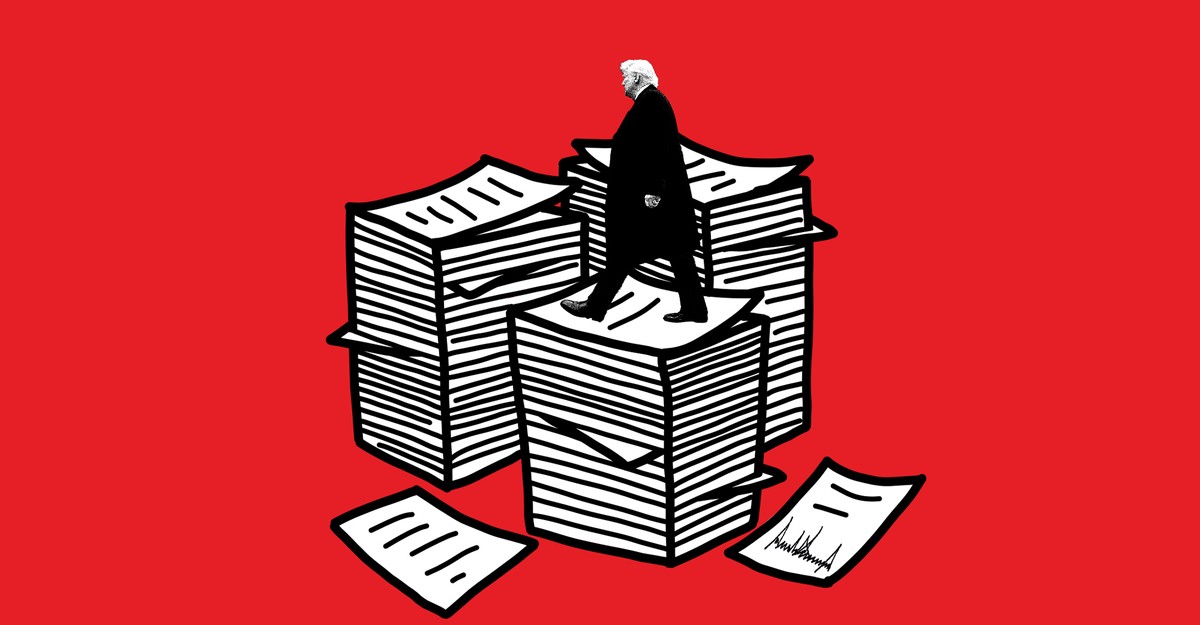

As Democrats gear up for next year's midterm elections, they have one big gun they're ready to wield: Opposition to Donald Trump's One Big Beautiful Bill Act. The bill is a massive giveaway to the wealthy, paid for by big cuts to services used by the American working and middle classes, that seems set to plunge the country into economic peril. The OBBBA is indefensible, and it's a gift to Democrats-assuming they're able to point their weapon in the right direction.

US politics

fromDocumented

7 months agoHow Trump's One Big Beautiful Bill Will Cut Health Care in New York - Documented

The One Big Beautiful Bill Act (OBBB), passed on July 4, 2025, enacts significant cuts to Medicaid and imposes restrictions on the Essential Plan, endangering coverage for 1.5 million New Yorkers.

Healthcare

[ Load more ]