"While no formal sales process has been initiated, interest from buyers and banks signals that Yahoo's DSP may soon be on the market."

"This invites speculation on who might step forward and what it says about the broader M&A landscape in ad tech."

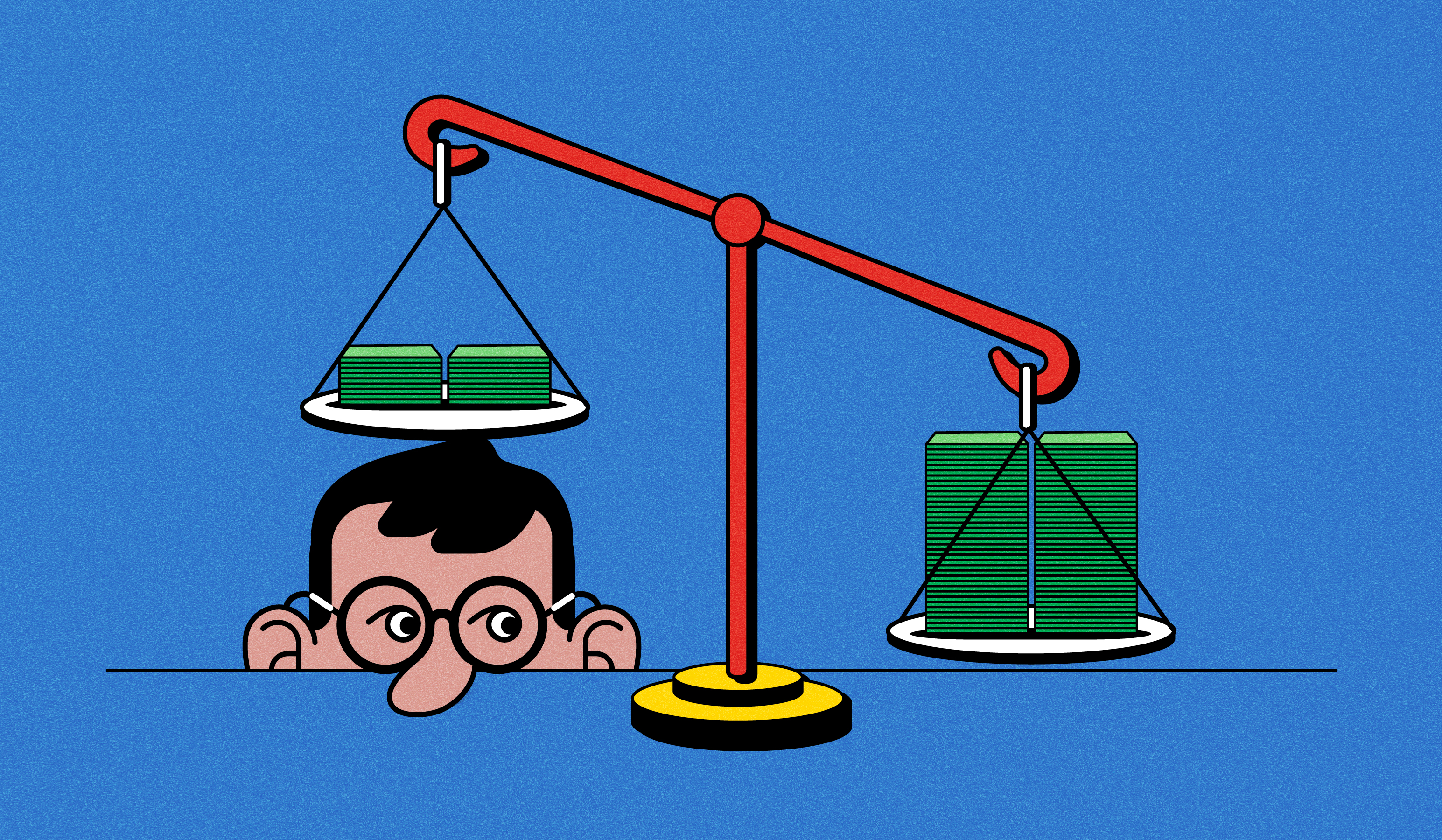

"Even though the DSP has remained a core asset, separate sources think the individual asset wouldn't be profitable."

"Any pricing would be based on revenue, and it was theorized that the asset may fetch approximately $500 million if the market was regular."

The potential divestment of Yahoo's demand-side platform (DSP) signals a notable shift in the ad tech industry, which is currently experiencing consolidation and recalibration. Despite no formal sales process being underway, interest from banks indicates that Yahoo's DSP may soon be put on the market. Under Apollo Global Management's ownership, Yahoo has transitioned significantly, focusing on partnerships rather than expansion. The DSP remains a well-regarded asset, although its profitability is in question. The anticipated sale could fetch around $500 million, reflecting broader trends in advertising mergers and acquisitions.

Read at Digiday

Unable to calculate read time

Collection

[

|

...

]