Silicon Valley

fromABC7 San Francisco

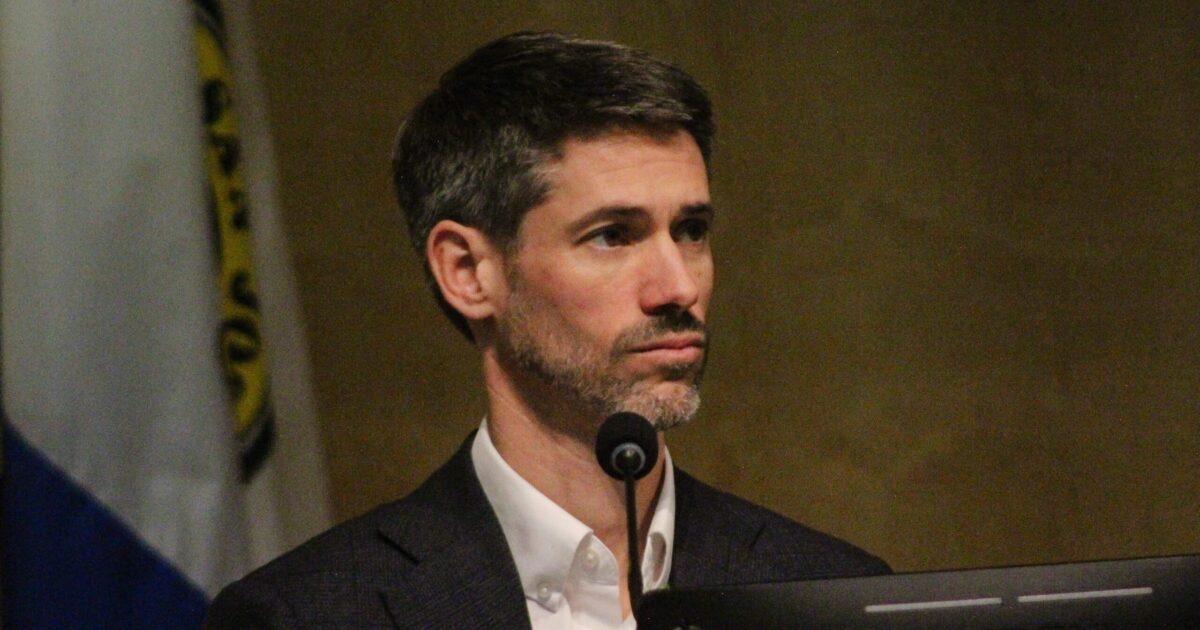

1 day agoSilicon Valley entrepreneur Ethan Agarwal launches challenge to Rep. Ro Khanna

