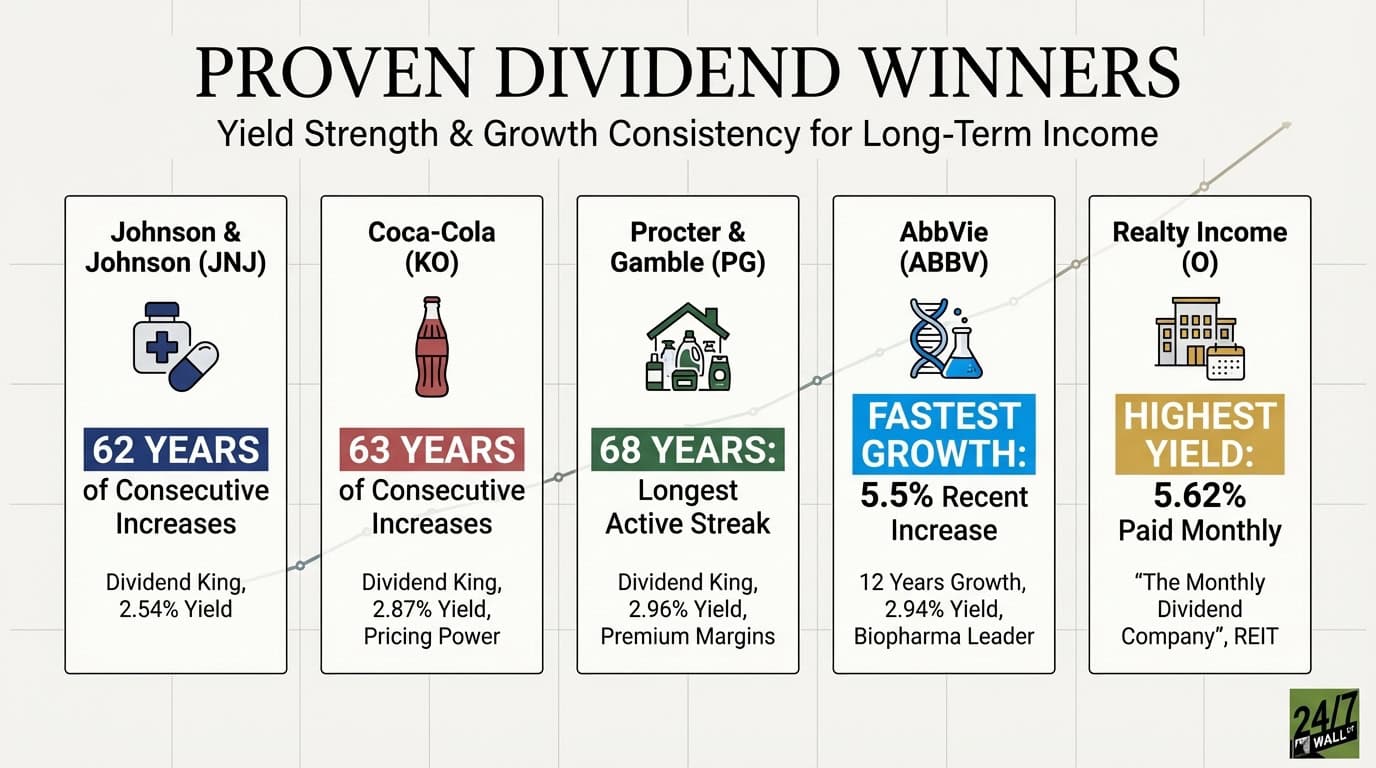

"Dividend investing rewards patience. The best dividend stocks don't just pay consistently-they raise payouts year after year, compounding income for shareholders who stay the course. Among thousands of publicly traded companies, only a select few have proven they can grow dividends through recessions, market crashes, and industry upheaval. We ranked these six proven dividend winners by combining yield strength, growth consistency, payout sustainability, and recent operational performance."

"Johnson & Johnson delivers a 2.54% yield backed by 62 consecutive years of dividend increases, earning its Dividend King status. The healthcare giant paid $5.08 per share in 2025, supported by a diversified portfolio spanning pharmaceuticals, medical devices, and consumer health products. Third quarter 2025 results showed strength: EPS of $2.80 beat expectations, while revenue climbed 6.8% year-over-year to $24.0 billion. Management raised full-year 2025 guidance, signaling confidence in continued growth."

"Coca-Cola's 2.87% yield comes from a company that has raised dividends for 63 straight years. The beverage giant paid $2.02 per share in 2025, backed by one of the world's most valuable brand portfolios and distribution networks reaching 200-plus countries. Third quarter 2025 demonstrated operational strength: EPS of $0.86 beat estimates, revenue rose 5% year-over-year to $12.5 billion, and operating margin held at 32%. That margin reflects pricin"

Dividend investing rewards long-term patience because top dividend stocks raise payouts year after year, compounding income for shareholders. Only a select group of public companies have sustained dividend growth through recessions, market crashes, and industry upheaval. Six proven dividend winners were evaluated by combining yield strength, growth consistency, payout sustainability, and recent operational performance. Johnson & Johnson yields 2.54% with 62 consecutive years of increases, paid $5.08 per share in 2025, reported Q3 EPS $2.80 and $24.0 billion revenue, and raised full-year guidance. Coca-Cola yields 2.87% with 63 years of increases, paid $2.02 per share in 2025, and reported Q3 EPS $0.86 and $12.5 billion revenue.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]