"High-income California residents face a combined federal and state tax rate exceeding 50%, which fundamentally changes bond investment economics. The tax exemption on municipal bonds creates a powerful arbitrage opportunity - what appears as a modest yield becomes substantially more valuable on an after-tax basis. This tax advantage explains why institutional investors like Osaic Holdings dramatically increased their PWZ stake by 382.7% during 2025, recognizing the value proposition for California taxpayers in Invesco California AMT-Free Municipal Bond ETF (NYSEARCA:PWZ)."

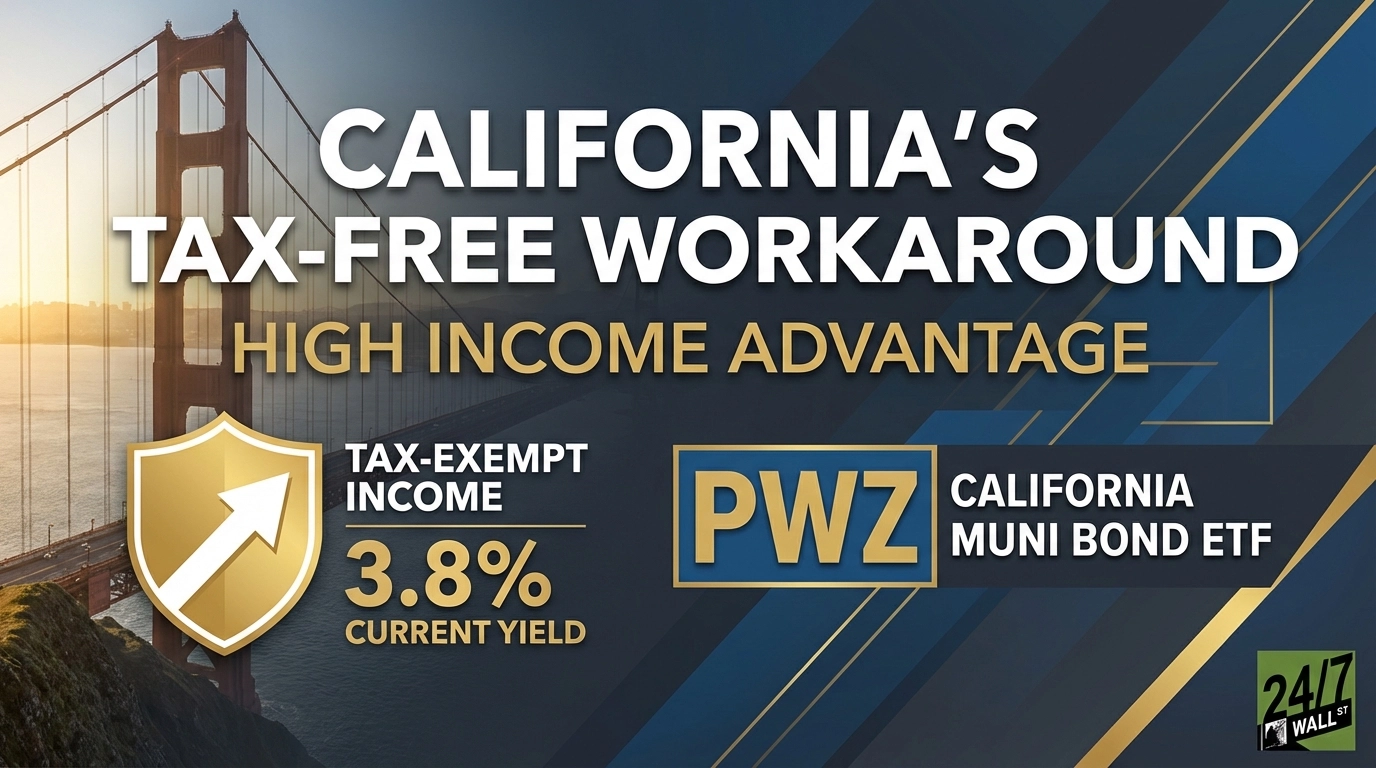

"PWZ invests in California municipal bonds exempt from both federal and California state income tax, while avoiding bonds subject to the Alternative Minimum Tax. The fund provides broad exposure to the state's municipal debt market through a diversified portfolio of over 1,000 individual bonds issued by California municipalities, school districts, and public agencies. With a net expense ratio of 0.28%, PWZ delivers monthly tax-exempt income at a current yield around 3.8%."

"The return engine centers on tax-advantaged income from California municipal bonds exempt from both federal and state income tax. For California residents in the top tax bracket, this tax exemption effectively doubles the real return compared to taxable bonds. The fund has maintained reliable monthly distributions for over 12 years, providing consistent tax-free income that compounds the advantage for high-income investors."

High-income California residents face combined federal and state tax rates exceeding 50%, which alters bond investment economics and makes tax-exempt municipal income especially valuable. PWZ holds over 1,000 California municipal bonds exempt from federal and California state income tax and avoids Alternative Minimum Tax exposure. The fund's diversified holdings provide monthly tax-free income, a current yield near 3.8%, and a net expense ratio of 0.28%. For top-bracket California taxpayers, the tax exemption substantially increases after-tax returns, effectively doubling real returns versus comparable taxable bonds. PWZ has delivered modest pre-tax returns but sustained reliable monthly distributions for more than 12 years.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]