""If you're planning to buy a house in the near future, it's okay to hold off on your retirement savings and put that money toward your down payment.""

""Make sure this is only a quick detour (like a year or two)-not a five-year pause.""

""Don't borrow from or cash out your retirement accounts to speed up your down payment savings.""

""Not only will you get hit with taxes and early withdrawal penalties, but you'll also tank the long-term growth of your retirement savings-costing you hundreds of thousands of dollars at retirement.""

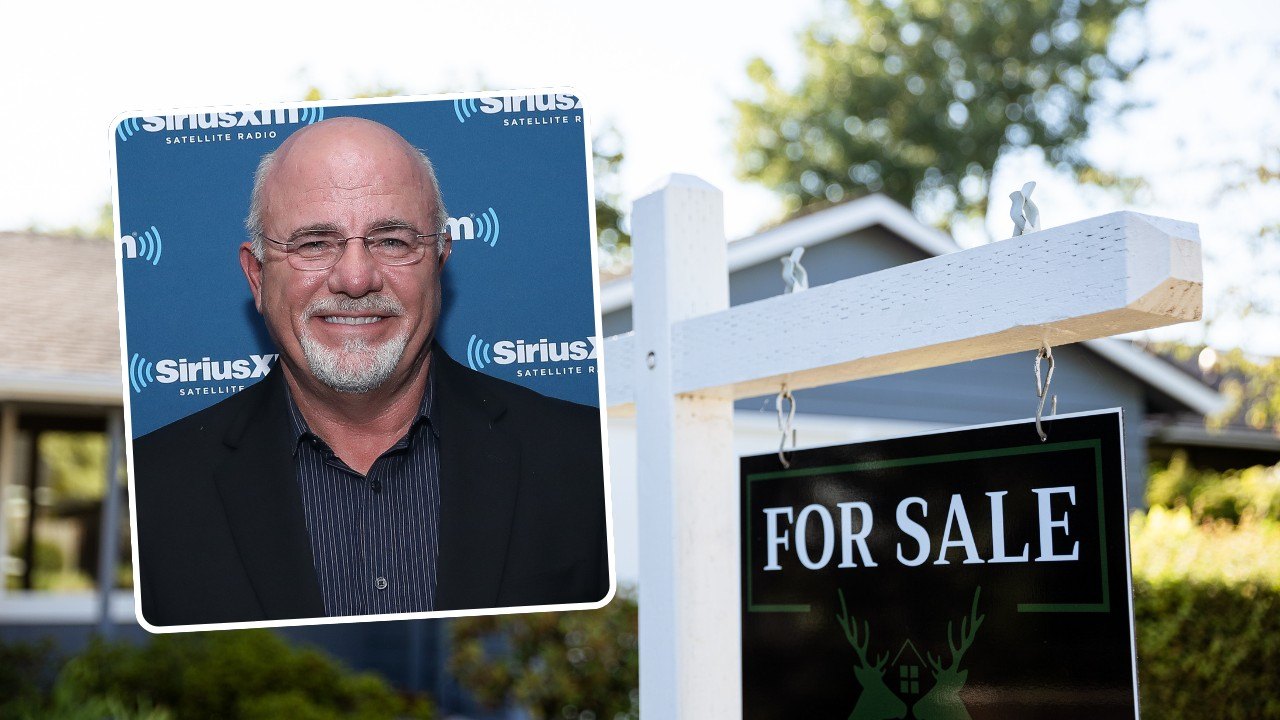

As rising home prices significantly increase down payment demands, financial expert Dave Ramsey suggests a bold approach to home buying: temporarily halt retirement savings to afford a down payment. While many financial advisors caution against this due to potential losses on compound interest and employer contributions, Ramsey argues that investing in real estate can also serve as a future-oriented financial move. He stresses the need for this strategy to be a short-term solution, recommending buyers avoid withdrawing from retirement accounts to prevent penalties and long-term growth setbacks.

Read at SFGATE

Unable to calculate read time

Collection

[

|

...

]