"When I recently reached out to Moody's Analytics chief economist Mark Zandi for his updated home price forecast, he said his long-term outlook for the U.S. housing market remains largely unchanged: he expects a prolonged period of stagnation as affordability gradually improves. Following the historic run-up in prices during the Pandemic Housing Boom and the subsequent mortgage rate shock, Zandi believes resale activity/existing home sales will likely stay frozen for several more years."

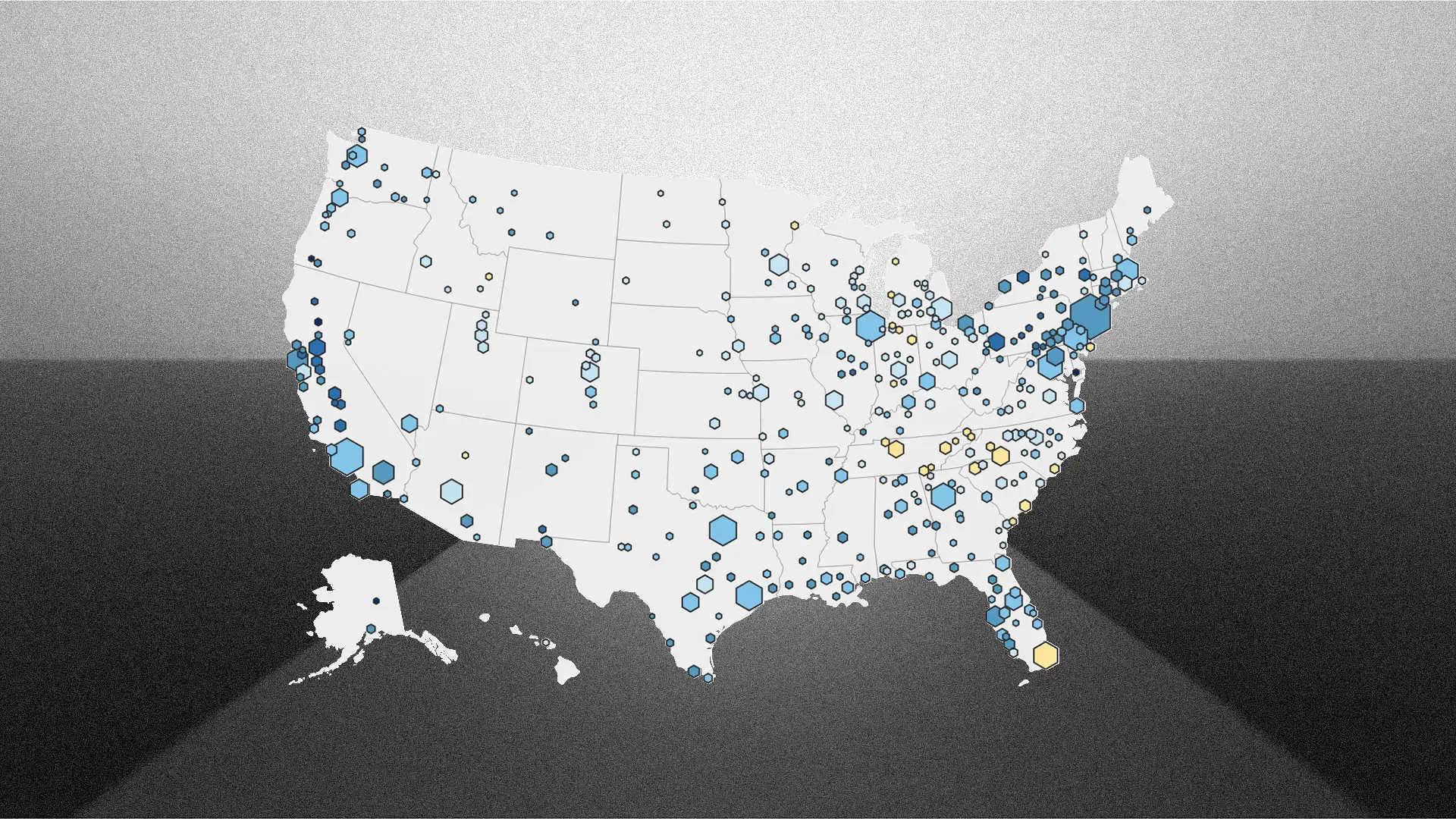

""Affordability has to be restored for housing to regain its mojo," Zandi told . "Flat home prices [adjusted for inflation] is the healthiest path forward-it's the only way for incomes to catch up." Zandi expects nominal national home prices to move sideways over the next 12 to 24 months, with local variation: markets in the South and West, where building has been stronger, seeing some modest declines, while tight-inventory markets in the Northeast and Midwest remain more stable."

""The worst of the pain in the housing market might be now and in the next six to nine months. After that, things will begin to feel a little better-but not good," Zandi said. "The housing market will heal . . . but it's going to take time-and a lot of patience." Over the next decade, Zandi projects U.S. home prices will rise roughly in line with inflation, meaning no "real" [adjusted for inflation] house price gains for around 10 years."

Long-term outlook for the U.S. housing market indicates prolonged stagnation as affordability gradually improves. Resale activity and existing home sales are likely to remain largely frozen for several more years following the pandemic price surge and mortgage rate shock. Nominal national home prices are expected to move sideways over the next 12 to 24 months, with modest declines in South and West markets where building was stronger and more stability in tight-inventory Northeast and Midwest markets. The worst of the pain may occur now and in the next six to nine months, with gradual healing thereafter. Over the next decade, nominal prices are forecast to rise roughly in line with inflation, producing no real price gains for about ten years.

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]