from24/7 Wall St.

2 weeks agoThe XSD Semiconductor ETF Pops 12%, But Has an Intel Problem

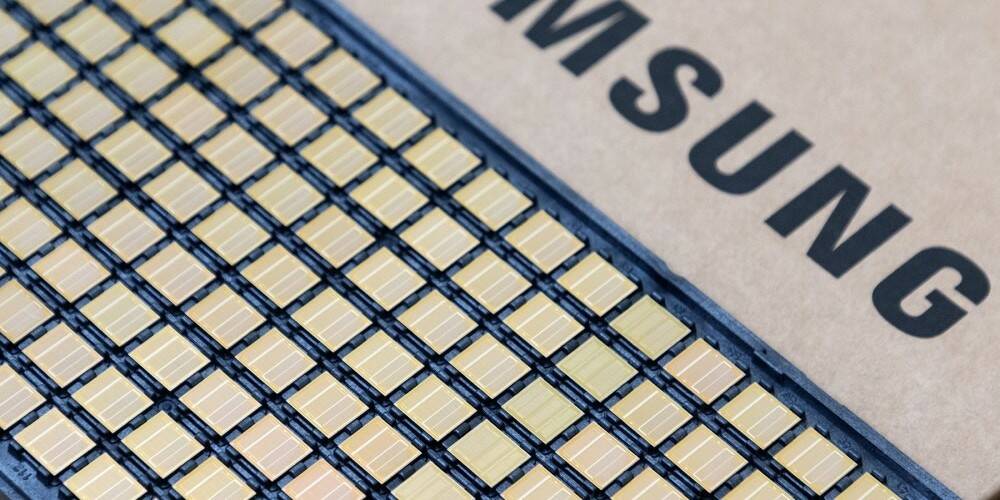

SPDR S&P Semiconductor ETF (NYSEARCA:XSD) offers equal-weight exposure to the semiconductor sector, a structure that amplifies both opportunity and risk. The fund has gained 43.15% over the past year as AI infrastructure spending supercharged demand for chips across the supply chain. The equal-weight structure - which gives smaller names the same influence as giants - has both amplified those gains and introduced drag from legacy players like Intel that have not kept pace with the AI cycle.

Tech industry