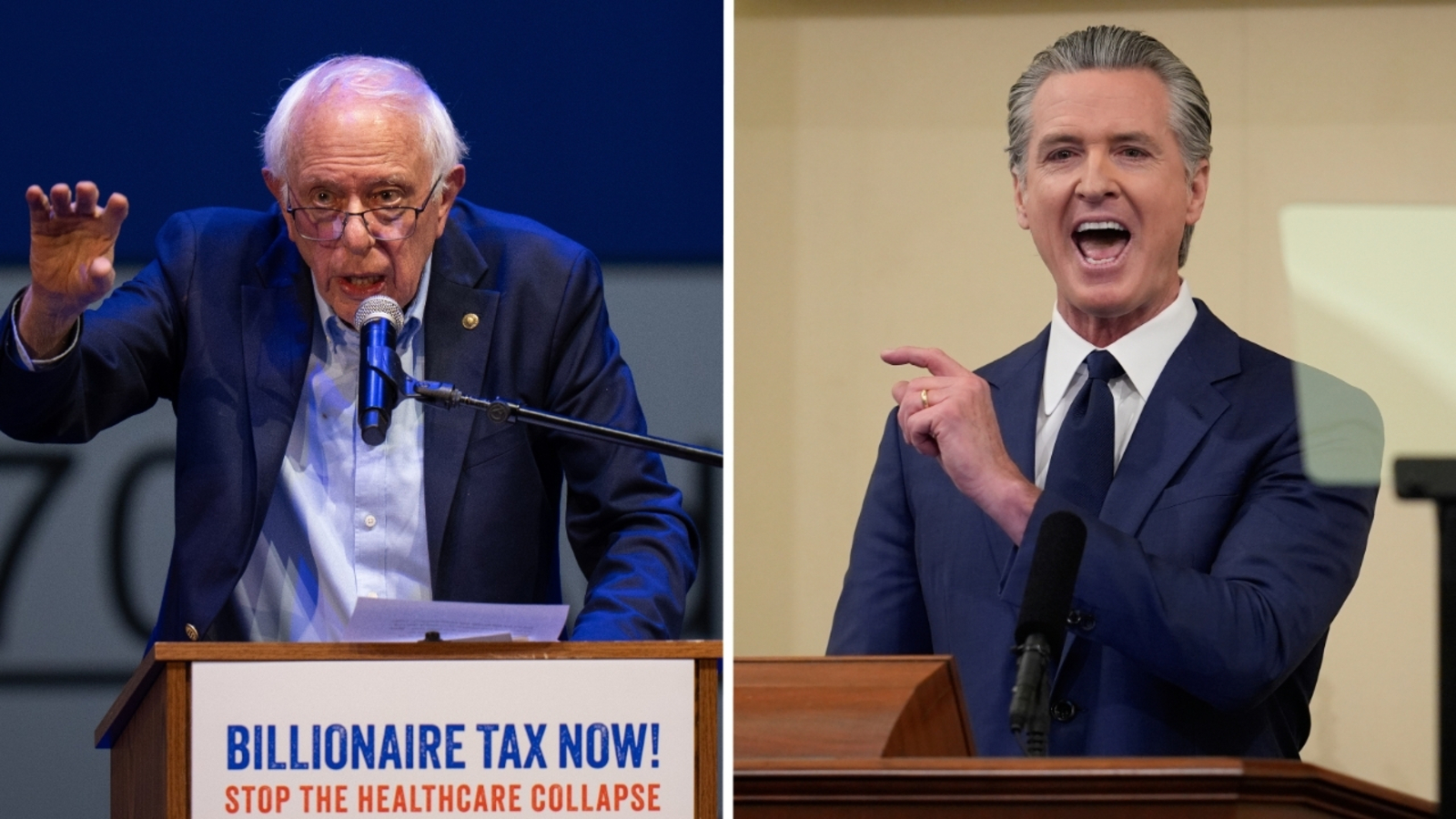

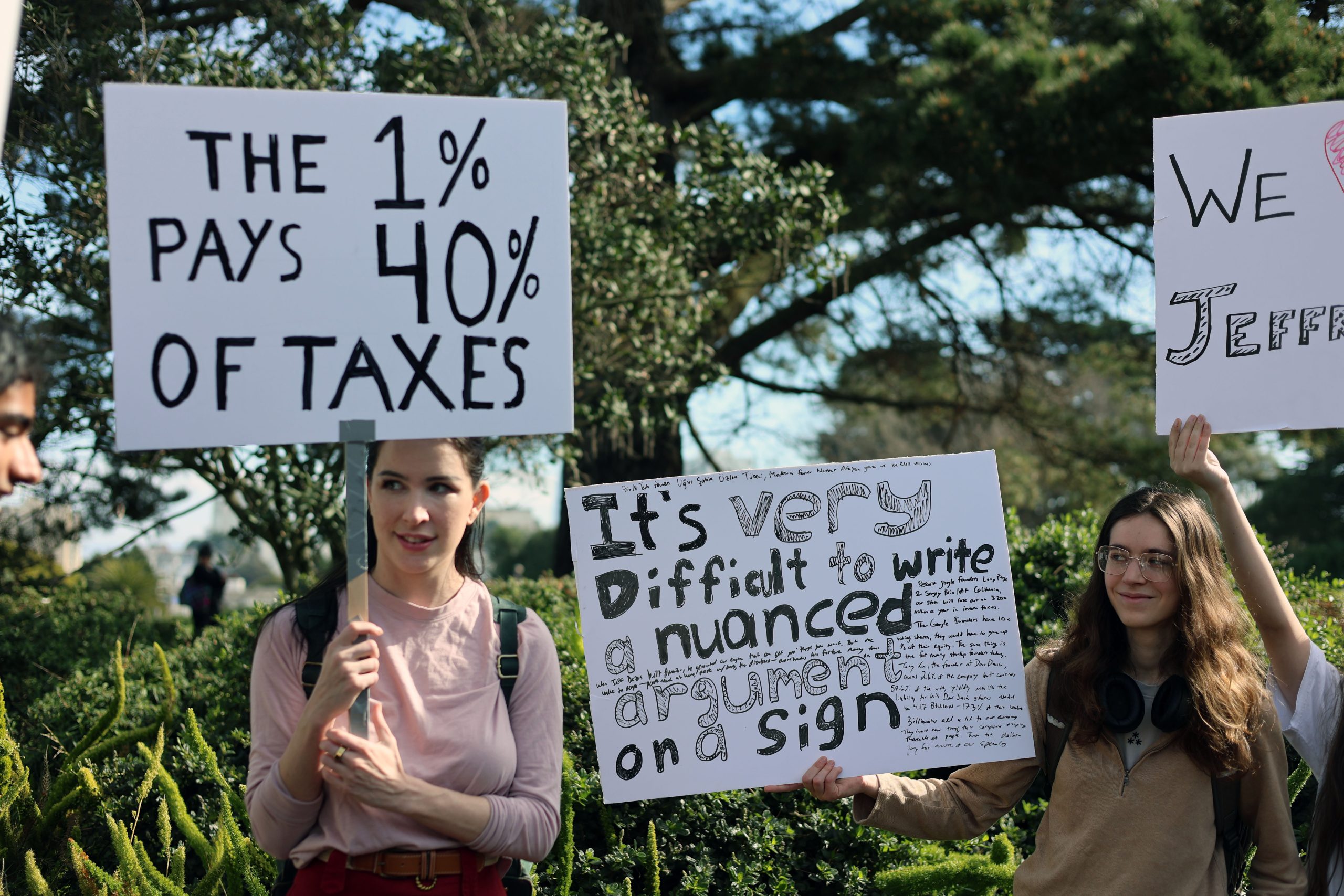

Tech entrepreneur Ethan Agarwal challenges Rep. Ro Khanna in a Democratic primary, criticizing his focus on national politics, wealth tax proposals, and high stock trading volume.