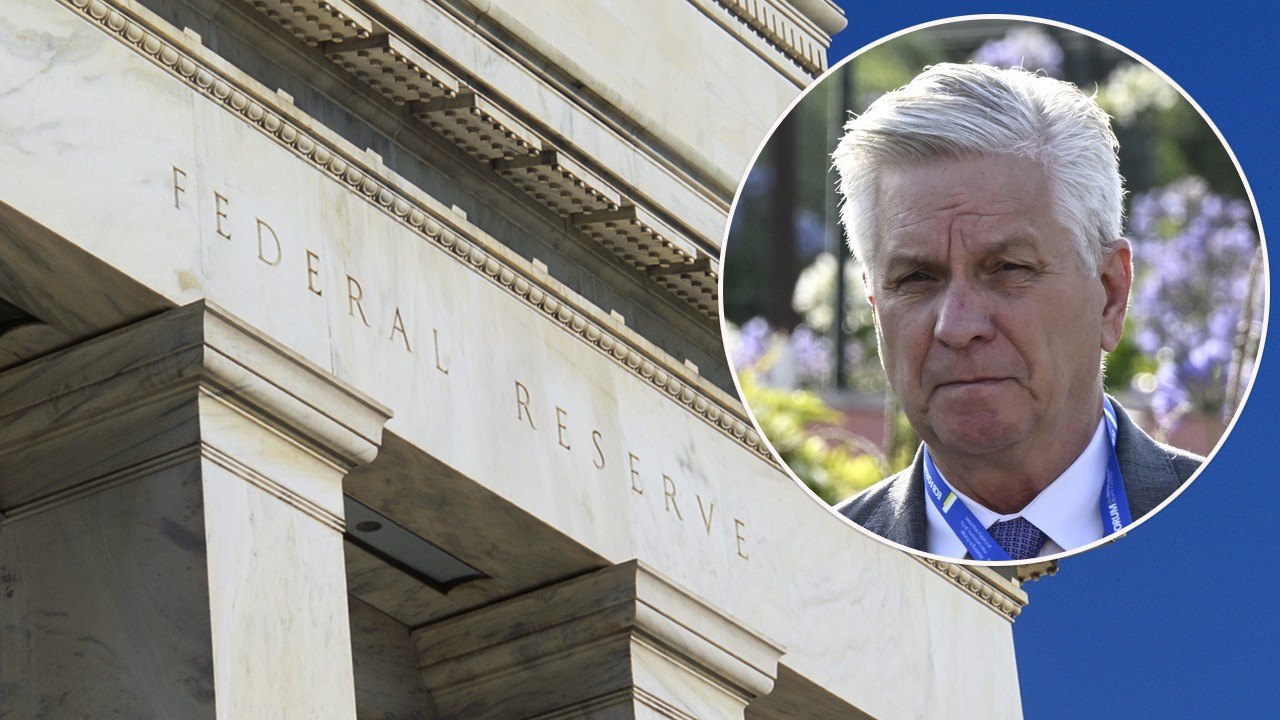

"Federal Reserve Governor Christopher Waller spoke out on the necessity of an interest rate cut due to weakening labor market conditions. Waller advocates for rate cuts to counteract the declining job market and boost economic activity. He spoke of the impact of rate cuts on various sectors, including mortgage rates and homebuyers. Additionally, his opinion addresses the dissent within the Fed regarding the need for rate adjustments and the considerations surrounding inflation and job creation in the decision-making process."

"Federal Reserve Governor Christopher Waller supports cutting interest rates at the upcoming meeting on Sept. 17 to address the deteriorating labor market, emphasizing the need for prompt action. Long-term bond yields dropped following Waller's remarks, indicating market anticipation of rate cuts, which could lead to lower mortgage rates and increased affordability for homebuyers."

Christopher Waller argued for an interest rate cut in response to weakening labor market conditions and slowing job creation. He advocated cutting rates to counteract a declining jobs market and to boost economic activity. He noted rate cuts would affect sectors like mortgage lending, potentially lowering mortgage rates and improving affordability for homebuyers. He addressed Fed internal dissent over timing and size of rate adjustments and emphasized weighing inflation risks against rising layoffs. Markets reacted with a drop in long-term bond yields, reflecting increased anticipation of Federal Reserve rate cuts at the September meeting.

Read at SFGATE

Unable to calculate read time

Collection

[

|

...

]