#pfizer

#pfizer

[ follow ]

#drug-pricing #trumprx #stock-market #dividend-stocks #pharmaceuticals #dividend-yield #medicaid #covid-19

fromFortune

1 month ago'We'll save the world from cancer': Inside Pfizer CEO's $23 billion postCOVID bet on oncology | Fortune

After leading Pfizer through the frantic race to develop the first FDA-approved COVID-19 vaccine, CEO Albert Bourla has set his sights on a new, arguably more difficult moonshot. "We saved the world from Covid, now we'll save the world from cancer," Bourla told Fortune Editor-in-Chief Alyson Shontell, outlining the company's massive pivot toward oncology following the pandemic. This ambition is backed by a historic reallocation of capital.

Medicine

from24/7 Wall St.

4 months agoPfizer's Q3 Earnings Beat on Top and Bottom Lines

Pfizer beat earnings expectations decisively this morning, posting adjusted EPS of $0.87 against a $0.64 consensus and revenue of $16.65 billion versus $16.50 billion expected. The stock gapped up roughly 12.6% in pre-market trading, reflecting strong investor validation of both the beat and the company's reaffirmed full-year guidance paired with a raised EPS outlook. Management reaffirmed full-year 2025 revenue guidance of $61.0 to $64.0 billion but raised EPS guidance to $3.00 to $3.15 from prior guidance.

Business

from24/7 Wall St.

4 months ago3 Stocks Under $30: Where to Put $1,000 to Work Today

The democratization of investing started with discount brokers slashing commissions and advanced through no-transaction-fee trading on apps like Robinhood ( NASDAQ:HOOD ) and Fidelity. Now, it no longer takes a lot of money to make money on Wall Street, as investors can buy fractional shares with as little as $5 or $10. That opens doors for everyday people to build portfolios without needing thousands upfront. But that doesn't mean buying cheap stocks is always a good idea, since a low price could signal company problems - and certainly steer clear of penny stocks, which carry high risks of fraud and volatility. Sometimes, though, a low share price signals real opportunity.

Business

fromMedCity News

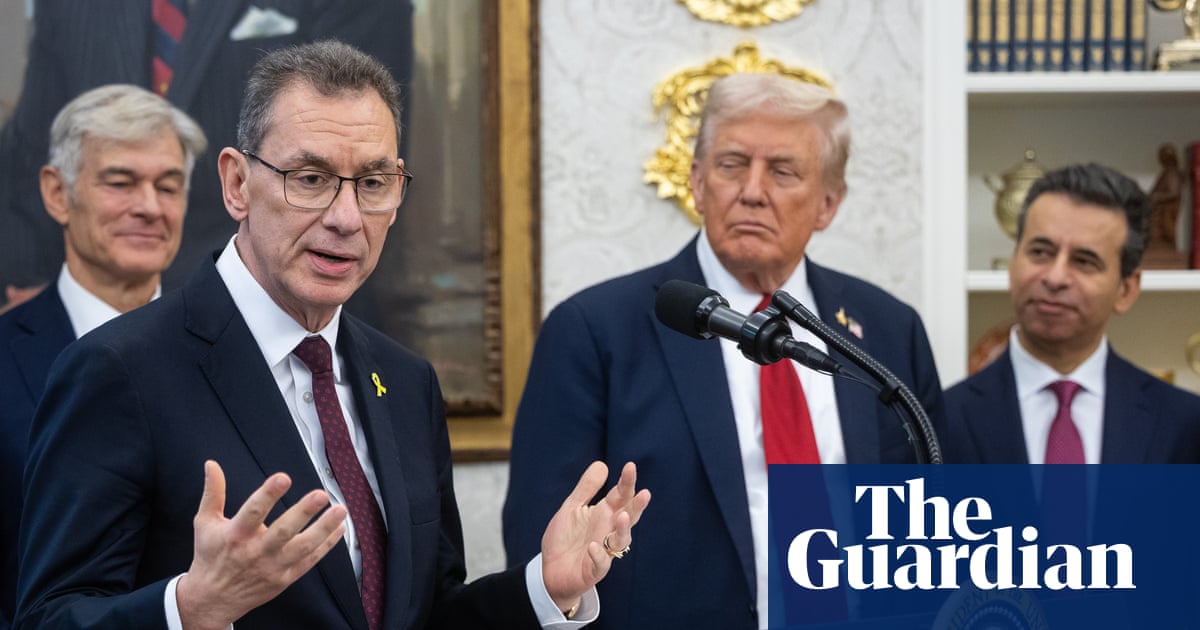

5 months agoPfizer Reaches Deal on Most-Favored Nation Drug Pricing; Other Pharmas Expected to Follow - MedCity News

Pfizer is the first big pharmaceutical company to reach an agreement with the Trump administration over most-favored nation drug pricing, a deal that lowers U.S. prices of certain medications and makes them available directly to patients through new online channels. The agreement announced Tuesday also gives Pfizer a grace period before facing potential tariffs on its drugs. With most-favored nation pricing, the prices of a drug in the U.S. will be matched to the lowest price of the same drug in a comparable developed nation.

Medicine

from24/7 Wall St.

8 months agoU.S. Awards Lockheed Martin a Record $68.5B, Larger Than the Next Two Contractors Combined

HII Mission Technologies earns approximately $4.5 billion annually, accounting for 1% of all DoD contract spending by developing unmanned underwater vehicles and drones for naval missions.

US politics

[ Load more ]