#equity-financing

#equity-financing

[ follow ]

#bitcoin #bitcoin-treasury #corporate-treasury #market-volatility #microstrategy #convertible-debt #warrants

fromBoston.com

3 weeks agoAsk the remodeler: What to know about putting an addition on your home

We have clients who have looked at property in the city or town where they live, but simply can't afford what is coming onto the market. Instead, they are considering using the considerable equity they have built up with those soaring real estate valuations in recent years. Many of these people can invest money into their properties and still have equity left after a major remodel and addition.

Real estate

fromcointelegraph.com

4 months agoDATs become corporate crypto's standard while Stablecoins take over payments in 2025.

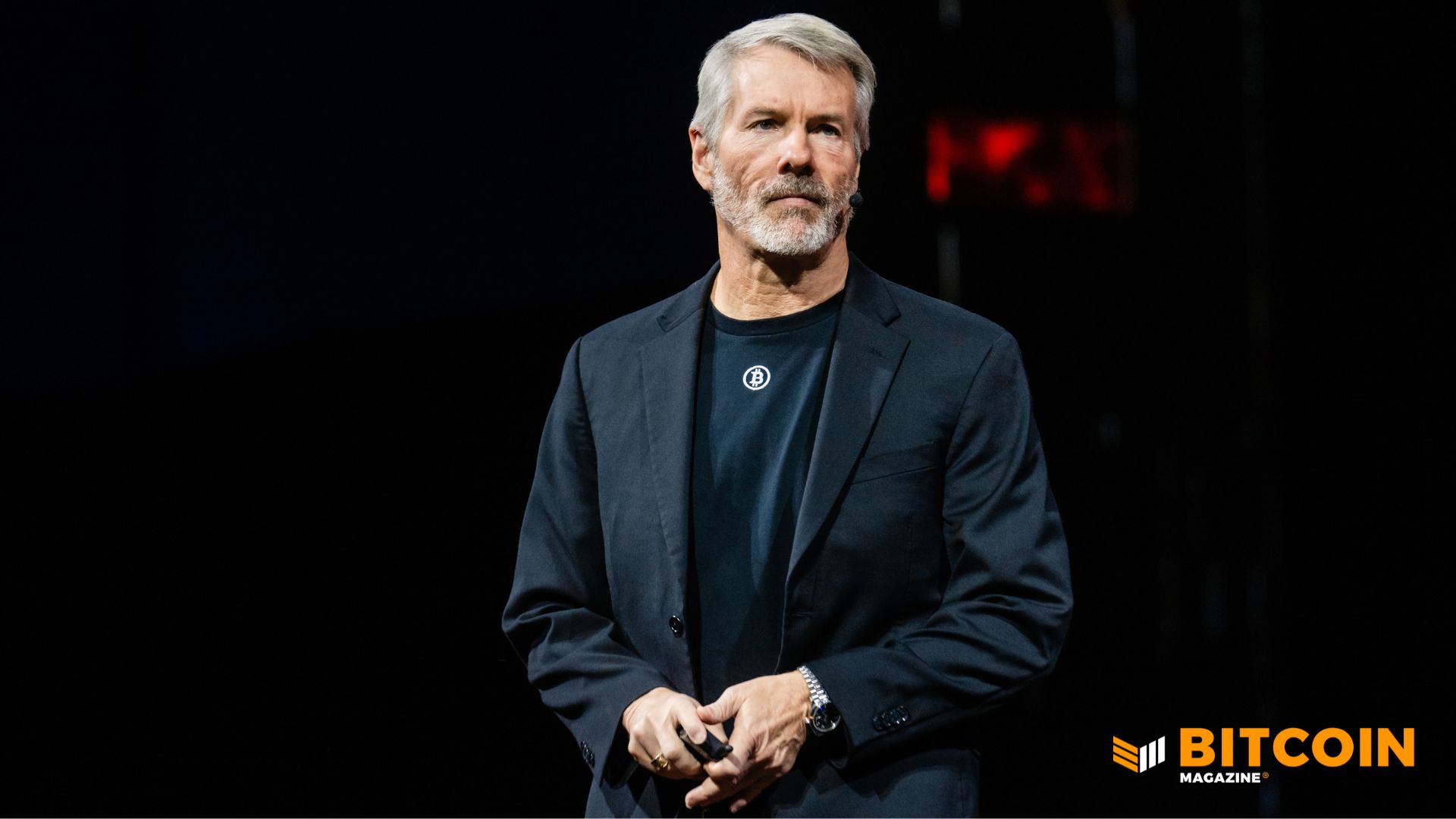

The Digital Asset Treasury (DAT) strategy has moved from an experiment to a consensus playbook for public companies seeking balance-sheet exposure. Digital Asset Treasuries are listed companies that accumulate tokens as treasury assets, using the stock market's financing power to steadily increase onchain holdings. In its half-year report, HTX research breaks down how the DAT strategy has become the industry standard, how perpetual aggregators ballooned, how stablecoins remain a dominant narrative, and more.

Business

[ Load more ]