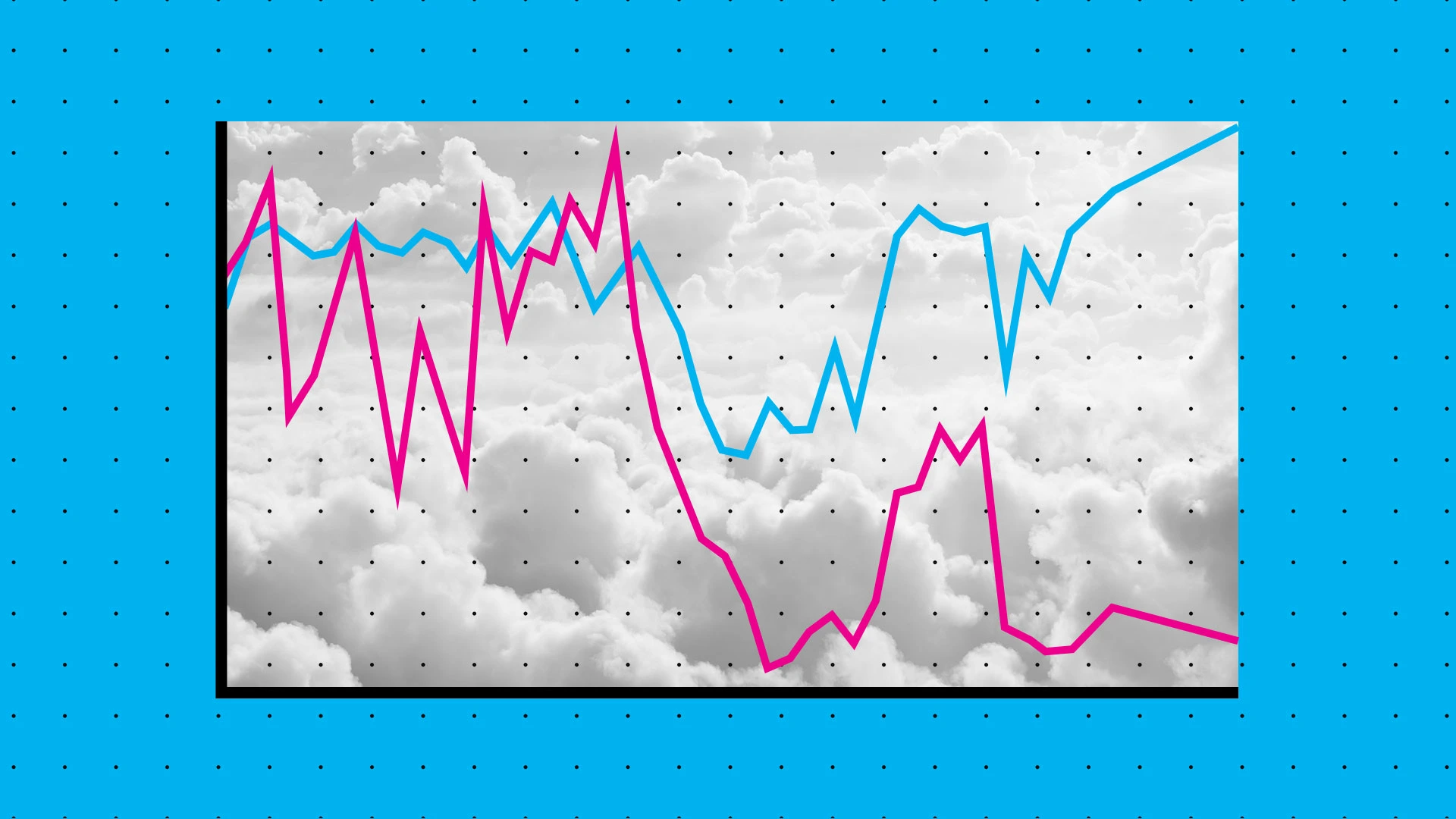

"The gap between the richest and poorest Americans is widening in what Federal Reserve Chairman Jerome Powell has called a " bifurcated economy," as the cost of living skyrockets from housing to food prices, but wages for most workers remain stagnant. Basically, high-income individuals are doing well, while lower-income consumers are struggling more and more. That situation has sparked discussions about whether we're in a so-called "K-shaped economy.""

"A K-shaped economy-coined after the shape of the letter: a horizontal line marked by two lines, one going lower, the other going up-happens when the economy is rolling along, and suddenly loses steam and begins to drop. And then, after a period, the Fed comes in and lowers interest rates to get things going again, professor Peter Ricchiuti at Tulane University's A.B. Freeman School of Business told Fast Company."

The richest and poorest Americans are diverging as housing and food costs surge while wages remain stagnant for most workers. High-income households gain from rising asset values such as stocks, bonds, and real estate, especially following interest-rate cuts. Middle-class savers see lower returns on money market funds and bank CDs when rates fall. Interest-rate reductions are a primary tool to stimulate a weakening economy, but they can increase inequality by boosting asset prices. Economic activity appears to be slowing and could move into recessionary conditions within the next year.

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]