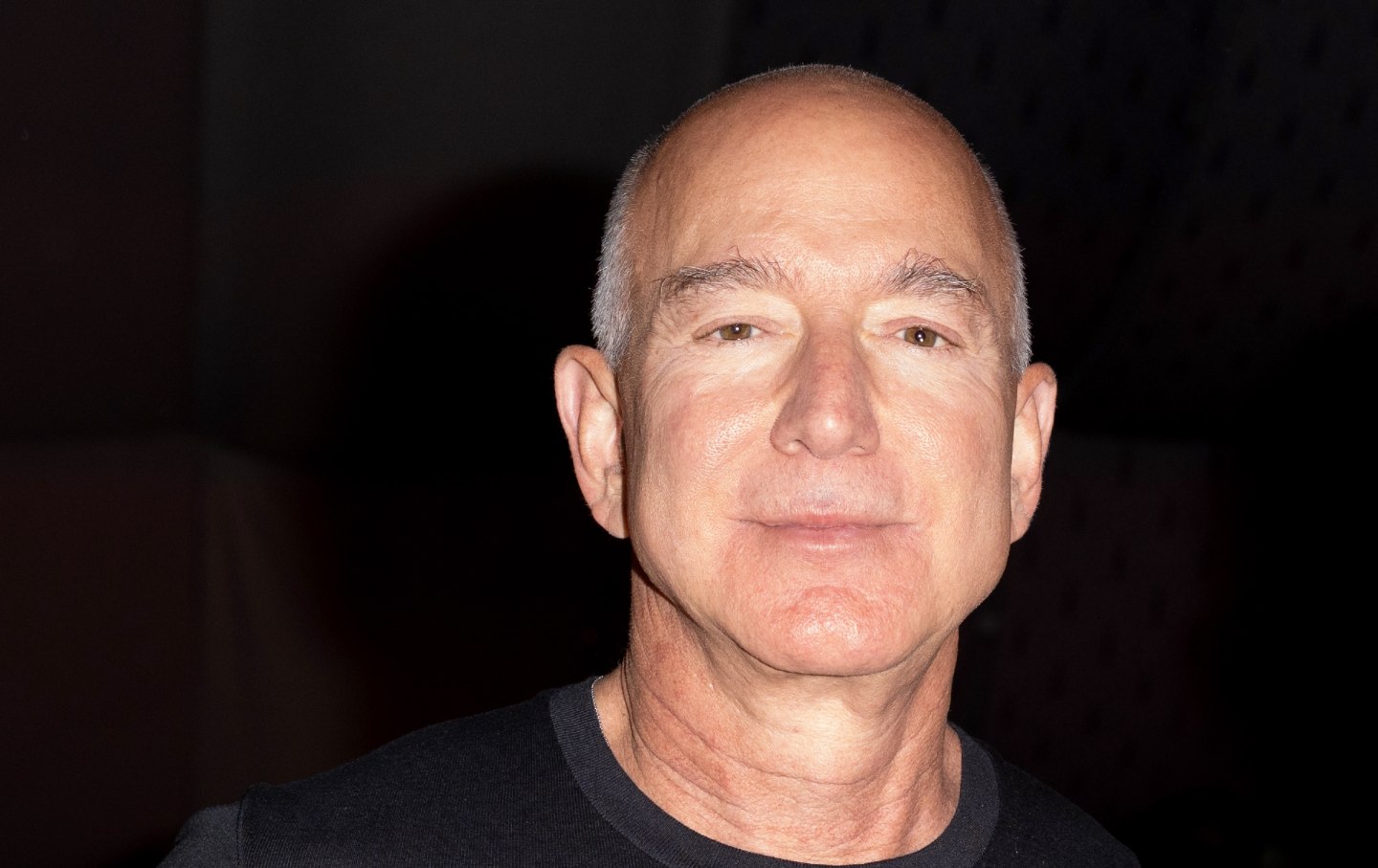

"Just how much has Bezos gained from this double standard? We looked into the $37 billion worth of Amazon stock he's sold since 2018. If we taxed income from wealth at the same rate as income from work, the world's second-richest man would've owed Uncle Sam $6.2 billion more on his capital gains from those sales alone."

"The House bill preserves this perversity, meaning that millions of middle-class Americans will continue to pay a higher tax rate than many billionaires."

The House recently passed a bill favoring tax cuts for corporations and billionaires, notably maintaining the corporate tax rate at 21%, benefitting Amazon significantly. Reports indicate Amazon CEO Andrew Jassy has received significant tax benefits, while Jeff Bezos, largely benefiting from capital gains taxed lower than ordinary income, could owe billions more under a fair taxation system. The bill perpetuates these inequalities, causing middle-class Americans to pay higher rates than many billionaires. Additionally, Amazon has not made substantial workforce investments despite receiving these tax advantages.

Read at The Nation

Unable to calculate read time

Collection

[

|

...

]