#dividend-kings

#dividend-kings

[ follow ]

#passive-income #dividend-investing #investment-strategy #total-return #dividend-stocks #high-yield-stocks

from24/7 Wall St.

2 months ago5 Dividend Powerhouses That Could Transform Your Portfolio Into a Wealth-Building Machine

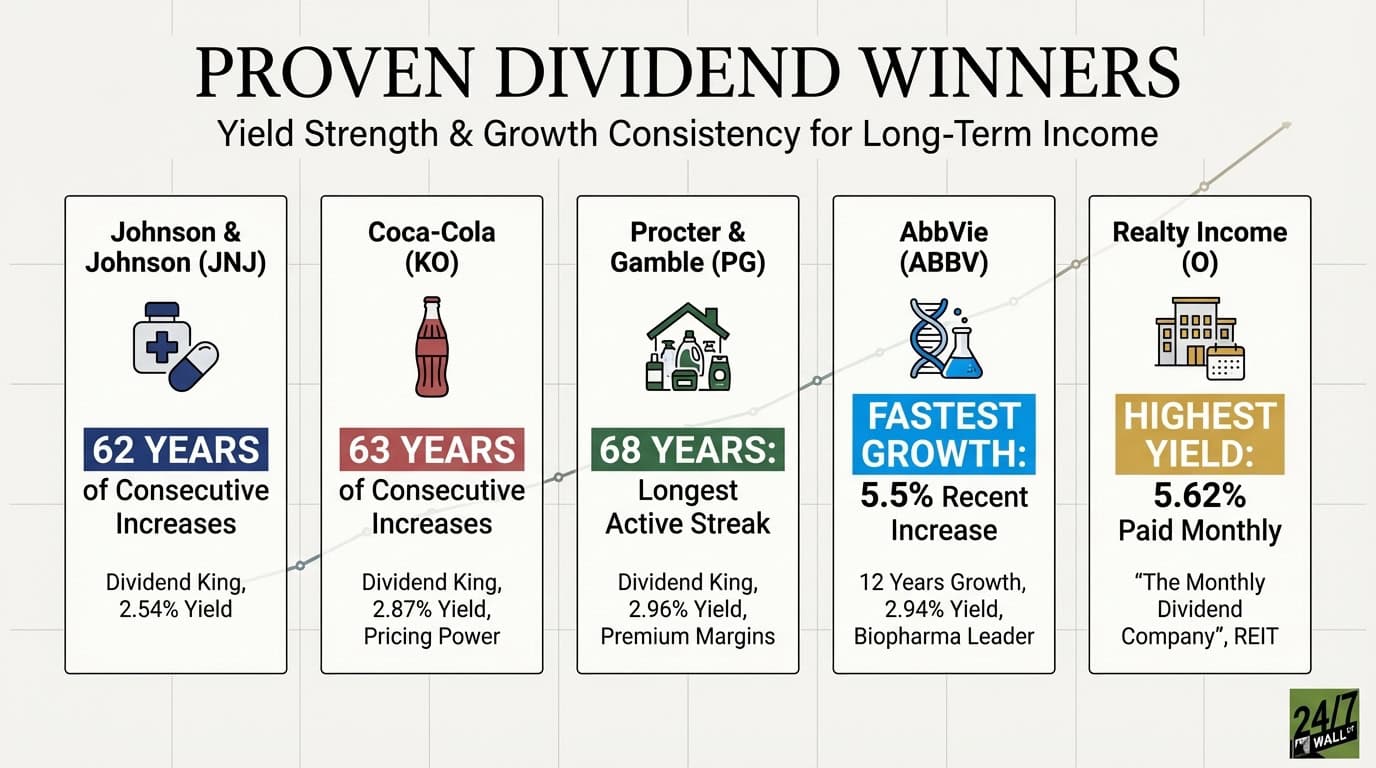

Building wealth through dividends requires more than chasing high yields. The path to "getting rich" combines meaningful current income with consistent dividend growth, backed by sustainable business fundamentals. These five stocks deliver that combination, each offering distinct advantages for compounding wealth over time. #5: Procter & Gamble (PG): The Steady Compounder Procter & Gamble earns its place as a 68-year Dividend King, having increased its payout annually since 1957. The consumer staples giant recently raised its quarterly dividend to $1.06, maintaining a 2.93% yield

Business

from24/7 Wall St.

4 months ago3 Dividend Aristocrats to Buy that Continued to Beat the Market

Most investors are well aware of the distinction between most dividend stocks and dividend aristocrats. The latter group is comprised of companies that have paid out a growing dividend for more than 25 years. Among this group, we have dividend kings, which have paid increasing dividends for more than five decades straight. I'm going to highlight three such companies in this piece.

Business

[ Load more ]