#401k

#401k

[ follow ]

#retirement-planning #retirement-savings #retirement-plans #cryptocurrency #financial-advice #retirement

fromBusiness Insider

2 weeks agoA physician saddled with 7-figure debt explains how she started buying property with her 401(k) funds

By the time Dr. Jill Green finished medical school, she'd racked up seven figures in student debt and had virtually zero assets. "My net worth was negative $1 million," the family practice and emergency medicine doctor told Business Insider. "Our primary home was our only asset." Green, who began her career in investment banking before pivoting to medicine, began entertaining the idea of property investing after hearing a physician couple speak at a virtual entrepreneur event for doctors.

Real estate

fromFortune

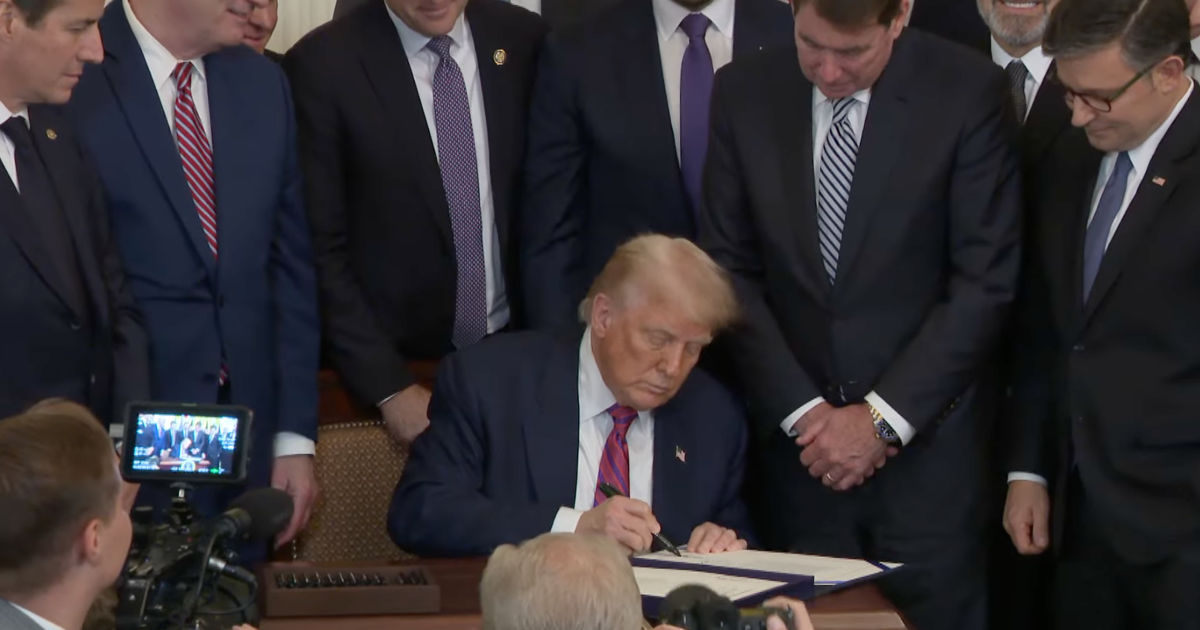

4 weeks agoTrump now says he's actually not 'a huge fan' of letting Americans tap their 401(k)s to use for a down payment | Fortune

Homebuying > retiring? Currently, 401(k) participants must pay an additional 10% tax on funds withdrawn from their account before the age of 59-and-a-half-also known as an early distribution-for any number of reasons, including buying a home. Rules are different under Individual Retirement Accounts (IRAs), which allow qualified first-time homebuyers to withdraw up to $10,000 without incurring the 10% penalty.

US politics

from24/7 Wall St.

1 month agoToday Is the Last Day to Take Your RMDs Without a Steep Penalty

Saving for retirement in a traditional IRA or 401(k) can make more sense than socking money away in a Roth account. That's because traditional retirement accounts give you a tax break on your contributions. If you're a higher earner in a higher tax bracket, that tax break may be very valuable to you. Plus, you might earn too much money to contribute to a Roth IRA directly, making a traditional IRA a better bet.

Retirement

from24/7 Wall St.

2 months agoIf You Already Max Out Your 401(k), These Are the 7 Next Money Moves You Should Make

This workplace account allows you to make pre-tax contributions to a retirement plan and, in many cases, your contributions also entitle you to receive matching funds from your employer. However, while most people know they should contribute to a 401(k), they aren't necessarily certain about what to do next. If you have a maxed-out account at work and you're trying to figure out what else to do with your money, here are some options to consider.

Retirement

from24/7 Wall St.

4 months agoMy Fidelity 401k Shows No Growth and Think It's Time To Move Out of SPAXX

A 401-K plan is a company-sponsored retirement account. Employees contribute their designated percentage of their income to be allocated. Employers often may offer to match at least a portion of these contributions. Contributions are made with pre-tax funds. There are two types of 401-K account categories: traditional and Roth-which differ primarily in how they're taxed. Assuming one is over age 59 ½, traditional 401-K withdrawals are taxed as income at the participant's income bracket at the time of withdrawal,

Retirement

fromwww.housingwire.com

5 months agoNew limits on retirement benefits for workers 50+

Higher-income workers who earn more than $145,000 must now put their catch-up contributions into a Roth 401(k), meaning that they'll pay taxes now rather than later in retirement. The rules generally apply to contributions beginning in 2027, but some plans can implement them earlier. The $145,000 income threshold is based on prior-year wages and applies separately at each employer. New hires and self-employed workers without W-2 wages are exempt.

Miscellaneous

Business

fromBusiness Insider

5 months agoPrivate markets are courting retail investors-but Blue Owl's CEO warns the road ahead may be rocky

Private markets firms invest heavily and slowly to attract wealthy retail and 401(k) investors, facing high costs, limited early traction, and reliance on financial advisors.

US politics

from24/7 Wall St.

5 months agoI'm terrified my dad will face a huge tax bill after he withdrew $200,000 from his 401k - What should I do?

Large 401(k) withdrawals are taxable and can increase tax liability, affect Social Security taxation and Medicare IRMAA; Roth 401(k) withdrawals avoid taxes.

#cryptocurrency

Cryptocurrency

fromBitcoin Magazine

9 months agoIn A New Statement, Coinbase CEO Brian Armstrong Says Bitcoin Is Headed Straight Into American Retirement Portfolios, Following The Company's S&P 500 Inclusion.

Coinbase's inclusion in the S&P 500 signals a shift toward cryptocurrency integration in retirement investing.

from24/7 Wall St.

9 months agoMy $1.6 million retirement account has an automatic annuity clause if I die - what are my options?

The Redditor discovered that $800,000 of their retirement funds were being shifted into an annuity, which they do not want, prompting concerns about accessing their wealth.

Retirement

[ Load more ]