from24/7 Wall St.

19 hours agoBusiness

Domino's Pizza: This Berkshire-Backed Dividend Dynamo Is a Buy

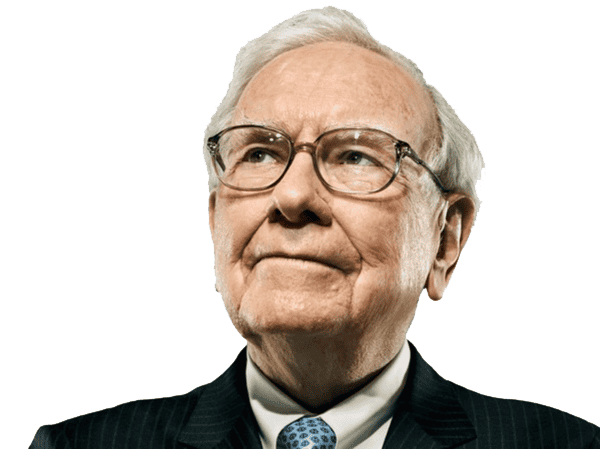

Berkshire Hathaway built a $1.4 billion stake in Domino's Pizza, viewing it as a deeply discounted value opportunity with durable competitive advantages despite post-pandemic demand normalization and stock underperformance.