#municipal-bonds

#municipal-bonds

[ follow ]

#tax-exempt-income #etf #retirement-planning #retirement-income #etfs #passive-income #investment-grade

Retirement

from24/7 Wall St.

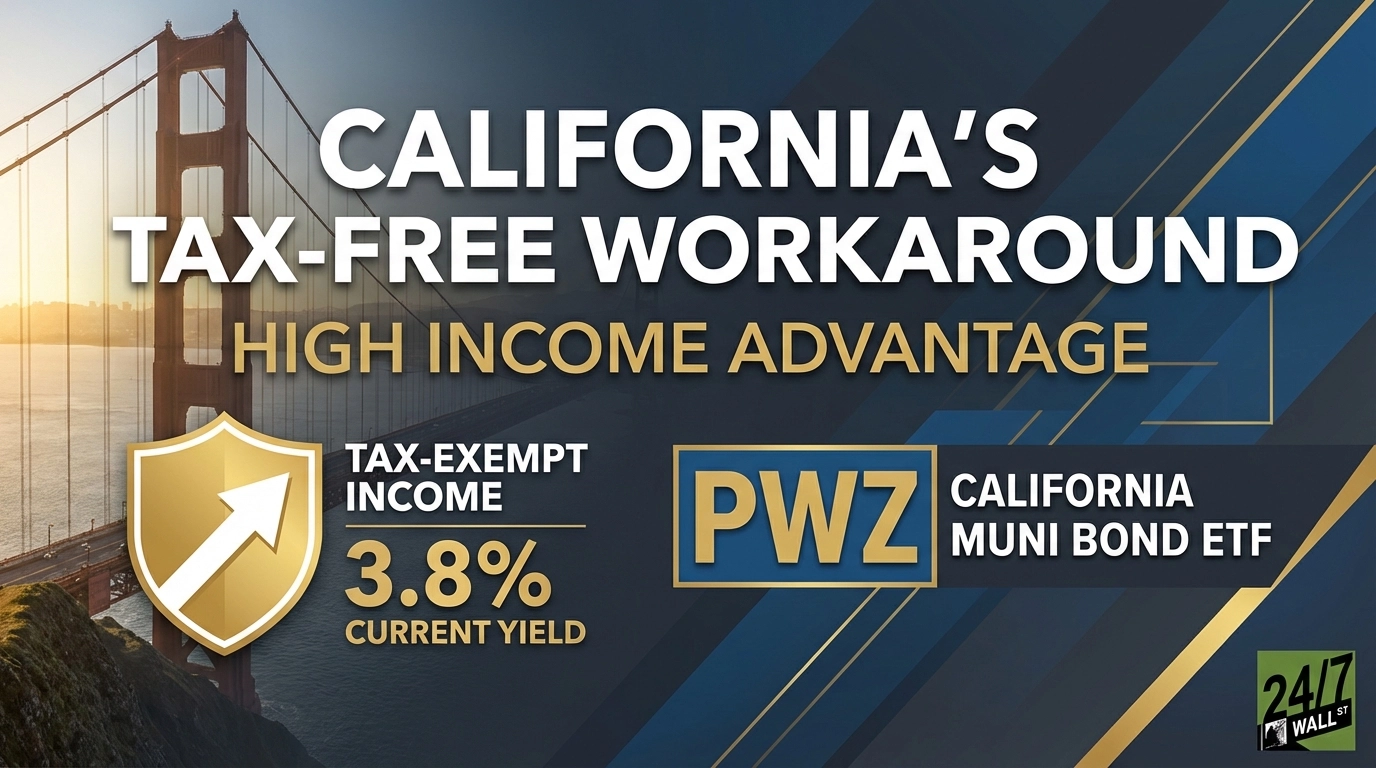

1 month agoWealthy Retirees Have A Special Loophole With A High Yield Municipal Bond ETF

Federally tax-exempt municipal bond income from JMUB provides tax-efficient monthly income, delivering higher after-tax purchasing power and diversified, investment-grade municipal exposure with moderate duration.

fromFortune

4 months agoWhy longer municipal strategies make sense now | Fortune

Municipal bonds have made their opening move. After months of being labeled "cheap," the tax-exempt market responded with a rally across the full curve. Yields dropped, ratios tightened, and early investors saw results. But if you missed the first wave, don't worry. There's still opportunity ahead, especially for those focused on what's next. Munis may not grab headlines, but their quiet consistency and tax advantages could make them a smart choice for investors seeking stability and income, especially in today's market.

Business

[ Load more ]