"Federal Reserve researchers estimate "new construction would have had to increase by roughly 300% to absorb the pandemic-era surge in demand.""

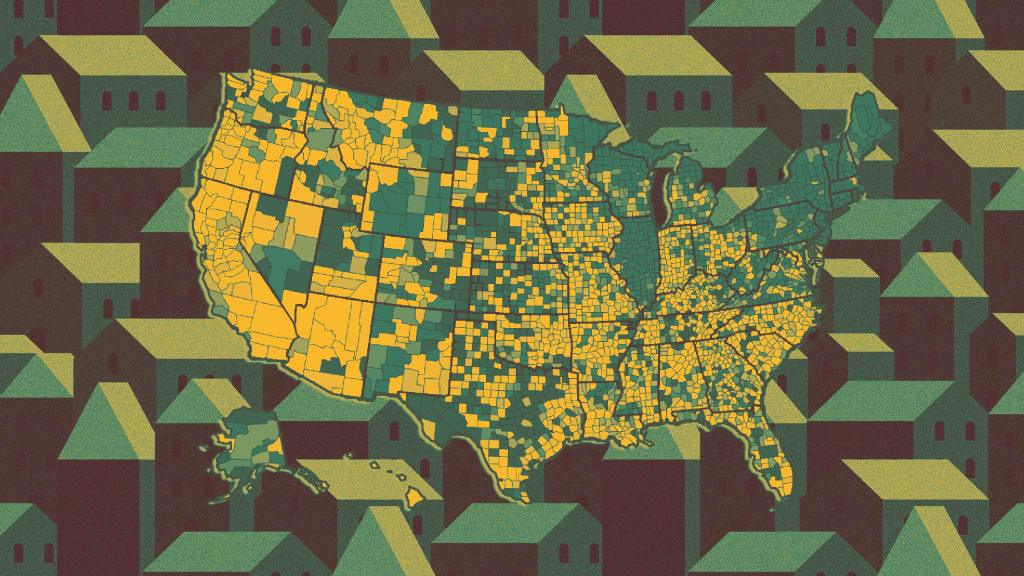

"ResiClub sees active inventory and months of supply as proxies for the supply-demand equilibrium. Large swings in active inventory are driven by shifts in demand."

"During the Pandemic Housing Boom, housing demand surged rapidly amid ultralow interest rates and the remote work boom- unlocking "WFH arbitrage.""

"Now, National active inventory is on a multiyear rise, contrasting sharply with the -50% levels seen during the pandemic's peak."

The article highlights the dramatic surge in housing demand during the pandemic fueled by low interest rates and remote work trends, leading to skyrocketing home prices. Federal Reserve researchers suggest that new construction would have needed a 300% increase to meet the demand. The article emphasizes that while housing demand is elastic, supply is not, which creates substantial fluctuations in active inventory and supply-demand dynamics. As of now, national active inventory is rising after a significant decrease in early 2022.

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]