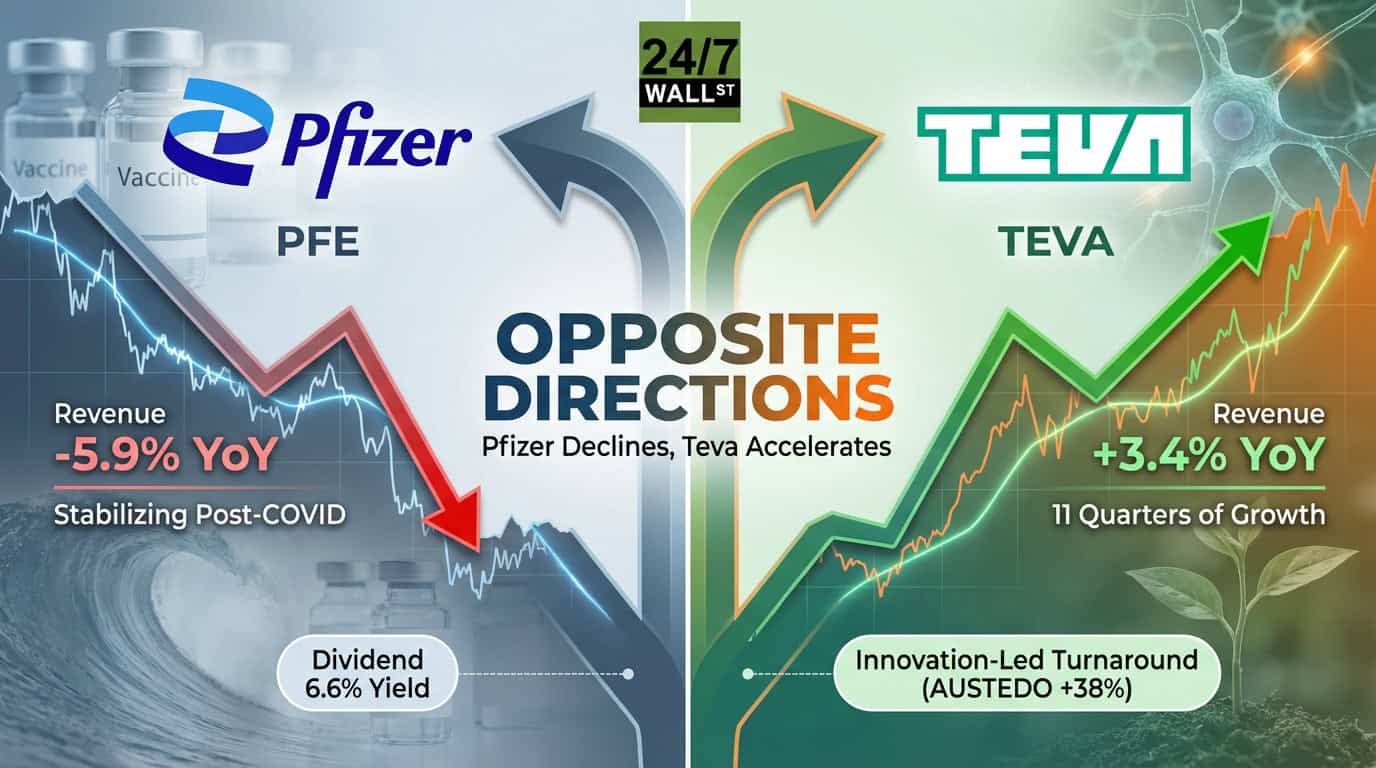

"Pfizer posted Q3 revenue of $16.65 billion, down 5.9% year-over-year, as COVID product sales continued declining. Paxlovid dropped 55% operationally and Comirnaty fell 20%. The company beat estimates on revenue and adjusted EPS of $0.87, but the business is still contracting. Non-COVID products grew just 4% operationally, with Eliquis up 22% and Vyndaqel up 7% providing the main lift."

"Teva delivered $4.48 billion in revenue, up 3.4% year-over-year, and crushed estimates with adjusted EPS of $0.78 versus consensus of $0.67. AUSTEDO, Teva's tardive dyskinesia treatment, surged 38% to $618 million. AJOVY climbed 19% to $168 million and UZEDY rose 24% to $43 million. The U.S. segment jumped 12% while Europe declined 2%. CEO Richard Francis pointed to momentum behind the "Pivot to Growth" strategy, shifting Teva from a generics house into a neuroscience and immunology specialist."

"Pfizer operates at a 35.3% operating margin with massive scale across cardiovascular, oncology, and vaccines. The company generates $4.60 billion in quarterly operating cash flow and pays a 6.6% dividend yield. But it carries $61.71 billion in debt and faces the challenge of replacing $56 billion in annual COVID revenue with organic growth."

Pfizer reported Q3 revenue of $16.65 billion, down 5.9% year-over-year as Paxlovid and Comirnaty sales fell sharply. Adjusted EPS beat at $0.87, while non-COVID products grew only 4% operationally, led by Eliquis and Vyndaqel. Pfizer maintains a 35.3% operating margin, generates $4.60 billion in quarterly operating cash flow, and yields 6.6%, but carries $61.71 billion in debt and must replace roughly $56 billion in COVID-era revenue. Teva reported $4.48 billion in revenue, up 3.4%, with robust product growth and a strategic shift toward neuroscience and immunology under its "Pivot to Growth."

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]