"The GOP's budget reconciliation bill creates a scenario where the poor and middle class see their income drop, while the wealthy, particularly the top 0.1%, benefit significantly."

"G. Elliott Morris critiques the proposed budget as a policy where lower-income families will pay more yet receive fewer government benefits, a clear imbalance."

"The CBO report highlights a troubling trend where federal deficit burdens increasingly fall on middle-income and poor families, marking a shift in fiscal responsibility."

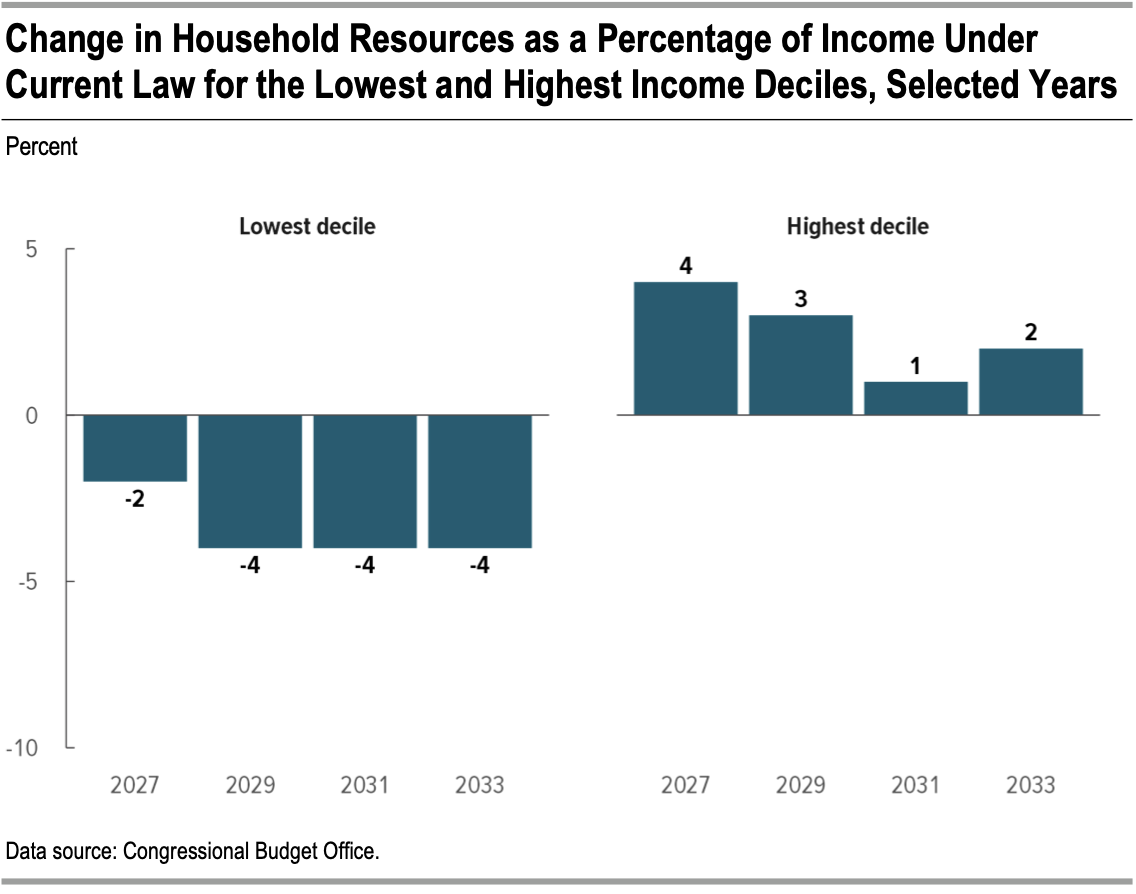

"The graphical data from the CBO illustrates that while the lower deciles experience stagnation, the upper earners are positioned to reap substantial financial gains."

A report from the Congressional Budget Office reveals that if the GOP's budget reconciliation bill is enacted, households in lower and middle-income brackets will see their income decrease while the wealthiest, particularly the top 0.1%, will experience substantial gains. This proposed restructuring results in poorer families shouldering a larger portion of the federal deficit without receiving adequate benefits. As described by G. Elliott Morris, this creates a scenario of 'paying more for less,' highlighting the inequality in the distribution of income and government support in this fiscal policy.

Read at FlowingData

Unable to calculate read time

Collection

[

|

...

]